The bank's mortgage customers' repayments during 2022 totalled $637 million

A majority of Kiwis are “in good shape for the year ahead,” with 68.1% of Westpac’s home loan customers ahead of scheduled mortgage repayments at the end of 2021, a jump from 65.9% at the end of the previous year.

Read more: Borrowers continue to struggle with mortgage payments

According to new Westpac NZ research, the median amount paid on home loans by borrowers who were ahead on their repayments was $11,022, or 10.5 months, compared to the $9,654 and nine months at the same period in 2020.

The repayments helped push the collective mortgage “buffer” for Westpac NZ customers up by $637 million.

Read more: Almost half of Kiwis rate their financial strength as 'fair' or 'poor'

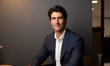

“COVID-19 is going to be part of our lives for some time and at the same time interest rates have been rising, so building up a savings or mortgage repayment buffer is a good way to help manage disruptions to the economy or changes to your own personal circumstances,” said Ian Hankins, Westpac NZ general manager of consumer banking and wealth. “These figures are backed up by customer survey data showing 21% of homeowners have spent more on paying their mortgages off during the pandemic.”

The data showed that Wellington was the leading region for both total proportion of customers ahead on repayments ($18,251) and average number of months ahead (19). West Coast (7.2%) and Manawatu-Whanganui (4.4%) recorded the biggest jumps in proportion of customers ahead. Meanwhile, every region saw an increase in customers ahead on repayments, including Auckland (0.9%).