Do you want to start a career in mortgage advice but don't have enough time for daily classes? This list of the top places to get CeMAP course online can help

Getting a Certificate in Mortgage Advice and Practice (CeMAP) is the starting point if you want to launch a career as a mortgage adviser. It is an industry-standard qualification that shows you have the skills and knowledge to give sound professional advice.

With a packed schedule, however, squeezing in time to take the necessary coursework isn’t always easy. The good news is you can complete a CeMAP course online.

In this article, Mortgage Introducer lists where you can get a CeMAP qualification online. We’ll give you an overview of each training provider and the different study support services they offer. If you’re keen on becoming a professional mortgage adviser, this guide can prove handy. Read on and find out which of these providers best suit your learning style.

What is CeMAP?

CeMAP is an industry-standard qualification for professionals who want to pursue a career as a mortgage adviser or other related roles. The Financial Conduct Authority (FCA) also requires anyone practicing in the profession to have the qualification.

CeMAP is intended to maintain high standards within the profession and protect consumers. Earning the certificate shows that you have a deep understanding of the mortgage market, including the different regulations and ethical practices.

Check out this guide on everything you need to know about CeMAP for more information about the qualification.

How can you get a CeMAP qualification?

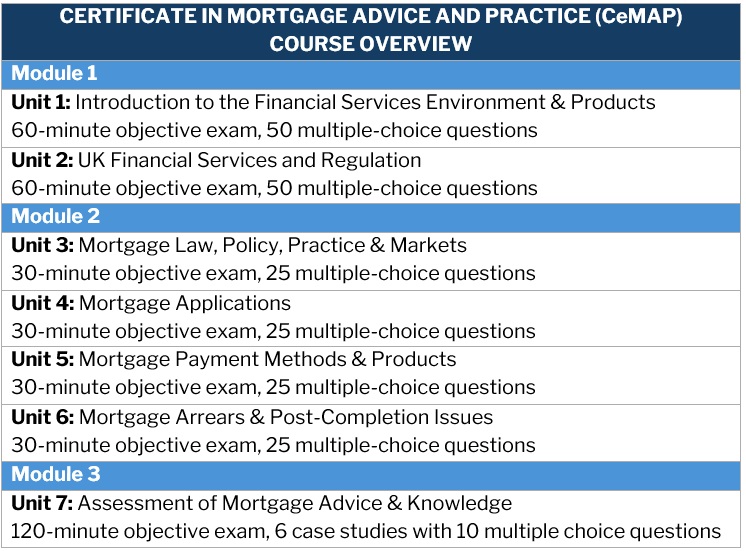

To earn a CeMAP qualification, you need to take the required courses. The coursework consists of seven units split into three modules. Studying for CeMAP helps you build the expertise to give advice on different mortgage products. You can also gain a deep understanding of the rules on the UK’s mortgage sector and the factors influencing consumers’ personal financial plans.

Here’s an overview of what each module consists of and what the exams typically look like. To pass the assessments, you will need to get at least 70% of your answers correctly.

Many past students say that CeMAP 1 (Module 1) is the hardest part of the course. Professionals with extensive experience in the mortgage industry, however, may find the courses relatively easy. You don’t have to the take modules in order, but it’s recommended that you do.

CeMAP is considered a Level 3 qualification, equivalent to an A-level or National Diploma.

CeMAP eligibility requirements

The London Institute of Banking and Finance (LIBF), CeMAP’s regulating body, doesn’t have set requirements for those wanting to earn the qualification. Applicants, however, should have a good grasp of English.

CeMAP courses are designed for students at least 19 years old. Students aged between 16 and 18 can study for this qualification through an apprenticeship.

Do you have to renew CeMAP?

Your CeMAP qualification has permanent validity, but it’s best to stay updated on the latest regulatory and industry developments. This ensures that you’re giving your clients the best advice.

