OCR cuts before mid-2024 look unlikely, economists say

Despite recessionary conditions, the New Zealand market has remained exceptionally tight, with strong gains in employment, a slight lift in the unemployment rate, and record-level labour market utilisation, according to ASB economists.

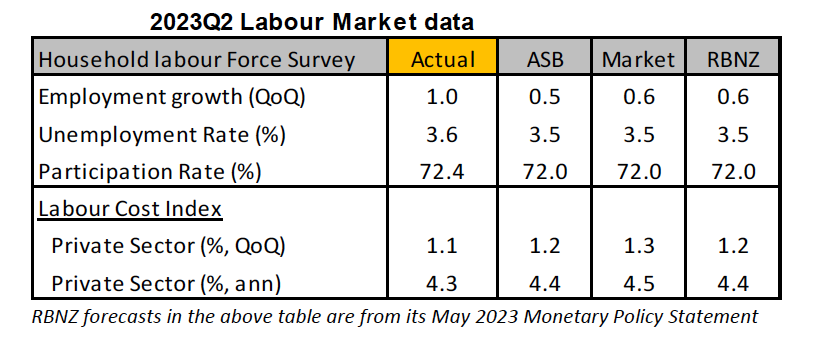

Latest data from Statistics New Zealand showed unemployment rate lifting to 3.6% in the June quarter from a record-low 3.4% in the prior quarter, while both labour force participation rate and employment rate were at their highest level since the survey began, at 72.4% and 69.8%, respectively.

“The unemployment rate did tick up, but this was in the context of exceptionally strong growth in the labour force,” said Nick Tuffley (pictured above), ASB chief economist. “If not, the Q2 unemployment rate would have had a ‘2’ in front of it.

“There appeared to be [an] element of ‘catch up’ with firms taking advantage of increased growth in the labour supply to meet acute labour market shortages. We don’t expect strong gains to persist given the sluggish demand environment.”

Despite experiencing recessionary conditions since late last year, the NZ economy has generated 113,000 more jobs in the last 12 months. According to the Quarterly Employment Survey (QES), filled jobs recorded a strong 2.6% qoq gain (6.5% yoy) and QES paid hours was up by a robust 2.3% qoq rate (6.3% yoy). Other measures, meanwhile, provided a more mixed picture, ASB economists said, with HLFS hours worked rising by a mere 0.3% qoq (+3.1% yoy).

“We are interpreting increases in employment as largely being driven by the greater availability of workers that has helped to plug long-standing labour shortages rather than an indication that the economy is continuing to churn out more and more jobs,” Tuffley said.

Offsetting strong employment growth was an even stronger growth in the labour force, which grew 1.1% qoq and 4.3% annually, the highest annual increase in six years. Working-age population, meanwhile, rose +0.6% in Q2 from the previous quarter, with an annual growth of 2.2%, the highest in nearly three years.

Continued tightness of the labour market, the soaring cost of living, as well as the April rises in the minimum wage (up 7.1% to $22.70 per hour) have continued to support nominal wage growth. Labour cost increases weren’t as high as expected by RBNZ and the market though, with labour costs for the private sector LCI (excluding overtime) rising 1.1% qoq (4.3% yoy) and for the public sector up a more tepid 0.6% qoq (4.2% yoy).

“Despite this, we are still in a high wage growth environment, which remains inconsistent with the 1-3% inflation target,” Tuffley said. “Wage increases were widespread with signs suggestive of a wage-price spiral.”

Absent a rebound in economic activity, ASB is predicting a growing margin of spare labour market capacity to emerge over the remainder of 2023 and into 2024 that will help drag down wage cost inflation.

“The RBNZ is likely to remain wary and will want to maintain restrictive OCR settings to squeeze inflation out of the system,” Tuffley said. “A nervous wait lies ahead for the RBNZ and there is still some risk of the OCR peaking above 5.5% this cycle. The RBNZ is unlikely to entertain OCR cuts until it is confident 1-3% inflation is attainable. OCR cuts before mid-2024 look unlikely.”

Use the comment section below to tell us how you felt about this.