Limited growth in property values

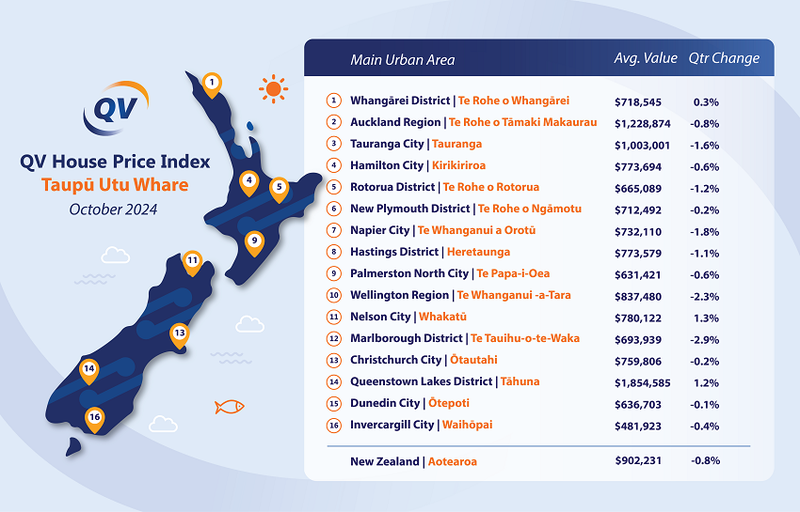

The QV House Price Index revealed that New Zealand’s housing market remains stagnant, with the average property value declining by just 0.8% over the three months to October.

While this marks a slowdown in declines from previous quarters, the national average home price now stands at $902,231 – just 0.3% lower than at the beginning of 2024.

“New Zealand’s housing market remains largely flat overall,” said James Wilson (pictured above), QV operations manager, citing economic constraints and recent interest rate reductions that have yet to fully impact the market.

Urban areas stabilise, but gains remain limited

Across New Zealand’s main cities, house prices have generally levelled.

For instance, Auckland saw a modest 0.8% decline, Christchurch was down by just 0.2%, and Hamilton fell by 0.6%. Even Wellington, which previously experienced larger declines, showed signs of slowing, with house prices dropping by 2.3%, down from a previous 3.2%.

However, areas like Nelson, Queenstown, and Whangarei managed slight growth, with increases of 1.3%, 1.2%, and 0.3%, respectively.

Consumer confidence slowly rebounding

Despite some positive shifts in sentiment, Wilson said that the market remains subdued.

“Interest rate relief is on the way for homeowners, but it will take some time for it to be fully felt,” he said.

Although consumer confidence is slowly improving, especially with expectations of further OCR cuts, housing affordability challenges persist.

Rising unemployment and stock availability are keeping house prices in check, making it a buyer’s market for those cautious about affordability and job security.

Auckland: Signs of a “bottoming out”

In Auckland, values fell by just 0.8% this quarter, indicating a “bottoming out” trend.

Registered valuer Hugh Robson noted that certain areas, particularly inner-city suburbs, are showing stable house prices, with tidy homes selling quickly.

“As mortgage rates drop and summer approaches, there seems to be a few more buyers out there now,” Robson said, particularly in areas with new-build apartments providing buyers with ample choice.

Wellington and other key regions

Wellington’s housing market showed a deceleration in its downturn, with home values dropping by 2.3% in the October quarter, a marked improvement from previous rates.

QV senior consultant David Cornford attributed this to recent interest rate drops, which appear to be helping support property values and increase market activity.

The market saw slight growth in Palmerston North (+0.4%) and Hamilton (+0.2%), where demand has been steady, with updated homes particularly attracting attention.

Mixed results in regional areas

In Tauranga, the average property value hovered around $1 million after a 1.6% decline.

Meanwhile, Northland saw its northernmost city, Whangarei, break out of the slump with a 0.3% increase, its first quarterly rise since May.

Waikato’s market presented mixed results: Hamilton saw a slight 0.2% monthly increase, while South Waikato and Waipa experienced gains of 3.1% and 1.7%, respectively.

However, Thames-Coromandel recorded the largest decline at 3.4%, QV data showed.

Growing interest from first-home buyers

First-home buyers remain the most active demographic, but investors and owner-occupiers are slowly re-entering the market, encouraged by stabilising house prices and an increasing selection of properties.

Wilson explained that while interest rates may attract more buyers, affordability remains challenging.

“Housing affordability remains a challenge for everyone, even as economic conditions slowly improve,” he said.

Prospective buyers face a difficult balancing act, weighing falling interest rates and a variety of property choices against concerns of rising unemployment and job security.

Read more: Is housing affordability still an issue in New Zealand?

Outlook remains cautious

While the market shows signs of stabilizing, significant growth remains unlikely in the short term.

“The market has bounced back with a bit more bustle, especially with more transactions in the lower quartile of home values,” said QV consultant Olivia Brownie of Canterbury’s market activity.

The expectation of more OCR cuts may bolster buyer interest, yet high stock levels and employment uncertainties continue to impact long-term confidence.

Read the latest QV report in full here.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.