Bank focuses on growth, stability

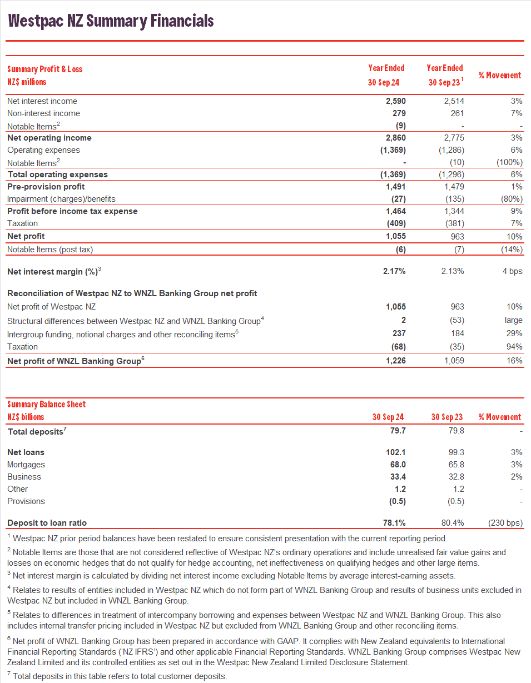

Westpac New Zealand posted a modest 1% increase in underlying profit for the year ending September 30, 2024, with net profit rising by 10% to $1,055 million due to lower impairment charges.

The bank highlighted its ongoing investments in technology and customer service to support clients through current economic challenges.

Increased lending amid competitive market

Westpac’s lending activities expanded, with home loans up by 3% and business loans by 2%.

“Our business lending outpaced system growth in the second half of the year,” Westpac said, adding that in-person engagements with business clients increased by 65%.

The bank also assisted nearly 5,900 first-time home buyers, noting a rise in applications as consumer confidence strengthens.

Passing on rate reductions to borrowers

Responding quickly to rate reductions, Westpac cut its one-year fixed home loan rate by 1.15% and floating rates by 0.75%, allowing potential savings of $58 million for its floating-rate customers.

“By year’s end, over a quarter of our fixed home loan customers will benefit from lower rates,” Westpac said.

Additionally, Westpac customers have redeemed $11 million in credit card rewards through its hotpoints Pay feature, offering flexibility for essential spending in a high-cost environment.

Fraud prevention efforts paying off

Westpac’s efforts to protect customers from fraud were effective, with a significant reduction in financial losses despite a 12% increase in reported cases.

Catherine McGrath (pictured above), Westpac NZ CEO, emphasised the need for social media giants to act faster against scam content, highlighting that $9 of every $10 in attempted fraud was prevented or recovered by Westpac’s systems.

Investing in customer experience and sustainability

Westpac has been improving customer experience through technology, including faster loan approvals, reduced service outages, and instant digital issuance of debit cards.

Additionally, Westpac financed three-quarters of New Zealand’s large-scale solar capacity and supported sustainable farming through its Sustainable Farm Loan program, providing over $3.6 billion in financing in the last 18 months to encourage on-farm environmental initiatives.

Positive economic forecast

Westpac economists expect a gradual recovery in the New Zealand economy, with predicted GDP growth of 2.3% in 2025 and inflation nearing 2% over the next year.

“We expect the economy and most of our customers will be in a better place 12 months from now, and we’re committed to supporting their growth,” Westpac said.

Read the Westpac announcement here.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.