Wealth rises with pension growth

Household pension assets saw a notable rise in the March 2024 quarter, driving an increase in overall household wealth, according to data released by Stats NZ.

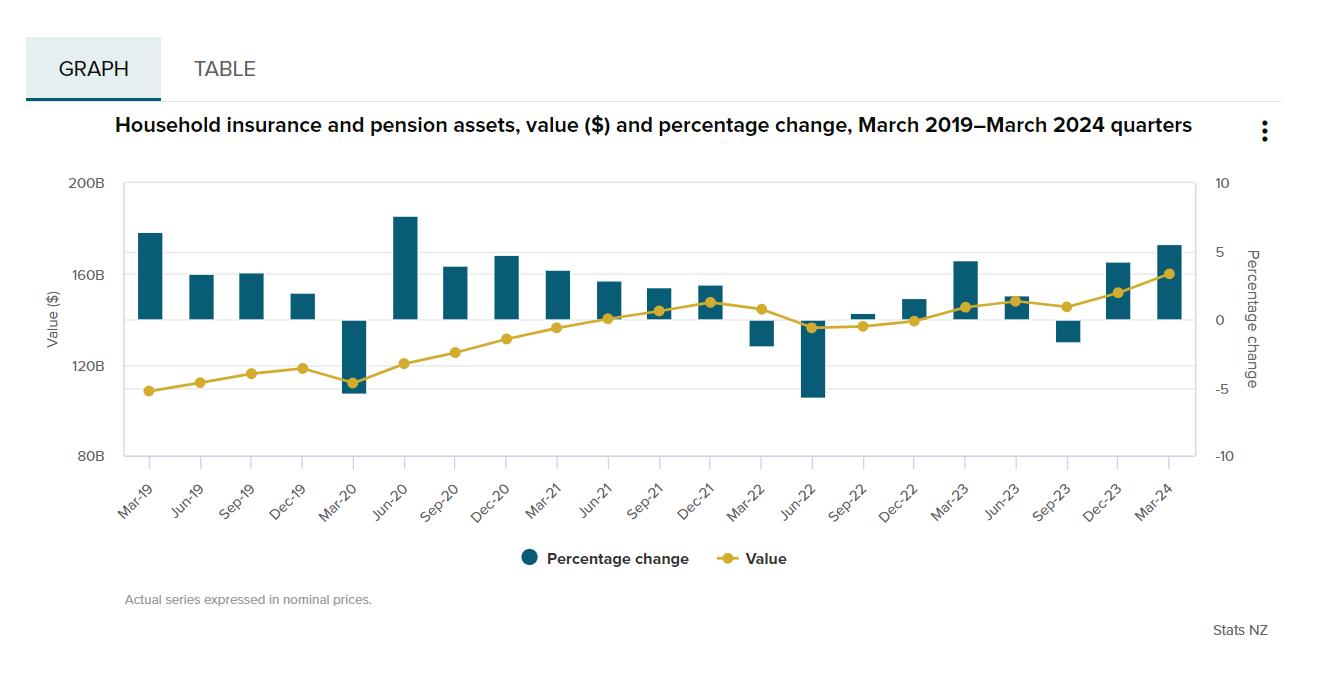

The total value of insurance and pension assets of households rose by $8.3 billion (5.5%) from the December 2023 quarter, following a $6.2 billion (4.3%) rise in the previous quarter.

In the year ended March, household insurance and pension assets increased by just over 10%.

“Superannuation funds, such as KiwiSaver, comprise the large majority of household insurance and pension assets,” said Paul Pascoe (pictured above), national accounts institutional sectors senior manager at Stats NZ.

“These funds are invested in local and global equities which can be quite volatile, and in this quarter led an increase in household wealth.”

Overall household wealth growth

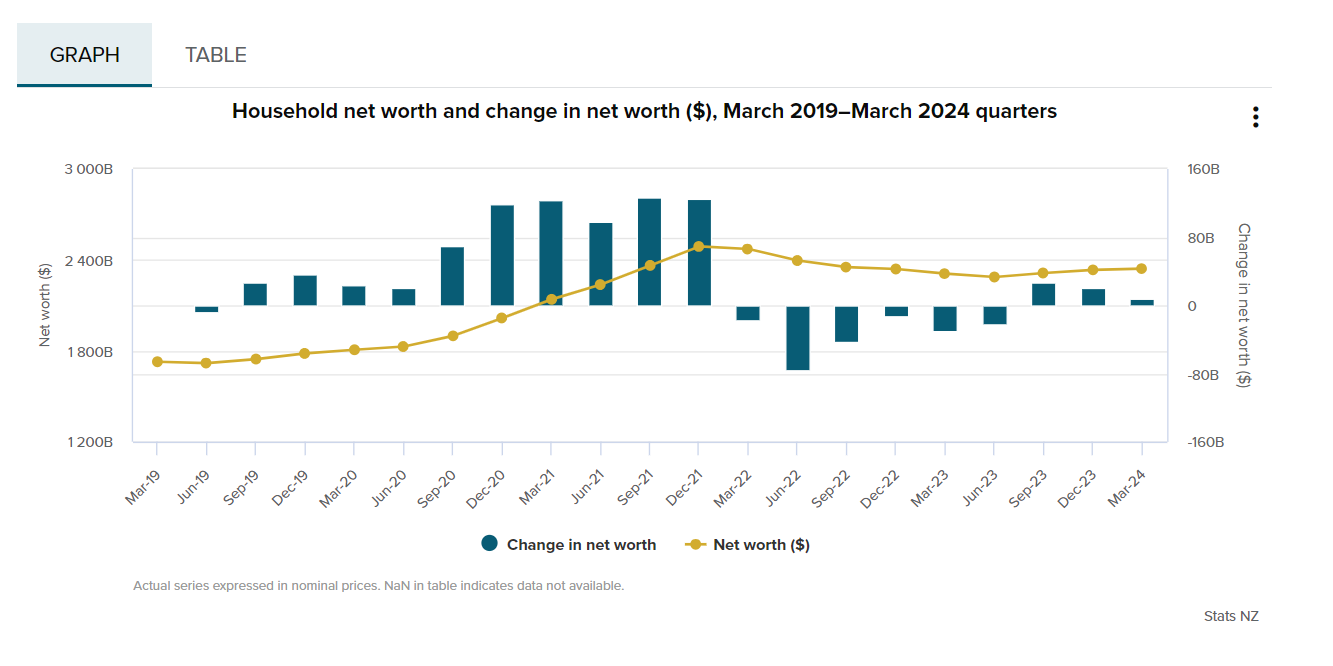

Total household assets increased by $10.3 billion, or 0.4%, in the March quarter.

Net worth, which is the value of total assets minus the value of total liabilities, rose by $7.8 billion (0.3%) during the quarter.

“This increase in net worth reflects the positive impact of rising pension assets on household wealth,” Pascoe said.

Read the Stats NZ media release.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.