Westpac gives its verdict

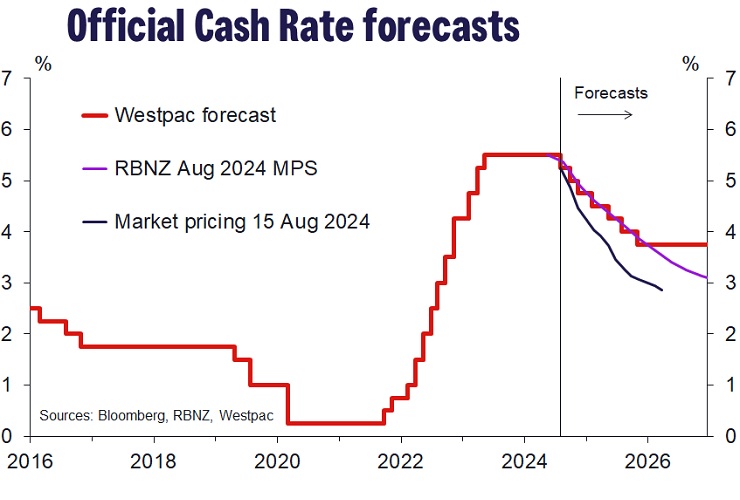

The Reserve Bank (RBNZ) unexpectedly cut the OCR by 25 basis points this week, signalling an additional 50 basis points of cuts in 2024.

Westpac NZ chief economist Kelly Eckhold (pictured above) noted that the move advances the easing cycle by six weeks, reflecting recent economic weakness.

“The weakness in the economy seen in the last few months seemed to justify a shift forward in policy easing from the RBNZ’s very hawkish position back in May,” Eckhold said.

Revised medium-term OCR forecasts

Westpac NZ has updated its medium-term forecasts, now expecting the OCR to fall to 3.75% by the end of 2025, down from the previously projected early 2026.

The pace of easing is expected to slow in 2025, with the RBNZ likely taking a measured and data-dependent approach.

“We have shifted forward our OCR profile by one meeting to reflect the earlier start to easing, but retain the same terminal OCR forecast of 3.75%,” Eckhold said.

Risks to the OCR path

Eckhold highlighted potential risks to the revised OCR path, including the possibility of a more front-loaded easing cycle if economic activity remains weak.

Additionally, if tradables sector inflation falls below historical norms, the RBNZ may consider taking interest rates below the neutral OCR estimate of 3.75% in late 2025.

“Any forecasts in 2025 remain indicative at best, and we see these as two-sided and highly dependent on the bounce-back in activity and housing market indicators,” Eckhold said.

Updated long-term interest rate forecasts

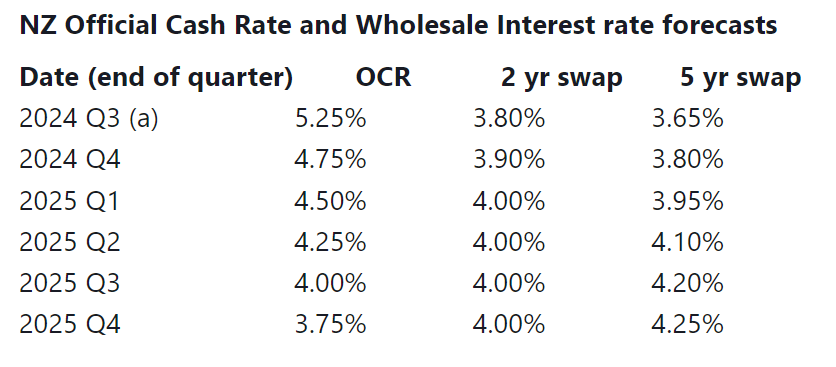

In response to the updated OCR outlook, Westpac NZ has also revised its long-term wholesale interest rate forecasts.

The bank now expects two- and five-year swap rates to bottom out at current levels before gradually increasing.

Markets are likely to adjust expectations for the terminal OCR from below 3% to around 3.75% as the economy responds to lower interest rates.

“Our view is that markets will continue to price in a lower terminal OCR for the next 6-12 months but will gradually adjust those views upwards,” Eckhold said.

NZD underperformance expected

Westpac NZ maintains its exchange rate forecasts, anticipating New Zealand dollar underperformance, particularly against the Australian dollar.

This outlook is driven by diverging macroeconomic conditions and interest rate cycles between the two countries.

“The macro picture and interest rate cycles are clearly diverging in ways that should undermine the NZD/AUD in the period ahead,” Eckhold said.

Read the Westpac insights in full.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.