Inflation expectations rise slightly

The Reserve Bank (RBNZ) is expected to cut the OCR by 50 basis points next week, despite a modest rise in inflation expectations.

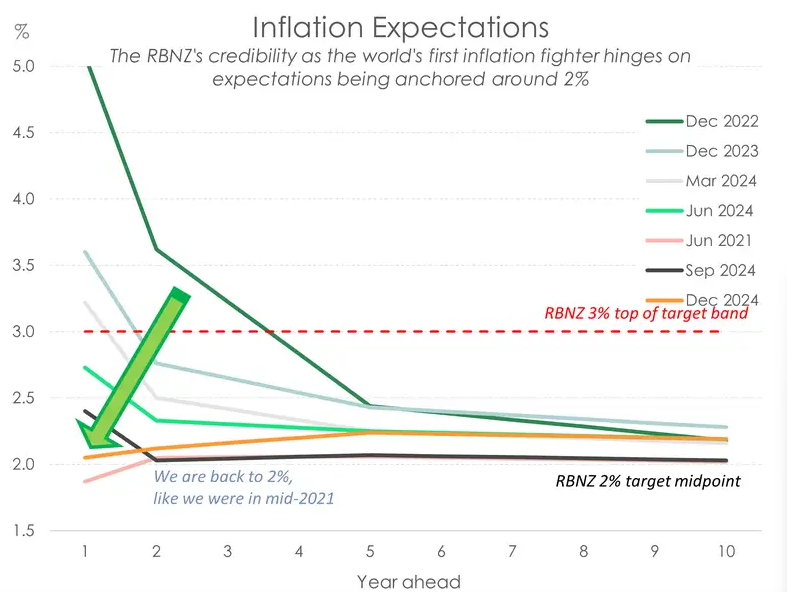

The central bank’s recent survey showed a slight increase in medium- and long-term inflation forecasts, with the two-year-ahead measure rising from 2.03% to 2.12%.

The development comes after inflation recently hit the 2% target band, a key catalyst for the RBNZ’s August rate cut.

While the uptick in inflation expectations is “frustrating,” Kiwibank economists Jarrod Kerr, Mary Jo Vergara, and Sabrina Delgado (pictured above, left to right) noted, “broadly speaking, expectations are still well contained, not too far from the 2% midpoint.”

Rate cuts needed to avoid damage

Economists argued that swift rate reductions are essential to prevent further harm to New Zealand’s economy.

“The inflation beast has been slayed!” the Kiwibank economists said, adding that RBNZ must loosen monetary policy to avoid undershooting inflation or causing unnecessary strain on businesses and households.

RBNZ is expected to lower the OCR to below 4% in the near term, aiming to bring it closer to its neutral setting of 2.5-3%. Further reductions may follow if inflation pressures continue to ease faster than anticipated.

Market trends: Rates, currency, and bonds

In financial markets, Kiwi rates ended the week 10bps higher across the curve, mirroring global trends. The NZ dollar/US dollar exchange rate also faced declines, dropping from a weekly high of 0.5980 to 0.5840. Traders are watching closely for signs of a potential rebound during the typically favorable holiday period.

Meanwhile, domestic bond supply will be a focus heading into 2025, Kiwibank reported.

Matthew Crowder, Treasury balance sheet manager, commented on the market volatility.

“With a lack of domestic catalysts before the MPS next week, expect to see a continuation of recent volatility exacerbated by typical drying up of liquidity,” Crowder said.

Kiwibank on long-term outlook and risks

The Kiwibank economists warned that if inflation expectations drift further from the 2% target, future rate cuts could be smaller than anticipated.

For now, the focus remains on next week’s meeting, where a 50bps cut is expected to deliver much-needed relief to New Zealand’s slowing economy.

View the full Kiwibank report.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.