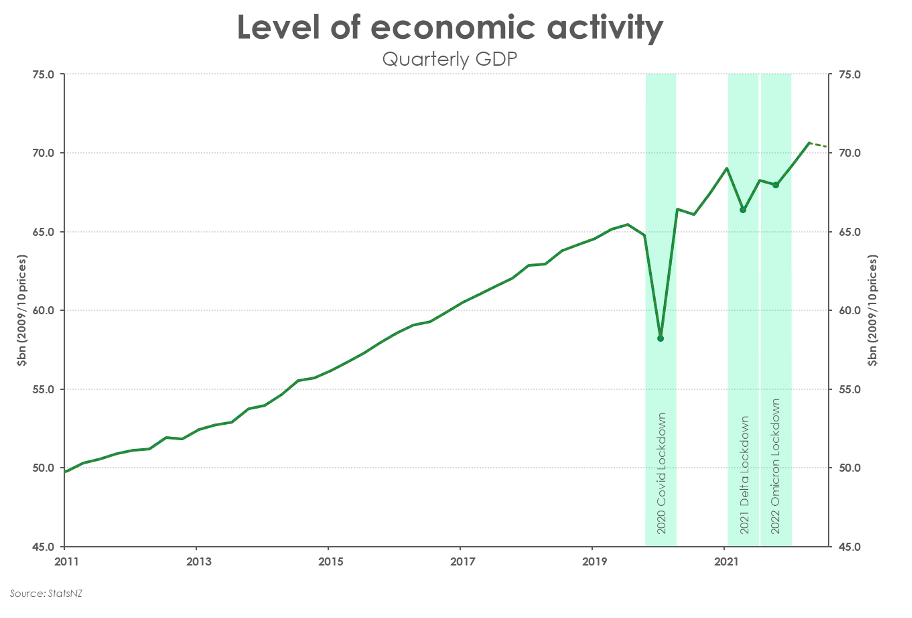

The economists still expect New Zealand to enter a shallow recession

With the “final piece of the 2022 economy puzzle” out on Thursday, Kiwibank said it was expecting economic activity to have contracted in the last quarter of the year as payback for the strong growth in previous quarters.

“We are expecting economic activity contracted 0.3% over the quarter. It’s predominantly payback for the blockbuster 2% growth in the September quarter alone, and the 1.9% the quarter before,” said Jarrod Kerr (pictured above), chief economist, and Mary Jo Vergara, senior economist, in Kiwibank’s latest publication.

“Such growth simply cannot be sustained. However, a -0.3% print would still make for impressive growth over the second half of 2022 at 1.2%. That’s well above the pre-Covid quarterly average of 0.7%. Over 2022, economic activity would have expanded a decent 2.6%.”

Kerr and Vergara said the contraction may have been deeper if not for the ongoing recovery in tourism, which is providing support to the services industries, particularly in arts and recreation.

“International tourism continues to climb,” they said. “Visitor arrivals have risen steadily with the removal of border restrictions last year. Arrivals are running at about 70% of the pre-COVID levels. So, there is more upside to come. Australians topped the list of tourist spending in the December quarter.”

The Kiwibank economists also noted that key measures of economic activity slowed into year-end.

“For one, retail trade data over the quarter disappointed,” they said. “Despite the value of retail sales holding up, when adjusting for hefty prices rises, the volume of goods sold fell. The cost-of-living crisis, the fall in property values, and the rise in interest rates are weighing on household demand. And weak consumption points to weak production. It’s a similar story in manufacturing sales. The value of sales dropped 0.4%, but the volume of sales dropped further – down 4.7% in the quarter alone.”

Construction, which was the star performer over the September quarter, saw a softening in building activity into the end of 2022, with Stats NZ data showing a 1.6% drop in the volume of activity over the quarter, driven by a 2.6% decline in residential activity.

“That comes as no surprise as it follows a weakening housing market,” the economists said. “New dwelling consents remain elevated but looked to have peaked early in 2022. The fall in volume of building work reflects the ongoing downtrend in building consents issued. The construction industry should see some payback after the 5.1% print recorded in Q3.”

Looking ahead, Kerr and Vergara said the cyclone clean-up and rebuilding would pose an upside risk to the 2023 growth outlook. However, they still are still expecting the Reserve Bank’s aggressive monetary policy tightening to result in New Zealand entering a shallow recession this year.

Click here to access the full report.

What do you think about this story? We’d love to hear from you in the comments below.