DTI investor ratio "too restrictive"

In response to the Reserve Bank of New Zealand's (RBNZ) proposed debt-to-income (DTI) ratio policy, major mortgage broker and non-bank lender Squirrel has submitted its feedback.

The RBNZ invited public comment on the DTI framework, which would set borrowing limits for home loans based on a borrower's income.

For owner-occupiers, the limit would be set at six times their income, while investment property purchases might allow up to seven times, potentially excluding new builds.

The regulator is also proposing that banks would be limited to issuing no more than 20% of their residential mortgages to borrowers exceeding these DTI limits.

“Broadly speaking, we think introducing DTI limits is a really good idea,” said Squirrel founder John Bolton (pictured above).

“Along with all the other lending restrictions that our banks are subject to in New Zealand, they’ll be an effective and valuable tool to help bring more stability to our housing market.”

Bolton said the owner-occupier DTI limit of six times income “felt appropriate”.

“All the data suggests that capping lending at this level will do an excellent job of limiting financial stress for this group at times of higher interest rates and won’t be too much of a handbrake on buyer activity until house prices start to ramp up,” Bolton said.

But beyond that, Bolton said the company has “several concerns” about the unintended impact of the proposed restrictions for property investors and business owners.

1. DTI investor ratio “too restrictive”

The goal of DTI limits is to act as a buffer during hot housing markets. By restricting how much buyers can borrow when prices are rising quickly, these limits can help prevent prices from spiralling out of control.

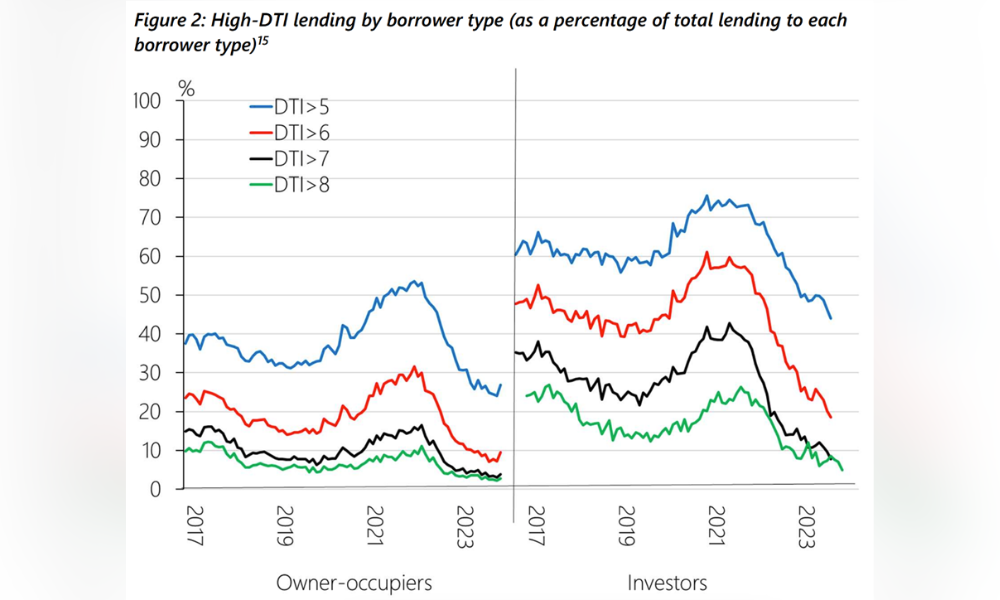

However, Bolton argues, as per the RBNZ chart below, that a significant proportion of New Zealand borrowers have borrowed at seven times their income or above.

“You can see there have been large periods (even excluding the 2021 boom) where a significant proportion of banking lending to property investors has been over the proposed limit, well outside the 20% buffer the banks will have to cater to this sort of thing,” Bolton said.

Bolton pointed out that the only time borrowers have been comfortably within the 20% restriction was after 2022.

“This was due to many factors that pretty much took investors out completely, including removing tax benefits on rental properties,” he said.

In other words, Squirrel argues that the last two years were not an accurate measure of how restrictive (or not) the proposed limits could be.

“Our concern is that a DTI of seven for this group has real potential to limit investor buying activity at all periods in the housing market cycle, so we recommended that a limit of eight would be more appropriate,” Bolton said.

2. The banks are “hyper-conservative”

The second concern Squirrel expressed to the RBNZ was that banks are often “hyper-conservative” when implementing lending restrictions – so the “speed limit” they work to will likely be even lower.

“Banks are conservative beasts by nature, and in our experience, they’ll always err on the side of caution when they implement this sort of thing internally,” Bolton said. “The RBNZ might have proposed a 20% speed limit on high-DTI lending, but the banks will probably work to something closer to 15%-17%.”

“That means even less appetite to cater to investors who need to borrow more, making the situation even more restrictive.”

This was another reason why Squirrel’s recommendation called for either an increase to the DTI investor limit of eight times income or consider a limit of 30% for this group.

3. Existing property investors may be caught out

Like most lending restrictions, DTIs won’t just apply when you buy a property.

“Your situation will also be reassessed when you want to offload a property, or if you need to make other material changes to your lending,” said Bolton. “The concern we outlined to the RBNZ is around investors who weren’t subject to DTI restrictions when they bought but will then become subject to them when they sell.”

Bolton said the risk was that investors may “unwittingly find themselves outside the limits”, and vulnerable to the banks acting (by claiming sale proceeds) to reduce their debt and bring them back within the DTI rules.

“If you’ve sold a property to use that money for something else, that will create a lot of pain,” he said.

Furthermore, Bolton said It could potentially create an even bigger mess for borrowers with loans across different banks.

“Because DTIs are calculated across your entire portfolio (rather than just property-by-property), if you’re over the limit with one of your lenders, you’re over the limit with all of them.”

4. Concerns over new builds

New builds will be exempt from DTI restrictions, as will homes purchased under the Kāinga Ora First Home Loan scheme (for first-home buyers), and refinancing deals where the loan amount stays the same.

Bolton said the issue with this is that the new build definition only applies at the time of purchase.

“What happens when an investor wants to make changes to their portfolio in future, and that triggers a reassessment? Will they again find themselves inadvertently outside the DTI limits?” he said.

“Given the challenges this could create, our submission questioned the logic behind the new build exemption – and encouraged the RBNZ to think through how it plans to manage the implications for property investors.”

5. Concerns for business owners

Many New Zealand business owners also invest in property. They often use their property portfolio as a source of additional capital for their businesses when needed.

Bolton is concerned that the DTI limits could restrict this flexibility. Business income can be cyclical, with ups and downs due to seasonal changes or economic downturns.

“There are huge potential consequences for business owners when it comes to leveraging their property portfolio to access business capital,” Bolton said.

“Especially if banks are already operating at the limit of their high-DTI lending, which feels likely for all the reasons we’ve mentioned already, the new rules could seriously restrict access to a key source of business capital when it’s most sorely needed.”

To view Squirrel’s submission, click here.

What do you think of Squirrel’s concerns about the upcoming DTO ratio? Comment below.