GDP contraction expected in Q2

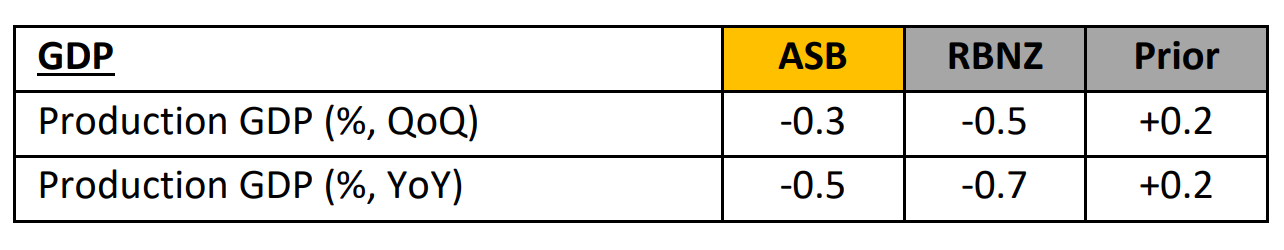

The New Zealand economy will contract by 0.3% in Q2 2024, marking the lowest GDP level in two years, according to ASB.

This would represent the fifth quarterly decline since the end of 2022.

“The per-capita story is set to be even weaker, and already exceeds the GFC decline,” ASB Chief Economist Nick Tuffley (pictured above) said, highlighting the prolonged impact of restrictive monetary policy on economic growth.

Primary and services sectors struggle

The primary sector has faced mixed results, with weak dairy and forestry production offset by stronger horticultural output.

Meanwhile, the services sector is expected to post its second consecutive quarterly decline, driven by sluggish retail trade and lower tourism numbers.

The downturn in tourism has been particularly evident, with visitor arrivals stagnating below pre-COVID levels throughout 2024.

Manufacturing surprises amid overall weakness

In contrast to the broader economic weakness, the manufacturing sector provided a bright spot in Q2, with non-food manufacturing, particularly in textiles and machinery, showing resilience.

However, construction and electricity generation have weighed on overall activity, with low hydro lake levels impacting power generation and expected to have a more significant effect in Q3.

Prolonged recovery expected

Despite signs of improvement in some areas, ASB remains cautious about the near future.

“We expect we are near a turning point,” Tuffley said, as less restrictive monetary policy should start to support growth heading into 2025.

However, domestic economic sluggishness, rising unemployment, and the potential slowdown in migration could hinder a robust recovery. A more noticeable rebound is not expected until 2025.

Monetary policy and future outlook

ASB expects the Reserve Bank (RBNZ), which initiated an easing cycle by cutting the OCR during its August Monetary Policy Statement meeting, to remain on course for further cuts to the OCR, predicting two additional cuts by the end of 2024, settling at 3.25% by 2025.

While the timing of these cuts will depend on the broader economic and inflation outlook, Tuffley noted that a smaller GDP contraction than RBNZ’s forecast of -0.5% could affect market expectations around rate cuts.

Read the ASB economic note here.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.