Post-election optimism wears off

Despite the post-election optimism in November, the New Zealand property market has experienced a significant slowdown in December, marking a 16-year low in new listings, excluding April 2020 due to COVID-19 lockdown, according to realestate.co.nz.

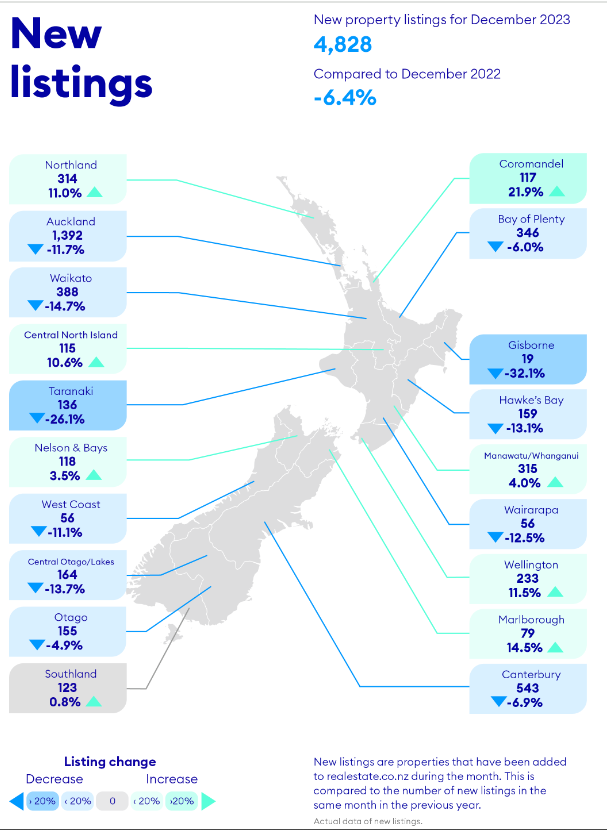

New listings were down by more than half compared to the previous month, resulting in a 6.4% year-on-year decrease to 4,828 new listings nationally.

The latest data from realestate.co.nz also revealed that both new listings and average asking prices remained below the levels observed in December 2022 nationwide.

“The summer break brings a different rhythm to the property market,” said Vanessa Williams, spokesperson for realestate.co.nz. “We typically see a natural slowdown as people focus on festivities, time with their loved ones, and getting away to the beach.”

However, some regional hotspots, such as Coromandel, defied the trend, showing a year-on-year increase in new listings (21.9%), stock (35.6%), and average asking prices exceeding $1 million.

Record low new listings in Auckland and nationwide

New listings in Auckland mirrored the national trend with a 16-year record low, down 11.7% to 1,392 new listings. Auckland had fewer listings in December than in April 2020 when COVID-19 lockdowns restricted the market.

Williams said that while it’s typical to see a dip in December, this year’s decrease is more significant than usual.

“The last time we saw levels like this was December 2019, when nationally, there were only 5,528 listings and just 1,422 in Auckland,” she said. “It starkly contrasts the more than 10,000 new listings which hit the market just a month earlier in November.”

Some vendors, Williams said, might be postponing listings until the New Year, aiming to sell via auction, which is typically rare during the Christmas break.

Nationwide, 11 out of 19 regions experienced a decline in new listings. The most significant decreases were observed in Gisborne (down 32.1% year-on-year to 19 new listings) and Taranaki (down 26.1% year-on-year to 136 new listings).

Conversely, Coromandel (up 21.9% year-on-year to 117 new listings) and Marlborough (up 14.5% year-on-year to 79 new listings) showed the most substantial increases.

National stock levels dip, some non-central areas resilient

National stock levels decreased by 4.6% year-on-year, typical during year-end celebrations, especially in major centers. Gisborne, however, experienced the most substantial drop with a 30.6% year-on-year decrease, to just 74 properties on the market.

Contrastingly, nine out of 19 regions saw increases in stock levels compared to December 2022. Coromandel and Central North Island led with notable year-on-year increases of 35.6% and 27.1%, respectively.

Mixed bag for average asking prices

December’s average asking prices displayed mixed results, driven by regional variations. Regional New Zealand continued to influence the market positively.

Amidst the holiday slowdown, Central Otago/Lakes District, Nelson and Bays, Taranaki, Wairarapa, and West Coast stood out with month-on-month and year-on-year growth in average asking prices for December.

Central Otago/Lakes District achieved an unprecedented high with the region’s highest average asking price reaching $1,590,855, marking a 16.2% year-on-year increase.

“Central Otago/Lakes District is a lifestyle region,” Williams said. “Despite its distance from major business hubs, it boasts the highest average asking price in the country. The average asking price in Central Otago/Lakes District is around half a million dollars more than in Auckland.”

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.