Cuts on popular loan terms

Westpac New Zealand is reducing rates across several of its fixed home loan offerings, now advertising the lowest two-year and three-year rates among the country’s five major banks.

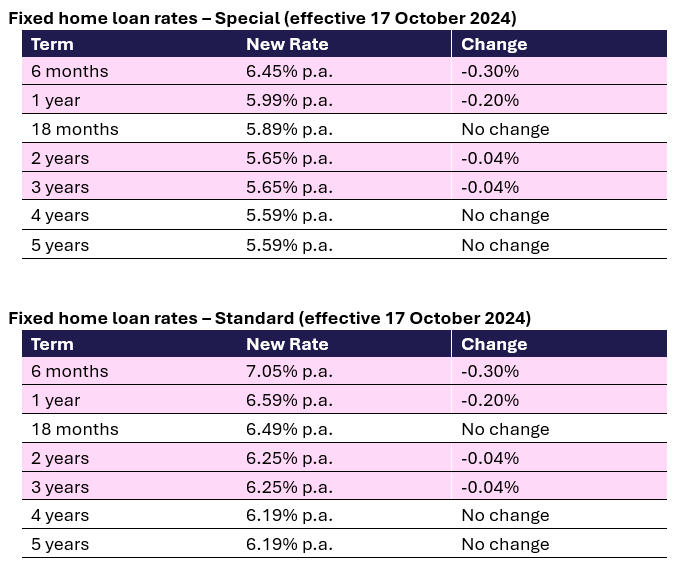

The changes took effect yesterday, with the six-month special rate dropping to 6.45% p.a. and the 12-month rate reduced to 5.99% p.a. The bank’s two- and three-year fixed rates have also been cut to 5.65% p.a.

In addition to its mortgage cuts, Westpac is lowering term deposit rates across five to 12-month terms.

Aimed at supporting homeowners amid tough market

Sarah Hearn (pictured above), Westpac NZ’s general manager of product, sustainability, and marketing, explained that the cuts are designed to provide a financial boost to homeowners refinancing loans.

“This is the eighth time we’ve announced cuts to fixed home loan rates since the start of July, in addition to a 0.75% p.a. cut for all our floating home loan customers over the same period,” Hearn said.

Competing for market share

The rate cuts reflect fierce competition among New Zealand’s major lenders, with banks vying to attract home loan customers during a challenging period in the housing market.

“Competition for home loans continues to be fierce, and we’re working hard to offer good value and great service to customers,” Hearn said.

Addressing concerns for savers

Hearn acknowledged that the falling interest rates may concern customers with savings.

“At the same time, we know our savings customers will be watching falling interest rates closely,” she said.

Westpac encourages customers with concerns about their accounts to reach out for personalised financial advice.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.