Intermediaries in the United Kingdom must choose a lender that provides the right home loan for their clients—just like The Mortgage Works for intermediaries

During mortgage transactions, mortgage brokers, also known as intermediaries, play a crucial part as the middleman between property buyers and mortgage lenders. In turn, these intermediaries must work with mortgage banks and companies that can cater to their client’s unique needs for mortgages.

The Mortgage Works for intermediaries is an intermediary-focused lender that offers a broad range of home loan services for every unique borrower. They provide specialised mortgage programs along with the common loan products available in the United Kingdom. This wide selection allows The Mortgage Works to help intermediaries find the most suitable mortgage solution based on their clients’ financial circumstances and goals.

In this article, Mortgage Introducer will highlight everything you need to know about The Mortgage Works for intermediaries. We will discuss what they can do for mortgage brokers and their clients as well as their product line. We will also explore their eligibility criteria and other important details to help you get to know this lender and check if they are the right one for you.

Introduction to The Mortgage Works for intermediaries

The Mortgage Works for intermediaries is the intermediary-only platform of The Mortgage Works plc. It is a wholly owned subsidiary of the Nationwide Building Society, a member of the Building Societies Association. The Mortgage Works is registered in England and Wales and is authorised by the Prudential Regulation Authority (PRA).

Like most lenders in the country, The Mortgage Works is regulated by the Financial Conduct Authority (FCA). The Mortgage Works also act as agent and mortgage administrator for Derbyshire Home Loans Ltd and for E-Mex Home Funding Ltd. These two lending companies are wholly owned subsidiaries of Nationwide Building Society.

Being in the mortgage industry for over 30 years, The Mortgage Works has already proven itself as an established lending institution in the UK. As such, applying as an intermediary under this lender can help propel you to a better position of succeeding in the industry.

What The Mortgage Works can do for intermediaries

The Mortgage Works for intermediaries’ tools and resources will surely help mortgage professionals in providing topnotch service for their clients. Their mortgage solutions can be tailored to different client profiles. Plus, their online portal can be accessed not just by mortgage brokers but also financial advisors for easier tracking of their applications.

They also have affordability calculators that you can use to check if your clients’ budget or income fits The Mortgage Works for intermediaries’ criteria. Here is a quick glance at their online calculators:

- maximum borrowing calculator

- rental income required calculator

- mortgage payment calculator

- rental yield calculator

- further advance calculator

Types of clients serviced by The Mortgage Works for intermediaries

The Mortgage Works offers numerous home loan products for intermediaries with clients such as the following:

- first time buyer

- first time landlord

- experienced landlord

- consumer Buy to Let applicant

Let us explore them one by one and see if you have clients who might fit any of these categories:

1. First time buyer

The Mortgage Works for intermediaries offers mortgage solutions for clients who have never owned or occupied their own home for the last six months. The first time buyer category also includes those who have not owned and let a Buy to Let property for the same amount of time.

Here are some of The Mortgage Works for intermediaries’ requirements for first time buyers:

- they must be accompanied by a current homeowner or experienced landlord

- they must be able to prove that they can support the mortgage from their own income

- they must make a deposit using their own resources, unless gifted by partner

The following circumstances might impact the acceptance of first-time buyers’ mortgage applications:

- if the deposit is wholly gifted by the second applicant or other party

- if the first-time buyer lives in a property of similar value (rented or with parents)

- if the applicant is not purchasing with spouse or partner

Other than these scenarios, home loan applications for first time buyers will be considered. However, they are still subject to additional underwriting.

Watch this video about first-time buyers mortgage:

To find out how you can support first-time buyers in their journey towards property ownership, look to the best in the industry. Check out the Top Brokers of 2024 for insights and inspiration from the UK’s award-winning intermediaries.

2. First time landlord

First time landlords are those who are owner-occupiers of their own property for at least the last six months but has not owned and let a Buy to Let property for the same amount of time. The same applies for clients who have a lone Buy to Let property that has been vacant for the last two months or so.

The Mortgage Works will not accept applications from first time landlords who wish to remortgage a second property. This includes inherited properties which are not yet included in a client’s name. In other words, the mortgage must be for purchasing a new Buy to Let property only.

The Mortgage Works for intermediaries also required evidence of client’s deposit for all applications. Check out the other qualifications for first time landlords below:

- the maximum LTV ratio allowed is 80%

- the maximum age must be 70 at the time of application; unless a joint application with an experienced landlord and below 65% loan-to-value (LTV) ratio

- the maximum number of properties for sole applicants is three

3. Experienced landlord

Intermediaries with experienced landlords as clients are also welcomed by The Mortgage Works. These are clients who have owned and rented out a Buy to Let property for at least the last six months. They can either be owner-occupiers of their own property or not.

If your clients’ sole Buy to Let property has been vacant for the last two months or so, The Mortgage Works for intermediaries would consider the application to be under the first-time landlord category.

