Downturn continues, hope ahead

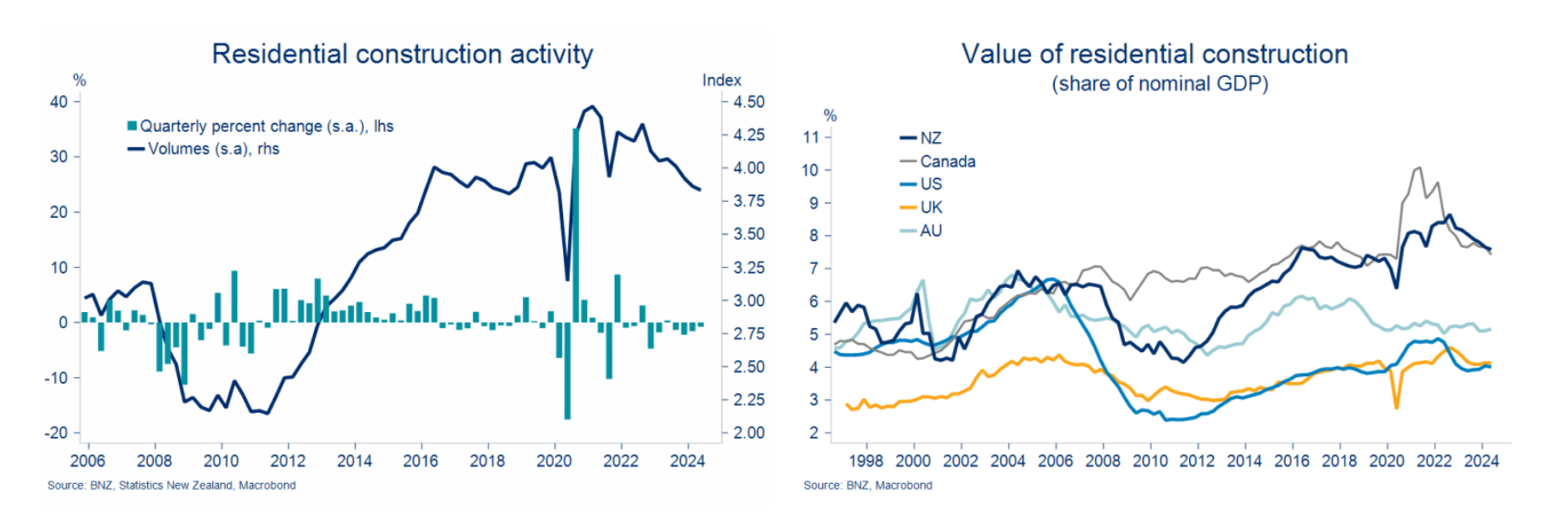

The residential construction sector continues to face significant challenges, with activity declining in six of the last seven quarters, dropping 14% from its peak in 2021.

“The downturn in residential construction is not over yet,” said Mike Jones (pictured above), BNZ chief economist.

The sector remains affected by high building costs, falling house prices, and easing demand due to slower population growth.

Although these trends align with global patterns, New Zealand’s share of GDP dedicated to home building remains higher than in many other countries.

