Easing rates prevent deeper corrections

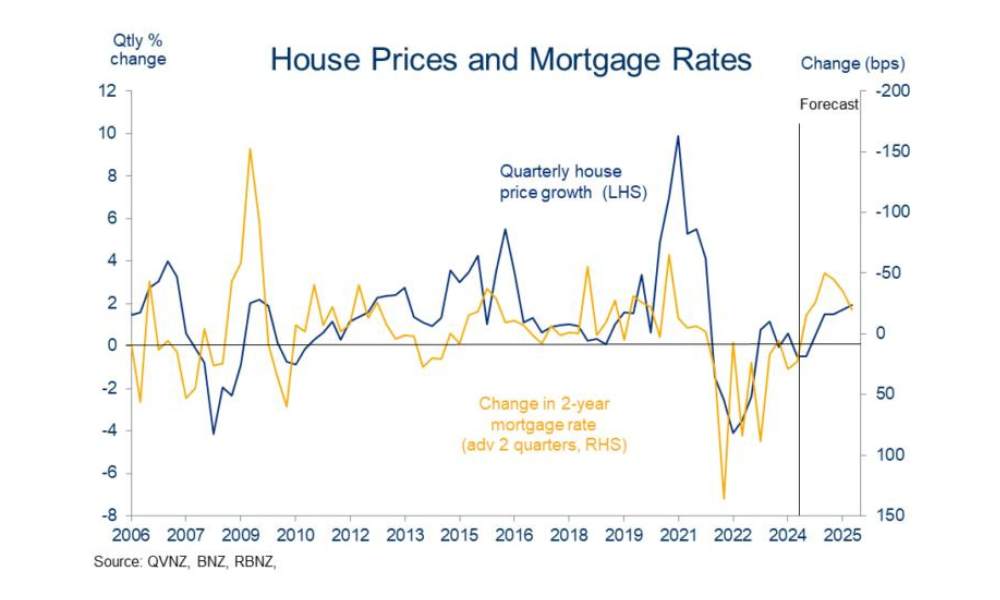

While recent mortgage rate declines won't trigger an immediate surge in the housing market, they are essential in preventing a deeper correction, according to BNZ chief economist Mike Jones (pictured above).

“We see recent falls in mortgage rates as more about preventing a deeper correction in house prices than providing the fuel for an immediate lurch higher,” Jones said.

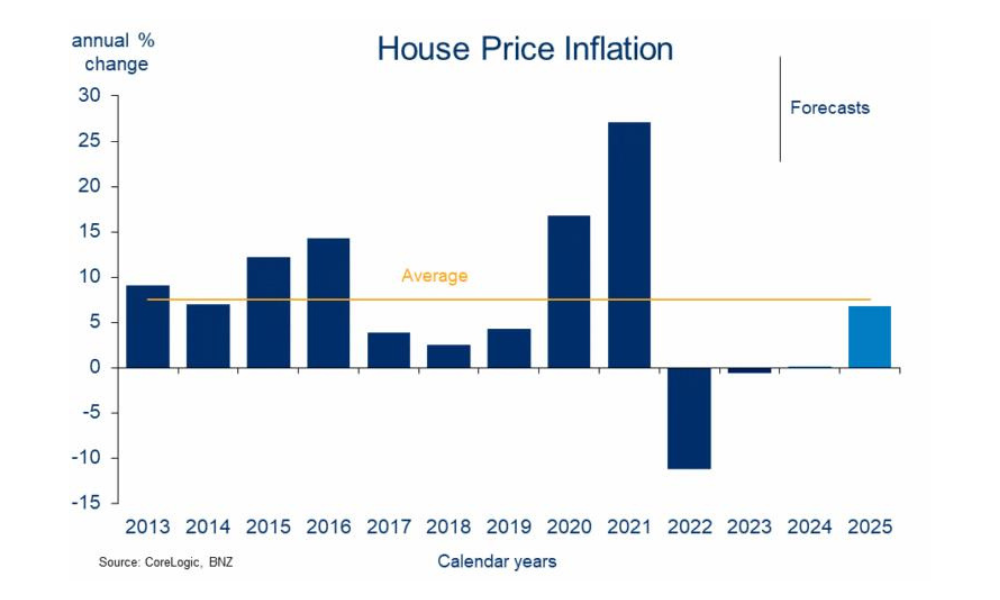

House prices expected to rise in 2025

Despite a flat housing market in 2024, Jones predicts a 7% increase in house prices through 2025.

“We’re still expecting a 7% lift in house prices over 2025,” he said.

The combination of easing mortgage rates and a more supportive policy environment is expected to drive this modest upswing.

Short-term borrowing to stay popular

Jones noted that mortgage borrowers are likely to continue favouring short-term fixed rates.

“The downtrend in interest rates is still in its infancy, and short-term rates appear to have more downside from here,” he said, suggesting that fixing for shorter periods could offer value as rates continue to decline.

Economic uncertainty tempers housing enthusiasm

While falling mortgage rates are expected to boost housing demand, broader economic factors, including a slowing labour market and reduced population growth, are likely to hold back significant price increases.

“Late cycle economic pressures remain intense... this is not something usually associated with rising house/asset prices,” Jones said.

Read the BNZ blog in full here.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.