4. Consumer Buy to Let applicant

Lastly, The Mortgage Works for intermediaries will also accept applications from consumer Buy to Let clients. These are borrowers who want to take out mortgage on a property that has either been inherited or has previously been occupied by the borrower.

The inheritor or occupier can also be a person related to the borrower. A consumer Buy to Let client must have no other rental properties.

Other acceptable clients

Aside from these four types of clients, The Mortgage Works for intermediaries can also provide mortgage services for portfolio landlords or those with more than one Buy to Let property. Mortgage brokers who have self-employed landlords and property owners with houses in multiple occupancy as clients are also welcome. The same is true for those who work with limited companies.

Eligibility criteria for clients

Since The Mortgage Works for intermediaries offers mortgages for various types of clients, they have a set of requirements that must be followed. Here are four of them:

- age

- residency

- loan purpose

- maximum loan per property

Let’s take a closer look at each requirement:

1. Age

The minimum age requirement for experienced landlord applications at 65% LTV ratio or less is 21 years old. This also applies to experienced landlord applications with higher LTV ratio.

There is no maximum age requirement except for first time landlords, which is 70 years old at the time of application.

That maximum age requirement will not apply for joint applications of first-time landlords with experienced landlords at 65% LTV ratio or less.

2. Residency

All mortgage products of The Mortgage Works for intermediaries are available for UK residents only. Mortgage applications from these applicants will not be accepted:

- applicants with a previous address abroad in the last three years

- applicants who work or live outside of the UK for the entire year at the time of application

Exceptions can be made for applicants who work or live outside of the UK for part of the year, subject to underwriting assessment. The maximum loan to value may be restricted to 70%.

For new clients, here are some of the acceptable IDs that The Mortgage Works for intermediaries require as proof of residency:

- copy of a valid full UK passport

- copy of a valid full or provisional UK photocard driving licence

3. Loan purpose

For loan purposes, The Mortgage Works for intermediaries accepts mortgage applications for purchase or remortgage of properties in England, Wales, and mainland Scotland. They will also consider applications for non-structural home improvements.

Remortgage applicants are acceptable after the property in question has been owned and let for a minimum of six months.

4. Maximum loan per property

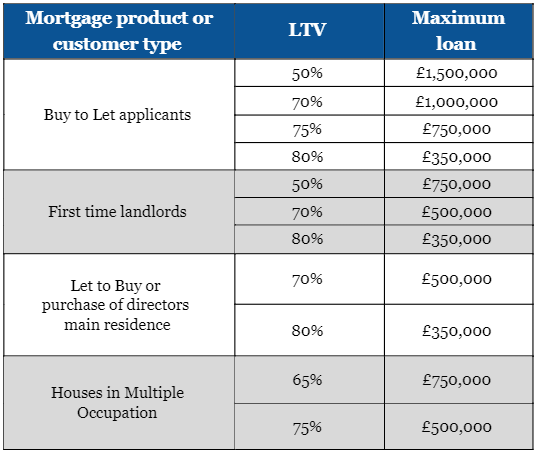

Check out the maximum loan requirements set by The Mortgage Works for intermediaries for the following mortgage applicants:

In addition, the maximum loan requirement for Green Further Advance mortgage applications is £15,000. Green mortgages are properties that must have an Energy Performance Certificate (EPC) rating of C or above.

Want to know more about green mortgages and their interest rates? Check out this article on green mortgage rates across the UK.

It is critical for intermediaries to stay updated on the changes made regarding the criteria, guidelines and products of The Mortgage Works for intermediaries. Remember, staying informed can open many opportunities to enhance your skills and gain more experience.

A good way to stay informed is to sign up for our free newsletter - get the latest news and industry updates delivered straight to your inbox.

Partnering with The Mortgage Works for Intermediaries

Since the Mortgage Works for intermediaries can cater to many types of clients along with a wide choice of mortgage loan options, it makes them a good choice for intermediaries. Partnering with them can be beneficial for mortgage brokers who want to establish themselves in the mortgage sector.

The Mortgage Works for intermediaries can provide a boost in your career especially if you want to see your name or brand with the top intermediaries in the UK. Nevertheless, if you do not think that they are the right lending company for you and your clients, we got you covered! You can check our overviews of other UK lenders’ intermediary services below:

- Your guide to Accord for intermediaries

- Your guide to Aldermore for intermediaries

- Your guide to Barclays for intermediaries

- Your guide to Coventry for intermediaries

- Your guide to HSBC for intermediaries

- Your guide to Kent Reliance for intermediaries

- Your guide to Leeds for intermediaries

- Your guide to Nationwide for intermediaries

- Your guide to NatWest for intermediaries

- Your guide to Virgin for intermediaries

- Your guide to the West Brom for intermediaries

Do you think that The Mortgage Works is a good lender for intermediaries to work with? Why or why not? Tell us what you think in the comments