Stabilisation in consents offers a glimmer of hope

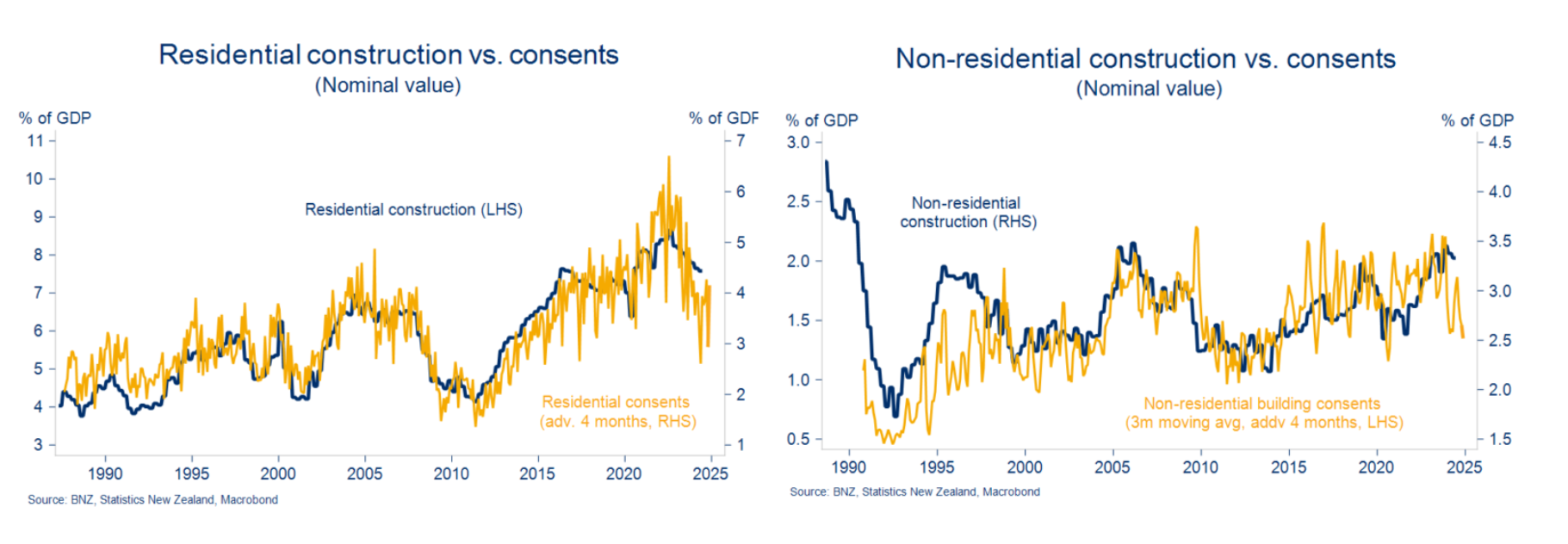

Building consent issuance, a key indicator of future construction activity, has shown signs of stabilisation this year after plummeting to about a third below 2022 highs.

This stabilisation has been driven primarily by an uptick in consents for stand-alone houses, while townhouses and apartments continue to lag.

Regions like Otago, Canterbury, and Waikato are showing the most promising signs of recovery.

Despite the slight improvement, the current low level of consents suggests that the construction downturn still has further to run.

High costs and low demand hinder recovery

One of the biggest hurdles for the sector has been the skyrocketing costs of construction, which rose by 35-40% from 2020 to 2023.

Although cost inflation has levelled off, the overall expense of building remains high, with the average cost of a standalone house hovering around $3,300 per square metre – about $1,000 more than in 2020.

“It’s still generally cheaper to buy existing than to build new,” Jones said, highlighting the significant price gap between building new homes and purchasing existing ones, which continues to dampen the financial appeal of new builds.

Easing population growth cools housing demand

The once-strong tailwind from housing demand has weakened as population growth has slowed.

While migration-driven demand pushed construction above estimated requirements in 2023, the cooling in population growth has brought housing supply and demand closer to balance.

The number of people per dwelling (PPD), a key measure of housing stock pressure, rose slightly in 2023 but may have already peaked, reflecting how recent construction has caught up with prior population growth, BNZ reported.

Hope for a rebound in 2025

Despite the current challenges, some macroeconomic factors are turning more favourable for the sector. Declining interest rates and a forecasted rise in house prices next year offer a potential turning point.

“We’ve pencilled the beginnings of a turn in the residential construction cycle for early 2025,” Jones said, though he cautions that risks of further delays remain.

A recovery in construction could provide much-needed stability to related sectors such as manufacturing and durable goods spending. Encouragingly, surveyed construction intentions have improved, indicating a potentially brighter outlook as the sector finds its footing.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.