Rates could drop faster than expected, experts say

Home loan rates may fall faster than expected, with two-year fixed rates potentially dropping to 5% or below by mid-2025, according to industry experts.

Recent rate cuts by banks, now below 5.8% from a peak of around 7% last year, are setting the stage for more favorable borrowing conditions.

Here are three factors that could accelerate the decline in rates for mortgage brokers and their clients, as reported by RNZ.

Bank competition heats up amid low market turnover

Low housing market turnover is prompting banks to compete more aggressively for the limited number of home loan customers.

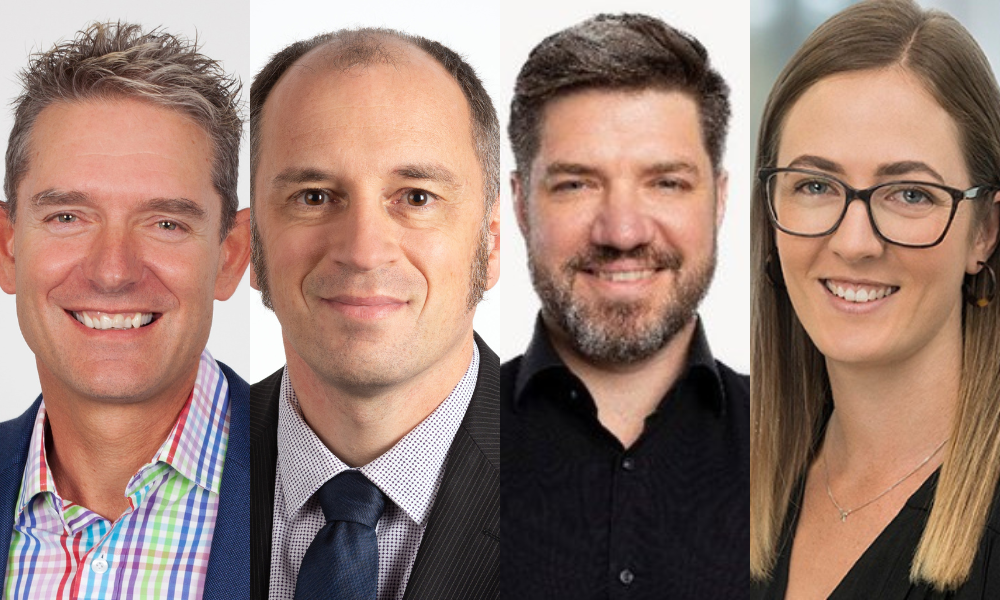

David Cunningham (pictured above, far left), CEO at mortgage broking firm Squirrel, noted that while banks appear eager to offer market-leading rates, this isn’t quite a “mortgage war.” Instead, banks are making calculated rate decisions based on weekly market conditions.

“Given the big falls in wholesale interest rates, we're seeing retail interest rates catch up,” Cunningham told RNZ, adding that bank margins remain substantial compared to wholesale rates, meaning room for further cuts exists.

Federal Reserve moves could pressure NZ rates lower

The US Federal Reserve’s recent 50-basis-point rate cut, double what was expected, could indirectly impact New Zealand’s interest rates.

Infometrics chief forecaster Gareth Kiernan (pictured above, second from left) explained that if the Fed continues to cut aggressively, it could push the US dollar down and strengthen the New Zealand dollar, effectively tightening local monetary conditions.

“The natural response to this outcome would be for our Reserve Bank to also cut interest rates more quickly,” Kiernan told RNZ, suggesting that New Zealand could see one or two 50 basis point cuts if this trend continues.

Economic contraction points to further rate cuts

Kiwibank Chief Economist Jarrod Kerr (pictured above, second from right) highlighted the latest GDP data showing the economy contracted by 0.2% in the June quarter, marking the fourth decline in seven quarters.

Kerr believes this slowdown supports the need for rapid rate cuts, arguing that the Reserve Bank has already done enough to curb inflationary pressures.

“Enough is enough. And the Reserve Bank are responding – late, but in earnest,” he said, predicting rate cuts of 50 basis points in both October and November.

Cautious Optimism from Other Economists

ASB’s Kim Mundy (pictured above, far right), however, urged caution, noting that while rate cuts are on the horizon, a swift economic recovery is unlikely given ongoing challenges like a weakening labour market.

“The economy is weak, as to be expected after a prolonged period of restrictive monetary policy,” Mundy told RNZ.

Mundy expects a more gradual recovery through 2025, with the OCR potentially reaching 3.25% by the end of that period.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.