Kiwis face credit challenges and opportunities in economic downturn

New Zealand's entry into a technical recession, marked by two consecutive quarters of economic contraction, is accompanied by mixed credit trends highlighting the uncertainty of 2024, according to Centrix.

Improvement in arrears with a caveat

Keith McLaughlin (pictured above), Centrix managing director, said that while there’s a glimmer of hope with a reduction in overall arrears to 457,000 people, down by 23,000 from the previous month, the year-on-year data tells a more troubling story.

“Arrears are 8.1% higher, tracking closely to 2018 levels after coming off historic lows,” McLaughlin said. “We continue to see arrears rise for mortgages, personal loans, and Buy Now Pay Later (BNPL) products as debt and financial stress builds.”

See LinkedIn post here.

Read this article to compare the March results with the previous month.

Credit demand and mortgage applications

Despite the recession, there's been a 3% increase in credit demand, driven by a rise in applications for unsecured credit.

However, mortgage applications have declined by 6% compared to last year, with vehicle loan applications down by 16%. Business credit demand has surged by 7%, with notable increases in the hospitality, retail, and transport sectors.

Financial hardship on the rise

The number of accounts reporting financial hardship has increased to 12,500, up 300 from January, marking a 27% rise year-on-year. Mortgages make up 44% of these hardship cases, highlighting the stress on homeowners.

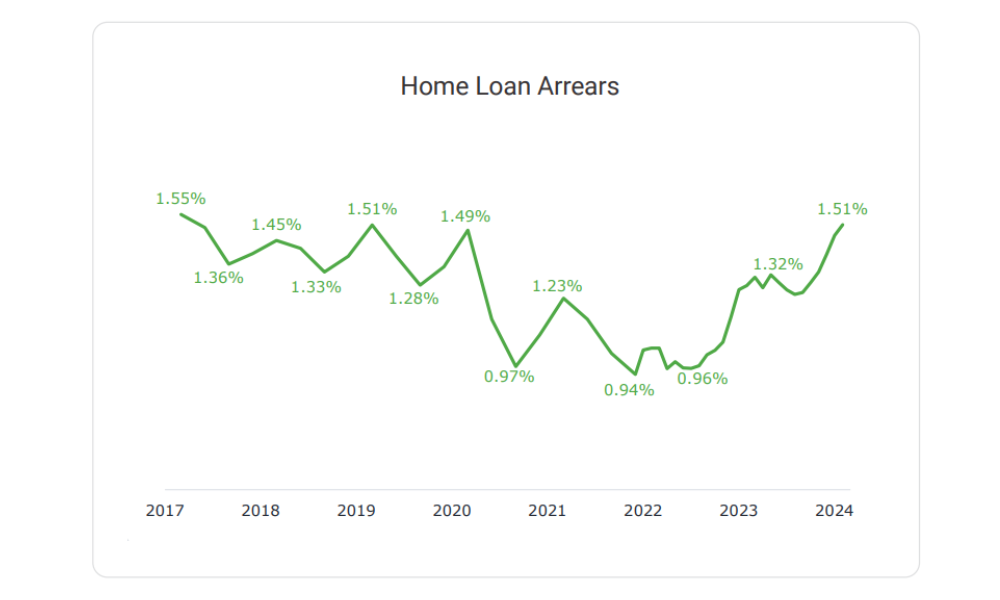

Mortgage stress and business credit defaults

Residential mortgage arrears have climbed to 1.51%, the highest since January 2020, with 22,600 mortgage accounts past due. Business credit defaults have also escalated, particularly in the property/rental, retail trade, and construction sectors, exacerbating the economic strain.

Hospitality sector under pressure

The hospitality sector faces significant challenges, with businesses more than twice as likely to fail compared to other NZ businesses. Rising costs, weak customer demand, and ongoing staff shortages continue to threaten the viability of pubs, bars, restaurants, and cafés, Centrix reported.

Access Centrix’s March Credit Indicator report.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.