Negative saving in NZ sector

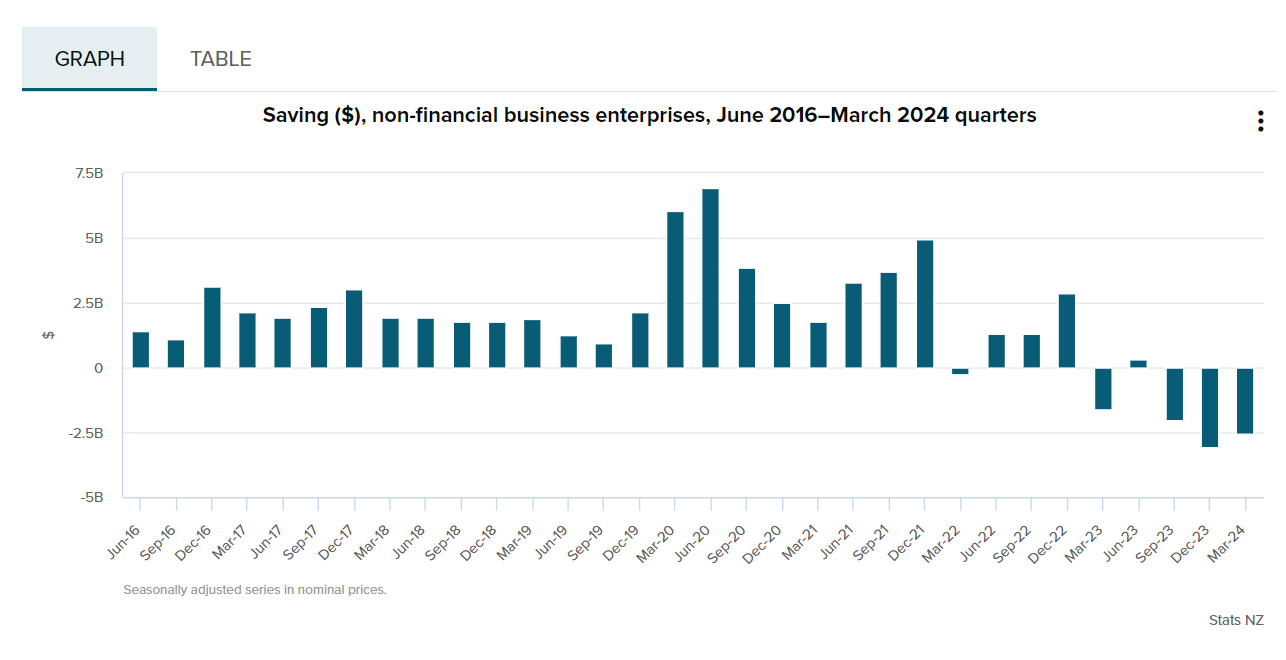

New Zealand’s non-financial business sector showed a negative saving of $2.5 billion in the March 2024 quarter, according to fresh figures released by Stats NZ.

This negative saving, which represents greater outgoings than income, is funded by prior savings or new borrowing.

The sector has experienced negative saving in four of the last five quarters, contrasting with positive saving in most quarters of the preceding six years.

Decline in gross operating surplus

The sector’s gross operating surplus decreased to $16bn in the March quarter, marking the fifth consecutive decrease since the final quarter of 2022 when it was $18.9bn.

“Decreases in operating surplus reflect lower profitability for the business sector,” said Paul Pascoe (pictured above), national accounts institutional sectors senior manager. “Over the last year, the production of goods and services slowed while the cost of labour continued to rise.”

Rising interest expenses

Interest paid increased by a further 2.2% to $7.2bn in the March quarter.

Interest expenses now constitute 28% of income payable in the latest quarter, up from 14% in the September 2021 quarter when interest paid was at its lowest level in the series ($3bn).

Increased debt and inventory reductions

Businesses have taken on more debt and reduced their inventories to cover the gap between income and outgoings.

The past year has seen three of the four highest quarters for new borrowing in the series, with $18.4bn of new borrowing in the year ended March. Over the same period, net inventories declined by $5.2bn, indicating that businesses are using or selling inventories without fully replacing stocks.

“These statistics represent all non-financial businesses and may not reflect the specific circumstances of any individual business,” Pascoe said.

The financial strain on New Zealand’s non-financial business sector highlights the challenges faced by businesses in maintaining profitability amid rising costs and economic pressures.

Read the Stats NZ media release.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.