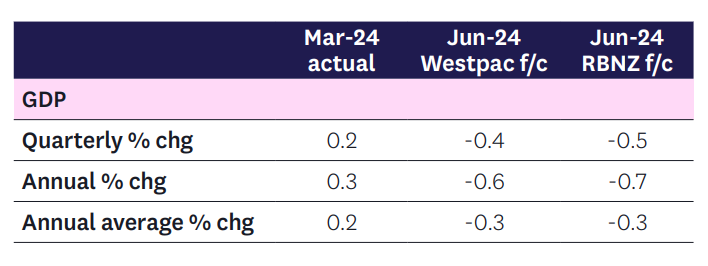

The GDP is expected to see a 0.4% decrease

The “rolling maul” recession that has been seen in the last few years has continued with the expectations of a 0.4% fall during the June 2024 quarter, according to a report by Westpac.

In the bank’s latest Economic Bulletin, which investigated the previews of the GDP in June, Westpac NZ senior economist Michael Gordon (pictured above) said that there was a softening in the spending in retail and tourism-related sectors, with economists from the bank also expecting the changes in the timing of tax payments to have a negative impact.

“Our forecast is slightly above the Reserve Bank’s estimate of -0.5%. The RBNZ noted a deterioration in the monthly activity data at the end of the quarter, but this weakness appears to have been short-lived,” said Gordon.

The “rolling maul” recession in the economy meant that there was one quarter of flat or slightly negative growth which had seamlessly merged with one another. It is expected that the GDP release on Thursday will show a continuation of this. With the 0.2% rise in the GDP for the quarter of March, it is expected that there will be a 0.4% fall for the quarter of June.

“That’s a modest upgrade from our earlier forecast of -0.6%, because of the final sectoral indicators that were released yesterday – which included a remarkably strong bounce in manufacturing activity,” said Gordon.

“The overall picture remains soft though, with most sectors expected to record declines for the quarter, and consumer spending remaining particularly weak as they continue to grapple with high interest rates and the rising cost of living,” he added.

According to Gordon, the bank’s forecast was slightly stronger than what the Reserve Bank had expected in August. However, should the forecast be true, it may not influence how the RBNZ thinks.

“In its decision to start cutting the OCR much sooner than previously signalled, the RBNZ cited a range of high frequency activity indicators that had lurched sharply lower in the June month. While those June results all but ensure a weak GDP outturn for the quarter as a whole, that weakness doesn’t appear to have carried through into July and August,” said Gordon.

“With the risk of a sharper than expected downturn now fading, we think the RBNZ will return its focus to the inflation data to determine how far or fast it will be able to reduce interest rates.”