Mortgage brokerage explains how it is dealing with unregulated advisors

The growth of finfluencers has been nothing short of phenomenal. Globally, the influencer marketing industry (which includes financially focused influencers known as finfluencers), has skyrocketed from $1.7 billion in 2016 to $16.4 billion by 2022, and projections estimate it will reach $24 billion by the end of 2024, according to Influencer Marketing Hub.

And the market is continuing to grow - financial influencers on Instagram, for example, saw a median follower increase of 6% between April 2023 and April 2024, compared to a 3% growth rate in other influencer categories.

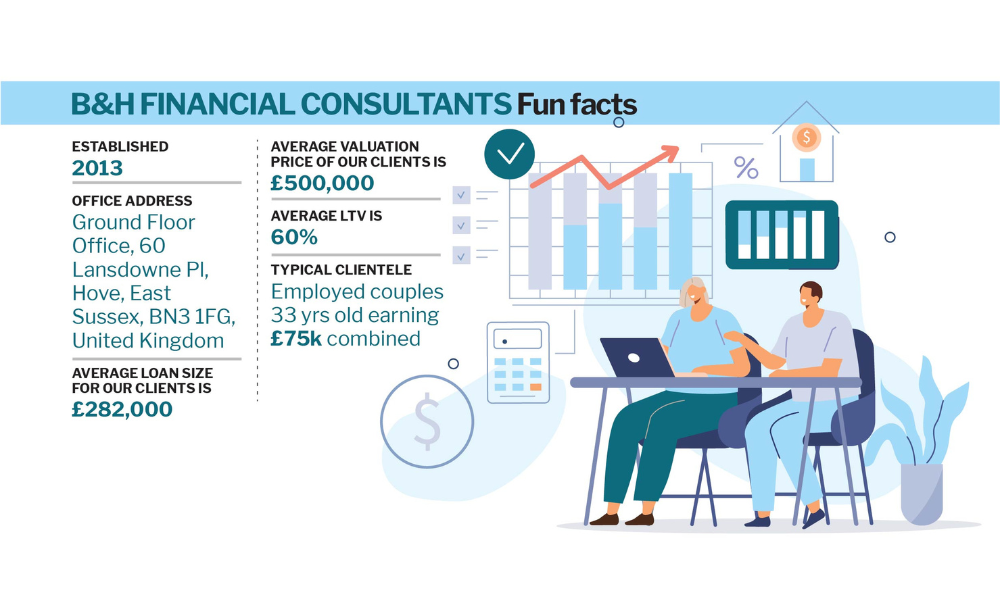

Adam Francis (pictured), managing director at Brighton & Hove Financial Consultants, is one mortgage professional responding to this social media wave driving new consumer behaviour. B&H Financial is facing a challenging but vital problem common to many mortgage brokers – how to participate in the new media, while educating clients on the importance of qualified, regulated financial guidance amid a sea of often unverified social media content.

“You don’t want to be left behind,” Francis told Mortgage Introducer, reflecting on why B&H Financial has expanded its social media presence to platforms like Instagram. Yet while they’re growing their digital footprint, he does say they’ve been more conservative with TikTok, citing the platform’s younger demographic and the need for “some of our younger advisors to get involved.”

The sway of finfluencers over financial decisions is particularly evident among younger generations, with 37% of Gen Z investors in the US crediting social media influencers as a major reason they began investing, according to MarketWatch. As Francis notes, social media content is capturing the attention of prospective clients, but it often does so with limited or inaccurate information. A major issue, he explained, is that clients frequently arrive with misconceptions that require immediate clarification. “They’ve watched a very short…20 second video and all of a sudden [they’re] panicking about it,” he said. Such situations often involve minor issues like a small gambling transaction or a minor credit card balance, which are unlikely to impact a mortgage application but can create significant anxiety for clients.

The sway of finfluencers over financial decisions is particularly evident among younger generations, with 37% of Gen Z investors in the US crediting social media influencers as a major reason they began investing, according to MarketWatch. As Francis notes, social media content is capturing the attention of prospective clients, but it often does so with limited or inaccurate information. A major issue, he explained, is that clients frequently arrive with misconceptions that require immediate clarification. “They’ve watched a very short…20 second video and all of a sudden [they’re] panicking about it,” he said. Such situations often involve minor issues like a small gambling transaction or a minor credit card balance, which are unlikely to impact a mortgage application but can create significant anxiety for clients.

The popularity of finfluencers reflects a growing appetite for accessible financial advice, but it also raises critical questions about the accuracy and regulation of such advice. The credibility gap between unregulated influencers and qualified advisers has become a focus for regulatory bodies and financial institutions alike. According to the CFA Institute and RPC, maintaining standards in financial advice on social media is increasingly crucial to protect consumers from potential misguidance. Francis is a strong proponent of more oversight in this space. He suggests that governing bodies like the FCA work directly with platforms like TikTok and Instagram to implement stricter measures, such as disclaimers or even demonetizing unqualified financial content. These steps could prevent misinformation from reaching consumers at the scale that it currently does. “The big one would be, have bigger disclaimers…but you need the platforms to be getting involved and monitoring that,” he said, adding that while it might seem aggressive, demonetising unqualified advice could deter individuals from promoting content without the necessary expertise.

And it looks like the FCA is starting to sit up and pay attention - it says it is starting to crack down on them. “Increasing numbers of young people are falling victim to scams, and finfluencers can often play a part,” said the regulator in a release. “Nearly two-thirds (62%) of 18- to 29-year olds follow social media influencers, 74% of those said they trusted their advice and nine in 10 young followers have been encouraged to change their financial behaviour.”

Francis believes the issue could be addressed through a certification system that verifies FCA-regulated advisers on social media. A stamp of approval, or a hashtag like #NotFinancialAdvice, would help users quickly distinguish between qualified and unqualified sources of advice. “You can…clearly see, or people can…clearly see if it was in…even if it’s a hashtag, you know, not financial advice,” he explained, noting that clear markers of credibility could bridge the gap between qualified advisers and influencers.

The rise of finfluencers poses direct competition to traditional financial advisers, who are held to regulatory standards and spend considerable time on in-depth, vetted advice for clients. For regulated firms like B&H Financial, this adds pressure to provide accessible yet high-quality guidance. Quick, engaging videos from finfluencers may be appealing, but, as Francis points out, they lack the “depth and accountability we provide as a regulated mortgage broker. Every recommendation we give [is] thoroughly vetted, unbiased, and designed to protect the client’s financial well-being.”

For the next two years, Francis intends to focus on trust-building, which he sees as critical to competing with the lure of influencer advice. Rather than attempting to directly counteract every piece of unregulated advice clients encounter, he emphasises the importance of creating relationships so that clients feel comfortable consulting him first.

“By the time we’ve spoken to the client, they’ve bought into us, and we’ve built that relationship,” he says.