But buyers, sellers still cautious, says REINZ CEO

The property market remains sluggish but there are signs of increased activity, REINZ says.

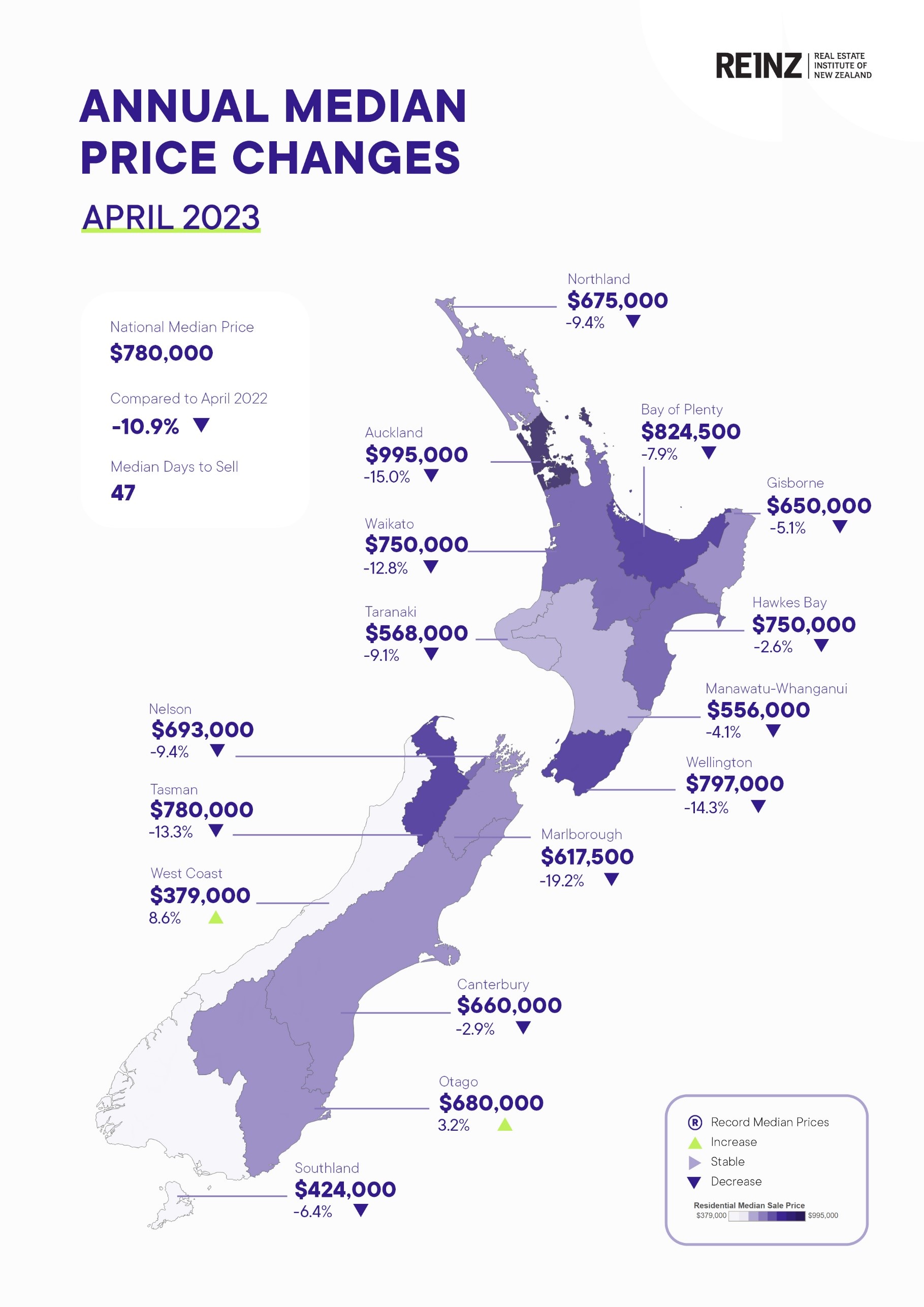

The national medium house price is $780,000, down 10.9% year-on-year, up 0.3% month-on-month (up 1.7% month-on-month in seasonally adjusted figures). The number of days to sell has reached 47 days, up nine days, REINZ April data shows.

Property values in Auckland were down 15% annually to $995,000, values in Wellington were down 14.3% to $797,000 and values in Canterbury were down 2.9% to $660,000.

Two regions bucking the trend and seeing an increase in their annual median price were the West Coast and Otago. The West Coast showed the biggest annual improvement – up 8.6% to $379,000, while Otago was up by 3.2%, to $680,000.

New listings were down 18.9% year-on-year to 7,142, down 22.7% in April compared to March.

REINZ chief executive Jen Baird (pictured above) told NZ Adviser that overall, its April data showed a “slower pace” of market, driven by current economic challenges, exacerbated by public and school holidays.

“Vendors who are motivated to sell tend to be meeting the market with their price expectations – properties are still changing hands, albeit at a slower pace than we would typically see for this time of year.”

Baird summed up the current sentiment among property buyers and sellers as “cautious”. “We can see that in the time it is taking to do deals, the volume of sales and the number of new properties coming onto the market,” she said.

The number of properties for sale at the end of the month (inventory levels) decreased slightly month-on-month, but year-on-year figures showed an increase as the current pressure on mortgage rates supressed buyer activity.

“We’re hearing from salespeople across New Zealand that buyers are taking their time to make purchase decisions with a fear of overpaying,” Baird said. “Vendors who are motivated to sell tend to be meeting the market with their price expectations — properties are still changing hands, albeit at a slower pace than we would typically see for this time of year.”

Signs of green shoots appearing

“What we’ve heard from real estate agents is that they are getting a sense that first home buyers in particular are out and about,” Baird said.

Noting the Reserve Bank’s proposed changes to loan-to-value restrictions, Baird said that some agents reported an “immediate impact” on attendance levels.

“It is good news for people who would like a mortgage with a lower deposit … there will be some people who will be able to get finance who weren’t able to before,” she said. “The cost of finance really is the big part of the equation right now.”

She told NZ Adviser that people were also sensing a “settling” in the economy as inflation moderated and interest rates appeared to be close to reaching their peak in the current cycle.

“Once that certainty starts to come back in the market, that gives people confidence to make decisions,” Baird said.