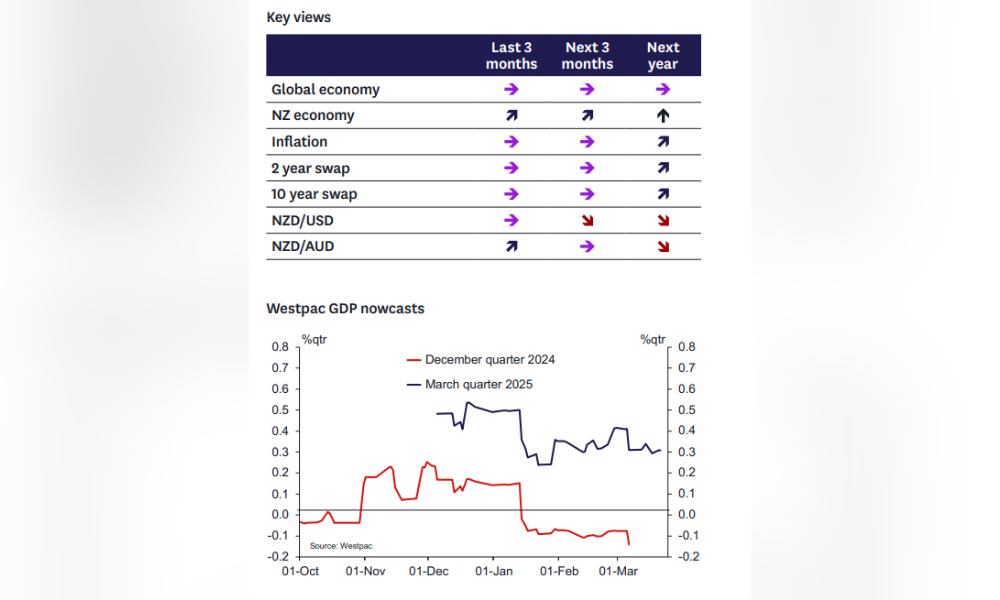

Modest GDP growth as New Zealand faces global pressures

As New Zealand steps out of recession, the recent economic data has sparked cautious optimism about the country's financial trajectory, despite global economic uncertainties and domestic challenges, Westpac reported.

The National Accounts for the December quarter showed that the GDP grew by 0.7% quarter-on-quarter, a figure that slightly exceeded expectations.

While annual output was down by 1.1%, this marked an improvement from a 1.6% decline in September.

According to Darren Gibbs (pictured), senior economist at Westpac, this data suggests a cautious optimism, with minor revisions indicating a stabilisation rather than the sharp declines seen previously.

Consumer spending and investment trends

Despite a general economic uplift, individual spending remained restrained with only a marginal increase of 0.1% quarter-on-quarter. This is set to change as households begin to refinance their mortgages at more favourable rates.

In contrast, tourism has provided a significant boost, with a 10% increase in tourist spending contributing to an 8.2% rise in service exports.

Business investments also saw growth, primarily driven by an uptick in plant, machinery, and intangible assets investments despite a downturn in construction activity.

Narrowing current account deficit

The current account deficit has shown signs of narrowing, decreasing to 6.2% of GDP from 6.9% the previous year, largely due to an improved balance of goods. While investment income outflows were higher than anticipated, substantial gains in export commodity prices are expected to further reduce the deficit.

This is supported by a significant 17% year-on-year increase in merchandise exports, including a notable 34% rise in dairy exports.

Consumer confidence and market outlook

However, the economic recovery faces headwinds from global uncertainties, particularly US trade policies, which have instilled a sense of caution among policymakers.

The Westpac-McDermott Miller Consumer Confidence Index noted a decline, reflecting these global concerns and a potential unease about the local labour market and inflation pressures.

Financial markets react cautiously

The financial markets have responded cautiously to these developments.

The focus now shifts to future RBNZ decisions, with expectations leaning towards a possible end to the current cycle of interest rate cuts, depending on forthcoming economic data.

Looking ahead

As RBNZ continues to navigate these uncertain waters, the upcoming ANZ consumer confidence and employment data will provide further clues about the trajectory of the domestic economy.

With a cautious but optimistic outlook, the nation seems poised for a gradual but potentially steady recovery as it moves into the latter half of the year.

Read the full insights from Westpac.