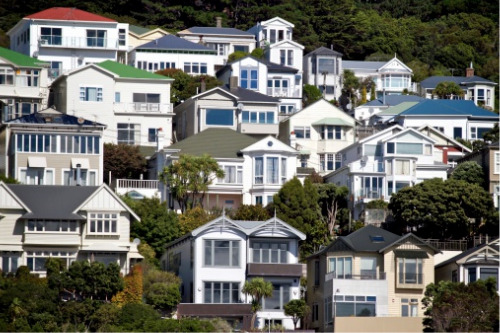

One main urban centre shows slight decline

It seems New Zealand’s property market is slightly cooling down as Quotable Value New Zealand’s (QV) latest data pointed to a significant reduction in house price growth across both ends of the property ladder, with one main urban centre showing a slight decline.

QV’s latest Quartile Index found a 2.2% reduction in value growth this quarter across the most expensive homes in New Zealand’s main centres, down from 8.5% growth to 6.3%. In addition, the country’s least expensive homes experienced a small 1.4% drop in average value growth from 8.3% to 6.9%.

Read more: Council reveals New Zealand’s largest industry – and you won’t be surprised

QV found the most significant drop in the rate of house price growth in the upper quartile in Marlborough, dropping by -0.1% to $1,032,839, making it the only major urban centre to show any quarterly decline in house value since winter last year.

QV general manager David Nagel explained that the drop in Marlborough might seem almost immaterial, but it is statistically significant when considering nearly 12 months of solid growth across all of the 16 major urban centres QV monitors.

Nagel warned about similarly small value drops next month across Napier and Queenstown’s upper quartile, where average house price growth has been largely static or slightly down in consecutive months and the first-home buyers’ segment of the Marlborough market has tapered off significantly since March.

“This easing is likely the effect of government intervention and a tightening of credit availability with the return of LVRs and the increasing likelihood of interest rate rises in the near future, not to mention the seasonal downturn that normally accompanies these cooler months,” he said.

“It’s worth reiterating that prices are still generally increasing, but they’re just not going up by nearly as much as they were before. While demand remains high and supply remains low, house prices are generally only going to go in one direction, and that’s up. How much higher will likely depend on how much higher interest rates will go.

“By spring, we should have a clearer picture of what the market is doing and whether or not this cooling effect on prices is here to stay.”