Where to take CeMAP course online

Professional body LIBF offers CeMAP courses online. If remote learning doesn’t suit you, you can choose from LIBF’s list of accredited learning support providers (ALSPs), which also offer face-to-face classes.

Here’s an overview of the places where you can get your CeMAP qualification online. We’ll start with LIBF, followed by the industry body’s roster of ALSPs arranged alphabetically.

1. London Institute of Banking and Finance

LIBF is an industry body focused on providing education and training to professionals in the financial services sector. It offers a range of undergraduate and postgraduate degree programmes, and professional certifications.

LIBF’s CeMAP training is conducted exclusively online. You have 12 months from registration to complete your studies, which should be enough. You can choose to take the course module by module or earn the complete qualification in one go.

You will need to pay £215 per module or £645 for all three. This allows you to access the following:

- online and hard copies of the study text (CeMAP 1 & 2)

- information booklet and summary paper (CeMAP 3)

- student-led discussion forum

- study-tip videos

- weekly study planner

- syllabus updates

- tax table

- MyLIBF student portal

- KnowledgeBank virtual library

You can also access the CeMAP Revision Tool (CRT), specimen digital exams, and online tutor support at an extra cost.

You can choose to take the exams virtually or at a test centre. Once you’ve passed, LIBF will provide you with a digital certificate. You can also order a hard copy of your CeMAP for an additional charge.

.jpeg)

2. Beacon Financial Training

Beacon offers CeMAP courses online priced between £360 and £600, depending on the package. This includes year-long 24/7 access to its training portal, where you can view learning videos and past exams, and answer practice tests. A support team is also ready to address your concerns. You can contact the team by phone or email.

You can also choose to join Beacon’s live CeMAP webinars, which allow you to ask questions in real time. The course is delivered via Zoom. Each module runs for five days. You can access recorded sessions free of charge. Practice exams and telephone and email support are also included.

The complete webinar package costs £1,026. You can also get the modules separately for £570 each. As with most ALSPs, Modules 2 and 3 are taken together.

3. Clarity Financial Training

Clarity FT offers a blended/distance learning CeMAP package at £425 and a live webinar package for £925.

The blended/virtual course comes with simplified hard copies of the lessons, multiple choice mock-style questions, and a customised study plan. The online CeMAP course also includes a two-hour webinar held on the last Wednesday of every month. You can access the course for 12 months starting from the date of purchase.

The live webinar, meanwhile, runs for nine days – five days for CeMAP 1 and four days for CeMAP 2 & 3. The sessions are conducted through Cisco Webex.

4. Effectus Learning

You can access CeMAP course online from Effectus Learning through live web classes or pre-recorded videos.

Delivered via Zoom, the live web classes also serve as interactive workshops. Course materials, which include workbooks and copies of LIBF specimen papers, can be delivered to your home for £30 per module. Separate CeMAP 1 and CMAP 2 & 3 courses cost £4,378 each. The price of the whole programme is £8,756.

Effectus Learning’s online video programme suits you if you’re more comfortable working at your own pace. It includes 25 pre-recorded videos and soft copies of support materials. You can also take a “fail support” webinar if there are areas you find challenging.

The online programme is priced at £349 per module and £698 for the complete qualification.

5. Futuretrend Training Academy

Futuretrend’s online CeMAP training can be taken either in a virtual classroom or through its home study programme.

Virtual classrooms run for 10 days – five days each for CeMAP 1 and CeMAP 2 & 3. The live lectures are also recorded and saved on the training portal. You can access the videos for three months. Hard and digital copies of the training materials are also provided at no extra charge. Futuretrend’s virtual programme costs £795, excluding value-added tax (VAT).

