Home lending outpaces market by 2.7 times

Kiwibank has unveiled its financial achievements for the half-year ending Dec. 31, revealing a net profit after tax of $105 million, marking a 7% increase from the previous half.

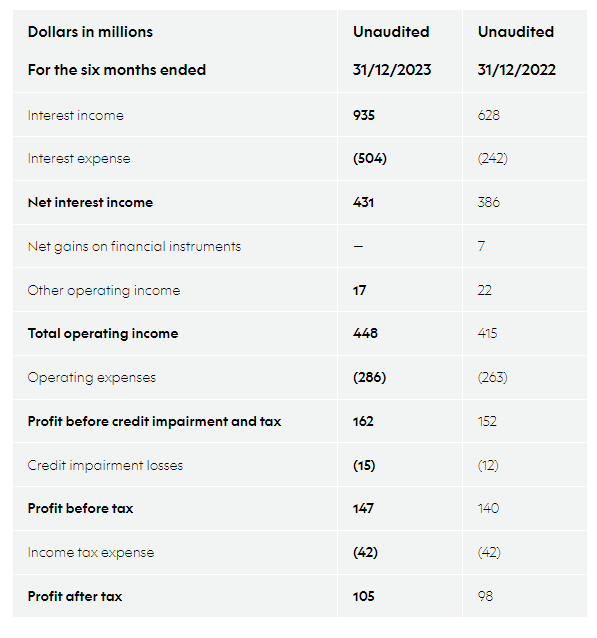

See in the table below the income statement for the six months ended Dec. 31.

Commitment to New Zealand’s prosperity

Steve Jurkovich (pictured above), Kiwibank CEO, stressed the significance of Kiwibank's 100% New Zealand ownership, highlighting its direct contribution to the nation’s prosperity.

“Being New Zealand-owned means all our earnings stay right here in Aotearoa New Zealand,” Jurkovich said. “This allows us to invest in building a better bank so we can be even more competitive, while at the same time delivering on our goals to make tamariki, Kiwi, and Kiwi businesses better off.”

Home lending success fuels growth

Jurkovich noted that Kiwibank's net lending growth hit $1.3 billion in the half, outpacing market growth in home lending by 2.7 times.

“This improved performance was driven by competitive pricing across key home lending rates, and a continued focus on growing our relationship with advisers,” he said. “This resulted in strong interest for customers looking to switch to Kiwibank, and a big increase in the number of first-home buyers choosing Kiwibank to achieve their homeownership goals.”

Support for Kiwi businesses

The Kiwibank boss also said business lending remained stable, reflecting businesses’ cautious borrowing approach amidst the current economic and geopolitical climate.

“The overall business lending market has contracted so in relative terms we can be pleased that we have helped more Kiwi businesses than ever,” he said.

Notable achievements and innovations

Among the key milestones of the half-year period were the introduction of Apple Pay for Kiwibank customers, the launch of Business Thrive HQ to support business growth, and the extension of Kiwibank’s partnership with Banqer, aimed at improving financial literacy in schools.

Additionally, Kiwibank was honoured as the Grand Effie winner at the 2023 Aotearoa Effie Awards, acknowledging its advertising campaigns.

Economic outlook and interest rates

Looking ahead, Jurkovich addressed the anticipation surrounding the Reserve Bank’s decision on interest rate adjustments. Despite the current economic climate and inflation concerns, he suggested that rate cuts might be less imminent than hoped, indicating a cautious approach to the evolving financial landscape.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.