Credit demand, arrears both up

As the festive season draws near, thoughts turn to barbecues, beaches, and relaxation after a challenging year. But it’s also a time when people can easily fall into debt traps while striving to manage expenses in the run-up to Christmas and the New Year, according to Centrix.

Credit demand up

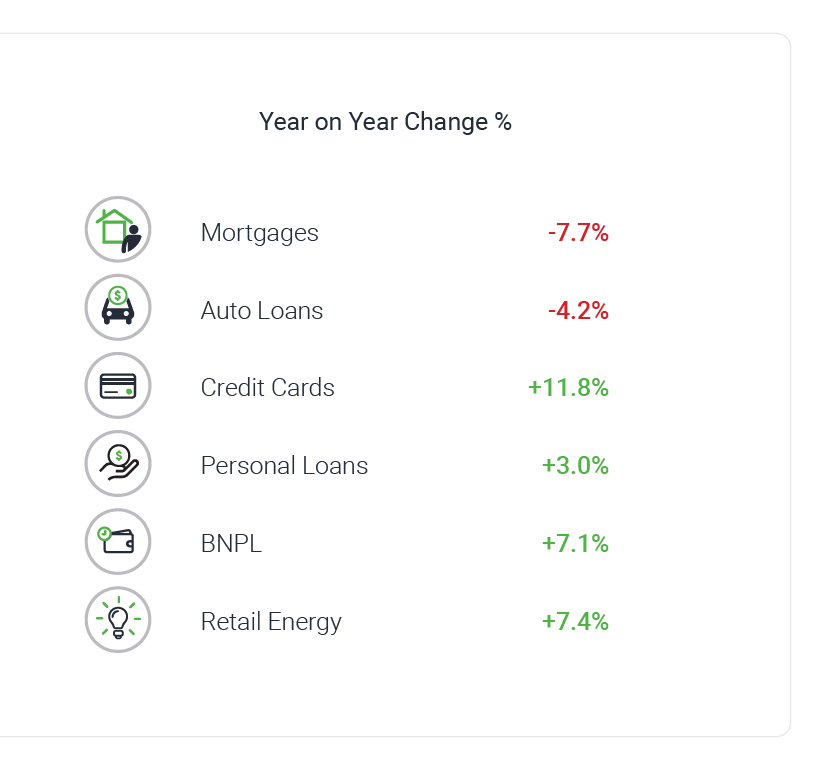

Centrix’s November Credit Indicator showed a surge in consumer credit, aligning with seasonal trends, driven by an 8% year-on-year increase in retail sales in November. This growth was primarily led by credit cards (+11.8%), BNPL products (+7.1%), and personal loans (+3.0%).

“Credit demand has a seasonal peak in November in the lead up to Black Friday sales and the holiday season,” said Keith McLaughlin (pictured above), Centrix managing director. “It is interesting that the volume of credit enquiries this year is similar to what we’ve observed in previous years, despite the cost-of-living crisis seeing households tighten their purse strings in general.”

McLaughlin said this suggests that Kiwi households may be attempting to manage their cash flow by capitalising on discounted prices before Christmas and, in some instances, spreading out their payments.

“Unfortunately, there will be a segment of the population that are stretching beyond their means, which in turn could spell trouble in 2024,” he said.

Credit arrears on the rise

Alongside heightened credit demand, arrears for mortgages, personal and vehicle loans, and credit cards are on the rise.

Consumer arrears inched up slightly to 11.78% of the credit-active population in October, compared to 11.70% in September, with the monthly count of people behind on payments rising to 431,000 from 427,000. Year-on-year, the current arrears level has increased by 6.1%, closely aligning with 2018 levels after emerging from historic lows during the COVID-19 years.

Among those 30-plus days past due, there are 156,000 consumers, with 103,000 exceeding 60-plus days past due and 83,000 surpassing 90-plus days past due.

Mortgage arrears, in particular, rose 25% year-on-year, which McLaughlin said could be a concern as households across the country continue to roll off fixed rates and into new, higher interest rates.

“While we don’t know what is on the horizon, there’s an expectation these rates could persist well into 2024,” he said.

McLaughlin urged those facing repayment challenges to contact credit providers for a payment plan and consider budgeting assistance through free services like MoneyTalks, as failure to address this could negatively impact one's credit score for years, influencing future financial decisions.

Businesses continuing to struggle

Centrix data also showed that corporate liquidations persist at elevated levels as businesses continue to grapple with the current economic climate, posing a substantial impact on retail trade. Additionally, a noticeable upward trend in credit defaults among small and medium-sized businesses year-on-year underscores the challenges many may face as they approach the summer season.

“Business credit defaults, liquidations, and closures are always tough,” McLaughlin said. “It’s imperative business owners get into the habit of credit-checking potential customers, business partners and suppliers to ensure they aren’t unknowingly extending funds to entities with bad credit risk.

To compare with the previous Centrix report, click here.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.