But underlying weakness evident, ASB economists says

Card spending etched out further gains in April, likely supported by ongoing restocking as well as widespread price rises, according to a new ASB report.

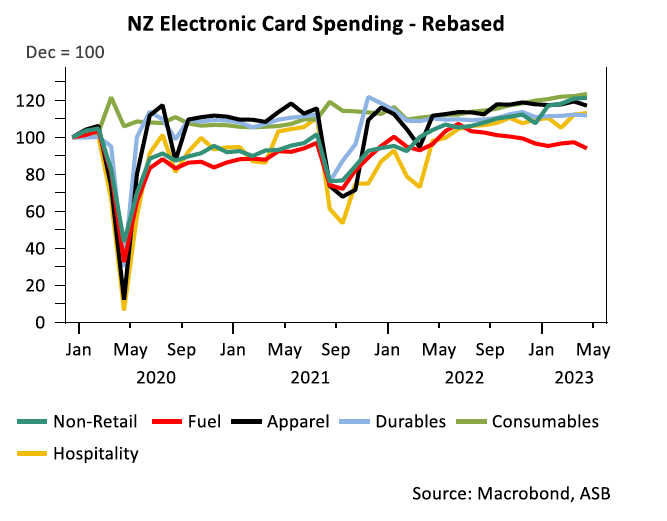

ASB’s latest Economic Note reported a 0.7% lift in electronic retail spending on March levels, when adjusted for seasonal effects, with spending growth concentrated in consumables and durables, while all other categories experiencing falls in the month.

“Elevated costs – particularly in the consumable sector – and some ongoing restocking activity likely underpinned April card spending,” said Kim Mundy (pictured above), senior economist. “However, softness across all other sectors serves as a good reminder that it is a challenging time for consumers.

Core spending, which excludes fuel and vehicle spending, increased 0.8% after a 0.6% rise in March. Total retail spending, which includes non-retail and services, meanwhile, saw a 1.0% rise in the month.

Mundy said consumer face mounting headwinds, which ASB expected will flow through to consumer spending as 2023 progresses.

“The housing market has yet to find a floor and living costs are set to keep climbing (including steep increases in debt servicing costs for mortgage holders),” she said. “At the same time, households have run down savings, which has weakened household confidence and the willingness to spend. The RBNZ has been explicit in noting domestic spending needs to slow to get inflation down.”

With inflation still too high, ASB said it is expecting another 25bps rate hike in May, adding that OCR cuts are unlikely until well into 2024.

“The RBNZ will need to see ample evidence of demand cooling and inflation easing before it considers easing monetary policy settings,” Mundy said.

Use the comment section below to tell us how you felt about this.