FHB market share surges to new high despite challenges

First home buyers have continued to dominate the New Zealand housing market, despite stretched affordability, high interest rates, and increasing cost of living, CoreLogic has reported.

CoreLogic’s latest First Home Buyer Report showed FHBs accounted for a record-high 27% of all property purchases in the third quarter, and have maintained, over the year to date, a market share of 26%, which was well above the long-term average of 21%. However, the number of deals remained lower than historical averages in a relatively sluggish market.

Kelvin Davidson (pictured above), New Zealand’s chief property economist, said FHBs are overcoming significant challenges to enter the property market.

“Whether it’s using the low-deposit lending speed limits at the banks, tapping their KiwiSaver to help with their deposit, securing First Home Grants or First Home Loans, or compromising on the size or location of their home, FHBs are proving relatively more successful in buying their first home than at any other time,” Davidson said in a media release.

The national trends are reflected in all six major urban areas, with each reporting above-average shares of FHB purchases so far this year.

Wider Wellington has had the biggest market share for FHBs, with 33% of purchases in the year to date, which is 4% above the average. On the other end of the spectrum, FHBs in Tauranga held 21% of purchases, which is 5% above the long-term average. Auckland, Christchurch, and Dunedin each reported 5% higher than the average, with Hamilton surpassing with 6% above the average for 2023.

Provincial markets also experienced a similar trend, with Invercargill leading the way with a strong market share of 32% for FHBs, which was 10 ppt above the long-term average. Whangarei, Rotorua, and smaller areas like South Waikato and Clutha are also seeing increased FHB activity.

FHB median price falls

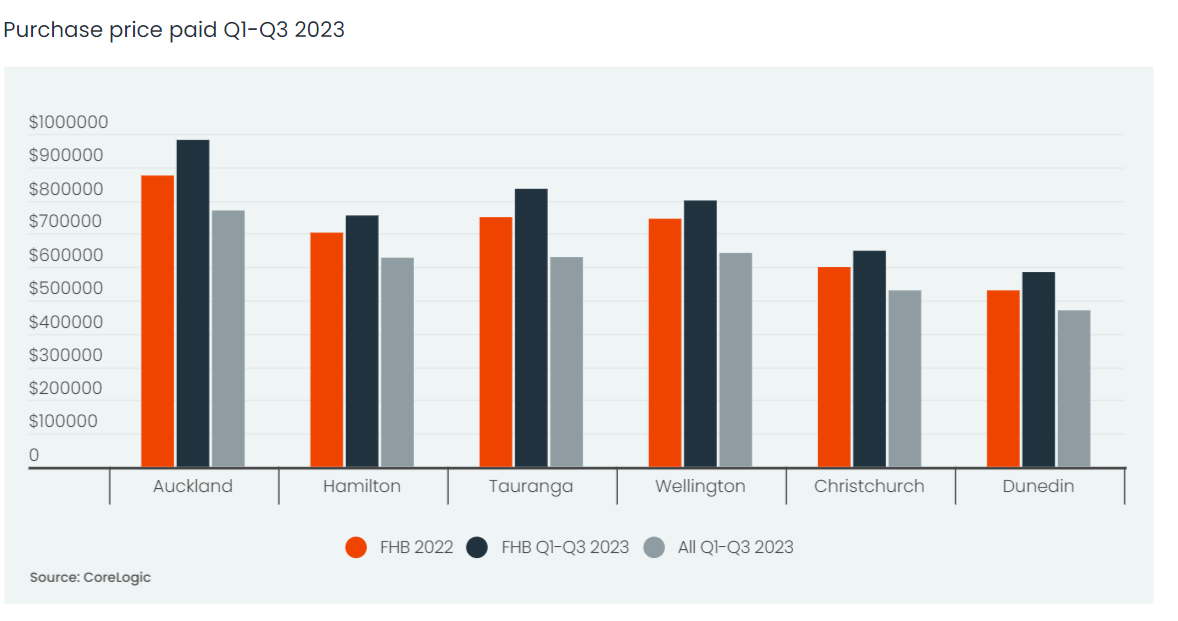

FHBs have benefited from the downturn in property values over the past 18 months. The median price paid by FHBs has fallen from $720,000 in 2022 to $690,000 in 2023 to date.

Davidson noted, however, that typical FHBs often enter the market slightly above the "bottom rung" rather than starting from the absolute bottom.

“For example, $690,000 is lower than the median price paid across all buyers at $762,500, but it’s significantly higher than the lower quartile across all buyers at $565,000,” he said.

Among the main urban areas, Auckland is where FHBs paid the most, with a median price of $875,000 in 2023. The figure was $107,000 less than the all-buyer median of $982,000. Median FHB prices paid ranged from $700,000 to $750,000 in Tauranga, Wellington, and Hamilton, while Christchurch and Dunedin sit at $600,000 and $530,000, respectively.

Property type preferences shifting

Standalone houses made up 71% of FHB purchases nationally in the third quarter, a figure on par with 2022 but less than the 75%-80% share seen in 2019 and 2020. Flats accounted for 22% of FHB purchases in the year to date, compared to 21% in the previous year and 18% across all buyers.

Standalone houses also represented the largest share of FHB purchases in main urban centers, with Dunedin at 89%, Hamilton at 88%, and Tauranga at 87%.

In Auckland, Christchurch, and Wellington, lower FHB purchases of houses might be due to greater affordability and availability of smaller dwellings like townhouses or apartments, Davidson said.

FHB market share across main urban areas

Across the main urban areas, FHB market share has remained strong in 2023.

Invercargill boasted the largest market share for FHBs, with 32% of purchases in 2023 to date, a full 10 ppt above the long-term average. Whangarei, Rotorua, Napier, and Hastings have each recorded at least 5 ppt higher than usual.

In contrast, FHBs in Queenstown struggled a bit in 2023, with a market share of just 13%, down from its long-term average of 15%.

Davidson said in the main urban areas, houses accounted for a significant share of FHB purchases given the makeup of housing stock.

“Over 2023 to date, houses have accounted for 93% of FHB purchases in Rotorua, with that figure also topping 90% in Gisborne, Whanganui, Palmerston North, and Invercargill,” he said.

“Figures of 80-90% have been seen in Whangarei, Napier, Hastings, New Plymouth, Kapiti Coast, and Nelson. Queenstown’s figure for houses as a share of FHB purchases fell to 53%, reflecting a wider range of property types and affordability pressures in that market.”

Download the First Home Buyer Report here.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.