This as replacement spending surged

Card spending rebounded in March, with evidence of repairing and restocking activity underway, but headwinds to the retail sector were intensifying, according to a new ASB report.

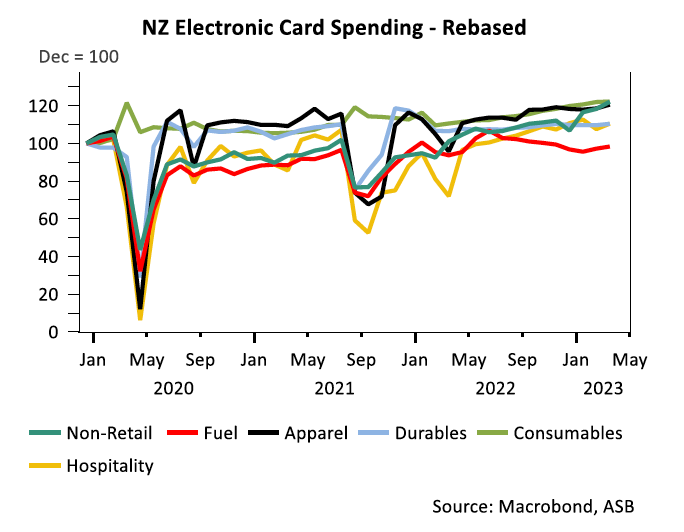

ASB’s Economic Note reported a 0.7% lift in retail electronic card spending on February levels, when adjusted for seasonal effects, with robust spending in non-retail, services, and hospitality driving the underlying trend, further boosted by post-cyclone repair and restocking of damaged goods.

“Core spending (which excludes fuel and vehicle spending) rose 0.5% after easing 0.3% in February amid weather-related disruptions,” said Kim Mundy (pictured above), ASB senior economist. “Meanwhile a surge in non-retail spending (+11.4% mom) drove the 3.1% lift in total card spending in March.

“The annual growth in retail (15.5% yoy), core (16.9% yoy), and total retail (17.3% yoy) moved further into double digits, helped in large part by widespread increases in consumer prices. The strong annual gains in hospitality (50.5% yoy) and non-retail (21% yoy) highlight that spending patterns are continuing to normalise post-COVID.”

Consumer spending on services, durable goods, and apparel was likely to remain resilient in the coming months as communities start repair work and replace damaged goods in the wake of Cyclone Gabrielle.

Mundy warned, however, that despite the cyclone boost, which was tipped to be reasonably short-lived, intensifying headwinds should take some heat out of the numbers once repair and replacement work runs its course.

“The housing market continues to weaken and living costs are set to keep climbing over the year (including steep increases in debt servicing costs for mortgage holders),” she said. “At the same time, households have run down savings, which has weakened household confidence and the willingness to spend. The RBNZ has been explicit in noting domestic spending needs to slow to get inflation down.”

Given the still-high inflation and the continued imbalances in demand and supply, ASB is expecting one final 25bp rate hike by the Reserve Bank in May to a peak of 5.5%, “but it’s a line-ball call.”

“OCR cuts are unlikely until well into 2024,” Mundy said. “The RBNZ will need to see ample evidence of demand cooling and inflation easing before it considers easing monetary policy settings.”

Use the comment section below to tell us how you felt about this story.