Centrix reports rising credit strain

The Reserve Bank’s recent decision to cut the OCR by 50 basis points to 4.25% has sparked optimism, with major banks promptly lowering their loan rates.

However, despite this relief, new credit data from Centrix revealed a more challenging financial picture for both consumers and businesses.

Consumer credit trends show mixed signals

Consumer arrears increased slightly to 461,000 in October, representing 12.14% of active credit users, up 3.1% compared to last year.

“The number of consumers behind on their payments rose slightly to 461,000 in October, up 3,000 month-on-month, equating to 12.14% of the active credit population,” said Keith McLaughlin (pictured above), managing director of Centrix.

Seasonal trends suggest arrears may rise further over summer, though the number of consumers overdue by 90+ days has decreased by 15% year-on-year, indicating some improvement in longer-term debt repayment.

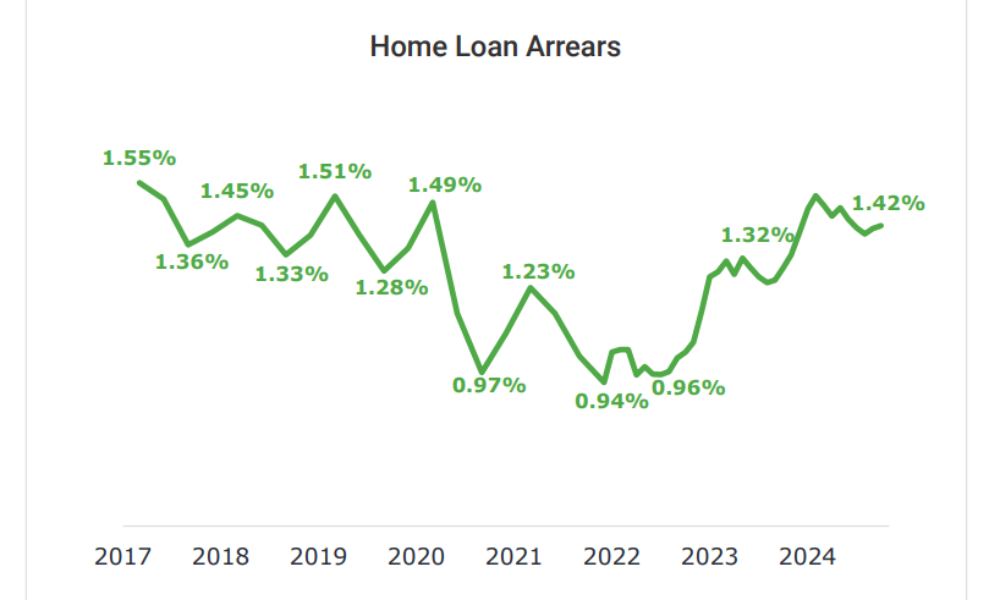

Mortgage arrears also climbed, with 21,300 home loans past due – 10% higher than October. However, new residential mortgage lending grew 7.7% year-on-year, signaling increased borrowing activity following eased interest rates and lending restrictions.

Financial hardship cases still rising

Cases of financial hardship remain a concern, up 20% year-on-year. Nearly half of these cases involve mortgage repayment issues, while 30% are tied to credit card debt.

Younger borrowers aged 35–39 are the most affected demographic. Consumer credit defaults have surged 37% year-on-year.

“The rate of growth for financial hardship cases is easing, but they’re still significantly up year-on-year,” McLaughlin said.

Business Defaults and Liquidations Escalate

The business sector is facing increasing credit challenges, with defaults rising 16% year-on-year.

Construction and transport industries have been hit hardest, with defaults up 38% and 35%, respectively.

Company liquidations are also climbing, up 27% year-on-year. Auckland saw a 41% rise in Q3 liquidations, while the rest of the North Island recorded a 51% increase, Centrix reported.

Outlook for the festive season

With rising credit arrears, defaults, and liquidations, Kiwis are advised to plan carefully for the festive season and seek financial advice where needed.

“It’s important for Kiwis to plan effectively for the road ahead, taking financial stock as the year comes to a close and seeking advice from a trusted financial advisor where appropriate,” McLaughlin said.

While easing interest rates offer some respite, the data underscores the importance of prudent financial management as 2024 comes to a close, Centrix

Read Centrix’s November Credit Indicator report in full here. To compare with the previous results, click here.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.