Consumer and mortgage arrears climb

New Zealand faces ongoing economic challenges despite a slight GDP growth following a technical recession, according to the latest credit report from Centrix.

“The challenging economic climate continues to persist,” said Keith McLaughlin (pictured above), managing director at Centrix.

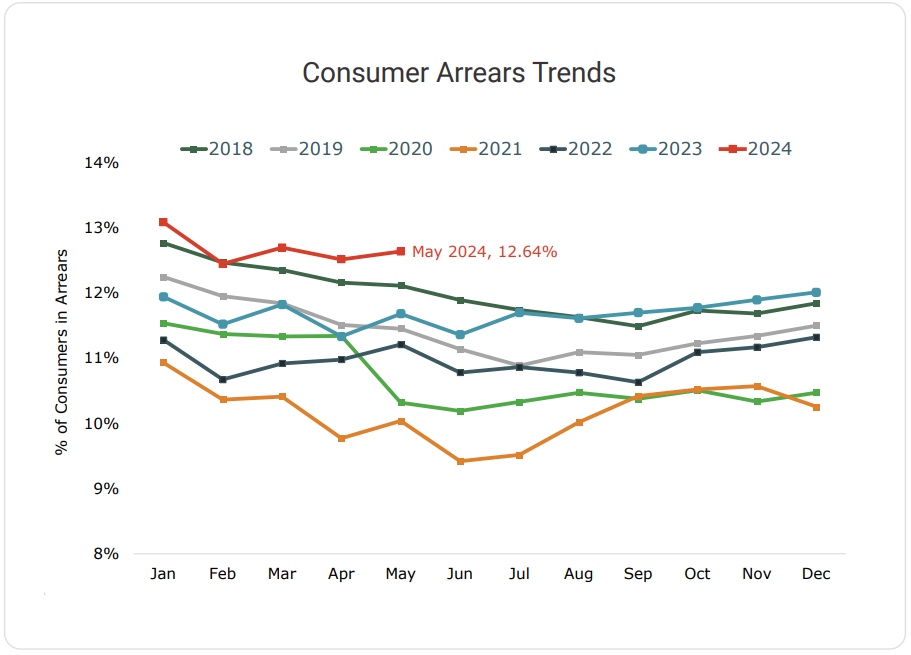

Consumer arrears have climbed, driven by telco and mortgage repayments, while auto arrears also show a gradual increase over recent years.

See LinkedIn post here.

Rising consumer arrears

In May, the number of consumers behind on payments increased by 16,000, reaching 474,000 people, or 12.64% of the credit active population.

“The number of consumers reported in arrears rose to 12.64% of the credit active population,” McLaughlin said.

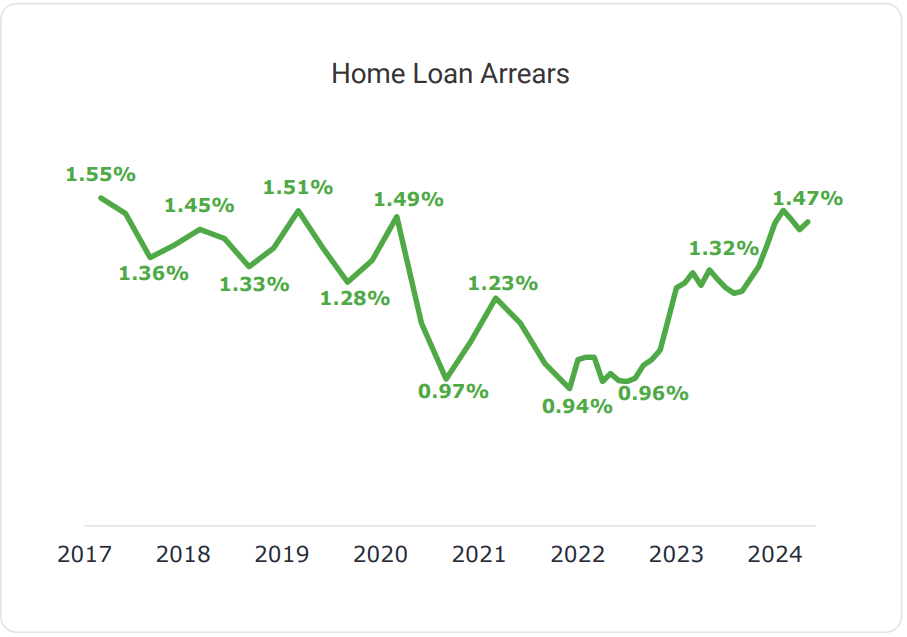

Mortgage arrears are up slightly, with 22,000 home loans past due, marking a 12% year-on-year increase.

