Retail spending dips marginally, with Westpac and ASB predicting a gradual recovery

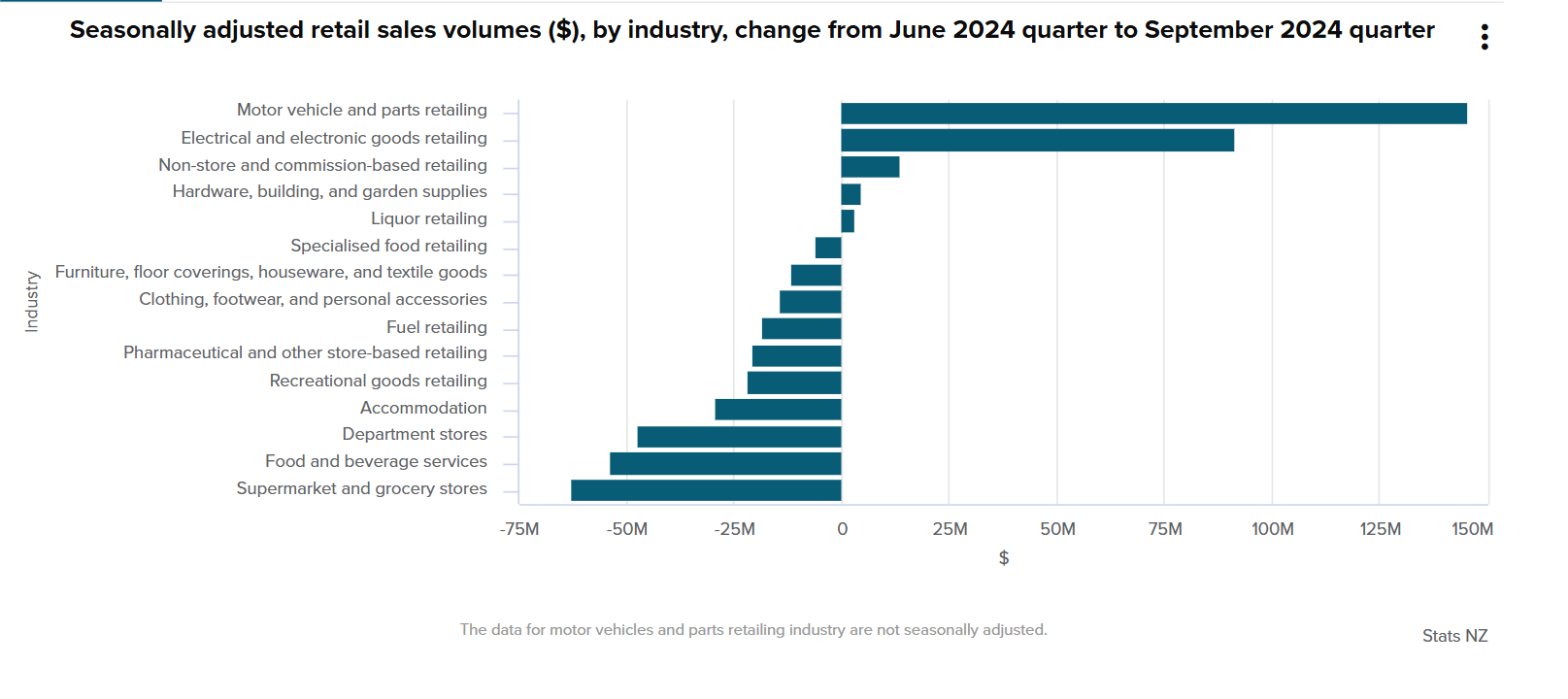

Retail sales volumes in New Zealand dropped 0.1% in the September 2024 quarter, continuing the softness seen throughout the year, according to Stats NZ data.

The decline reflects subdued spending across most retail industries, with notable drops in grocery and food services.

“Retail activity was flat in the September quarter,” said Michael Heslop, Stats NZ economic indicators spokesperson. “A decrease in spending in most retail industries was offset by an increase in motor vehicles and electrical goods.”

Supermarkets and grocery stores saw a 1.3% decline, while food and beverage services fell 2.1%. Ten of 15 retail categories recorded lower sales volumes.

ASB: Economic headwinds persist

Nick Tuffley (pictured above left), ASB chief economist, highlighted the challenges facing the retail sector.

“The prospects for retail remain constrained by weakening labour market conditions and slowing wage growth,” he said. “The unemployment rate rose to 4.8% in Q3 and is projected to hit 5.5% by mid-2025.”

Tuffley acknowledged modest positives, including tax cuts, easing inflation, and declining interest rates.

“Lower inflation, now at 2.2%, offers some relief, and further OCR cuts will provide additional support,” he said. However, it will take time for these factors to translate into a meaningful lift in household spending.”

ASB expects the Reserve Bank to deliver another 50bp OCR cut this week, with rates reaching 3.25% by 2025.

Westpac: Gradual recovery on the horizon

Satish Ranchhod (pictured above right), senior economist at Westpac NZ, said retail spending in Q3 was softer but not as weak as anticipated.

“Spending remains subdued, particularly in discretionary areas like furnishings and dining out,” he noted. “Core retail sales, excluding vehicles and fuel, fell 0.8% in the quarter and are down 2.8% year-on-year.”

Looking ahead, Ranchhod expects spending to gradually improve as inflation eases and tax cuts take effect.

“While financial headwinds are easing, it will take time for households to feel the full benefits,” the Westpac economist said. “We expect gradual recovery through the holiday season, with a more significant lift by mid-2025.”

Implications for GDP growth

The softness in retail aligns with forecasts for a 0.2% contraction in GDP in the September quarter, according to Westpac.

“While today’s figures were firmer than expected, they confirm the continued economic weakness we anticipate,” Ranchhod said. “The easing financial pressures should support a gradual recovery in spending and GDP growth heading into 2025.”

Holiday spending and beyond

Both ASB and Westpac expect the Christmas shopping season to see slight improvements, with the broader recovery building over time.

“With inflation cooling, interest rates falling, and tax cuts supporting household budgets, we foresee retail spending gaining momentum in the coming months,” Ranchhod said.

To view the Stats NZ report, click here. Also see the commentaries from ASB and Westpac.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.