If you prefer to study on your own, you can enrol in the company’s home study programme for £350. This gives you access to the online portal where you can listen to audio training materials and watch pre-recorded videos. You will also receive these specimen exams:

- three mock papers for CeMAP 1 (100 questions per paper)

- three mock papers for CeMAP 2 (100 questions per paper)

- two mock papers for CeMAP 3 (60 questions per paper)

6. New Leaf Distribution

NLD is the only ALSP that offers CeMAP courses online for free. All you need to do is register for the virtual classes on the company’s website. The sessions typically run for five hours every Monday. It starts at around midday and ends at 5pm.

.png)

7. Quilter Financial Advisor School

Quilter provides an online programme for CeMAP 2 & 3 only. The total cost of the course depends on your personal circumstances, but the maximum amount you should pay is £2,000. Quilter Financial Planning firms are entitled to a discount.

The programme includes customised online learning materials, regular practice tests, and access to experienced trainers. The online CeMAP course runs for 10 weeks. Quilter recommends between 12 and 15 hours of study per week.

8. Simply Academy

You can take CeMAP course online from Simply Academy either through a live webinar or e-learning.

The webinars consist of 20 sessions conducted within 10 days by experienced industry professionals. These sessions also allow you to take part in lively discussions with fellow students. The webinars are recorded, which helps a lot if you miss a class.

Each module costs £495, excluding VAT. This includes the study text. You can save £100 if you take all modules in one go. Your course adviser can also help process your exam registration as part of your enrolment. Initial exam fees are £215.

For the e-learning programme, you’ll receive mobile-friendly study materials with hundreds of practice questionnaires. You can also participate in webinar revision tutorials at no extra charge.

Each module costs £345 plus VAT. The same with live webinars, you can save £100 if you register for the full course. You can complete the online CeMAP course within three to four months, but Simply Academy gives you access to the study materials for 12 months.

This guide can give you tips and strategies on getting the most out of your CeMAP training course.

What are the benefits of having a CeMAP?

CeMAP is an FCA-required qualification for anyone in the UK who wants to work professionally as a mortgage adviser. It proves that you have the skills and knowledge to help clients make informed decisions. Apart from this, having CeMAP designation comes with several benefits, including:

More career opportunities

CeMAP opens doors to a range of career opportunities within the mortgage industry. You can pursue these roles:

- mortgage adviser

- financial consultant

- mortgage broker

- mortgage underwriter

- mortgage compliance officer

By having CeMAP qualification, you can also improve your chances of securing a rewarding career in the financial services sector.

Boosts credibility

CeMAP demonstrates your competence and expertise as a mortgage adviser. The qualification establishes your reputation as a credible and reliable professional. It also instills trust in both your clients and employers.

Strong earning potential

CeMAP can pave the way for a financially rewarding career with strong growth potential. As a mortgage adviser, you often get a salary supplemented by commission-based earnings. Having CeMAP shows that you possess the skills and expertise to give valuable mortgage advice. This can lead to higher commissions.

Increased marketability

Employers prefer candidates with relevant qualifications and having CeMAP gives you a competitive edge over other applicants. CeMAP on your resume shows potential employers your dedication to career development and a commitment to providing quality service.

Makes you more adaptable

The mortgage industry is continuously evolving. This includes changing regulations, economic volatility, and shifting consumer behaviour. Earning a CeMAP equips you with the right skills and knowledge to adapt to these changes and advance your career.

Networking opportunities

CeMAP can open more opportunities for you to connect with like-minded professionals. This can lead to various opportunities for employment, mentorship and training, participation in industry events, and membership in professional associations. Networking can also help you gain valuable insights into the mortgage industry.

Sense of fulfilment

If you’re passionate about helping people achieve their homeownership dreams, CeMAP allows you to do so. Being able to guide aspiring homeowners through the mortgage process and leaving a positive impact on their lives is what makes the profession truly rewarding.

Earning a CeMAP is often the first step to becoming a mortgage adviser. If you plan on pursuing this career, this step-by-step guide on how to become a mortgage adviser in the UK can help.

Is taking a CeMAP course online better than getting training in a classroom setting? What are the benefits of taking online CeMAP courses? Chat us up in the comments section below.