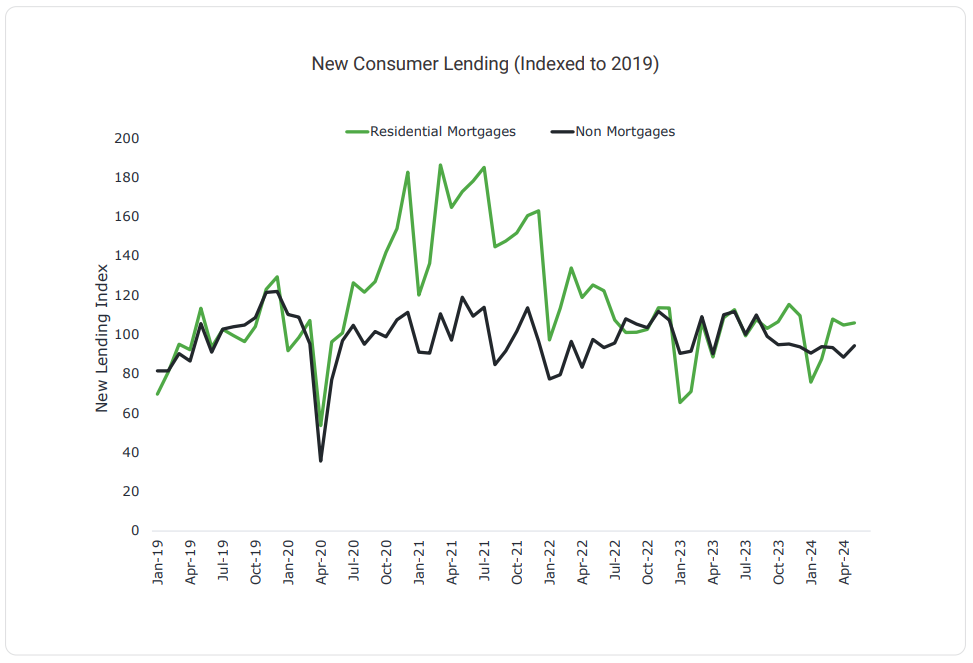

Mortgage Lending Trends

Residential mortgage lending rose by 4.9% year-on-year for the May quarter, signaling a potential warming of the housing market as average values decline.

However, non-mortgage lending is down 10.7% year-on-year due to lower new car sales.

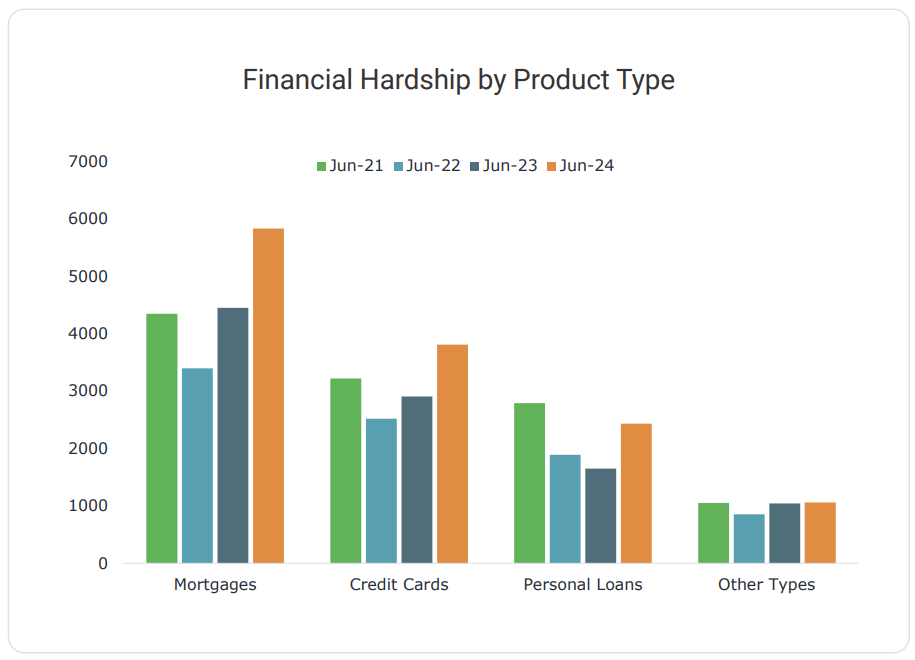

Financial hardship incrases

Reports of financial hardship are up 25% year-on-year, with mortgage repayment difficulties comprising nearly half of these cases.

“The cost-of-living crisis continues to bite Kiwi households,” McLaughlin said, emphasising the importance of seeking early financial advice to mitigate long-term impacts.

Business credit defaults

Business credit defaults have also risen year-on-year, pointing to broader economic strain. The South Island has seen a significant increase in company liquidations in the first quarter of 2024 compared to the same period in 2023.

Company liquidations spike

May saw 233 companies placed into liquidation, the highest May figure since 2014. This represents a significant rise, particularly in the retail trade, property/rental, and transportation sectors.

“We’ve seen company defaults and liquidations rise in May,” McLaughlin said.

Encouraging signs amidst challenges

Despite these challenges, there are some positive signs. The proportion of households behind on energy payments has slightly decreased, offering some relief as New Zealand enters the winter months.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.