Intermediaries in the UK should work with mortgage lenders that can help boost their career like Virgin Money for intermediaries. Read on for more

The demand for mortgage brokers in the United Kingdom has been steadily rising in recent years. This is due to changes in the real estate market and the economy. As a result, more people are becoming interested in making this profession either a side hustle or their full-time job.

For aspiring mortgage brokers in the country, it is best to connect with banks and other mortgage companies that are not only trusted but well-known in the industry. The same is true for current intermediaries. If you are a part of the mortgage broker sector, making connections with lenders that have intermediary-only platforms is guaranteed to serve you well.

One example of these lenders is Virgin Money. They have been in the financing business for more than two decades—making them arguably one of the most credible lenders in the country. In this article, Mortgage Introducer will help you get to know Virgin Money and shed light on their mortgage products. We will also introduce their eligibility criteria for applicants and discuss the benefits it offers brokers under its Virgin for intermediaries arm.

Get to know Virgin for intermediaries

Virgin Money for intermediaries is the exclusive platform for mortgage brokers of Virgin Money UK plc, a banking and financial services company. It was established in 1995 by Sir Richard Branson, a famed business magnate in the country.

Being a banking giant, Virgin Money is listed on the London Stock Exchange as well as the Australian Securities Exchange. It specialises in credit cards, savings accounts, and investments. Check out their available services below:

- current accounts

- business accounts

- credit cards

- savings

- personal loans

- insurance

- investments

- pensions

Virgin for intermediaries’ products and services

There are five main home loan products offered by Virgin for intermediaries. These mortgage solutions are available for eligible applicants such as first-time home buyers and property investors. You can introduce the following home loans to your prospects:

- Buy to Let mortgage

- Portfolio Buy to Let mortgage

- New Build mortgage

- Retrofit Boost mortgage

- Own New Rate Reducer mortgage

To further understand each home loan option, let us discuss them one by one:

1. Buy to Let mortgage

For intermediaries with clients who are landlords, Virgin Money offers up to 75% loan-to-value (LTV) ratio for a minimum property value of £50,000. For houses that are valued at £100,000, you can apply for a home loan of £350,000 with 80% LTV ratio on behalf of your clients.

Landlords can also ask their mortgage brokers to apply for a Buy to Let mortgage of up to £3 million. Virgin for intermediaries will accept applications from first time landlords as long as at least one applicant is an owner-occupier. They should also have been occupying their own property for six months or more. Learn more about Virgin for intermediaries’ Buy to Let mortgages in this clip:

2. Portfolio Buy to Let mortgage

The Portfolio Buy to Let mortgage is the same as Buy to Let but instead of catering to landlords who might be first timers, this is for applicants with multiple properties. There are no portfolio background limits for this mortgage. Postcodes and LTV ratios are also less restricted.

Mortgage brokers can register and use Virgin for intermediaries’ BTL Hub for smoother transactions.

3. New Build mortgage

Virgin for intermediaries classify developments as new builds for up to two years after they are constructed, converted, or first occupied. Houses that are built or converted in the last ten years need a warranty or professional consultant's certificate. These documents should be submitted when applying for a New Build mortgage.

Successful intermediary applicants can expect up to 5% in incentives and 90% LTV ratio.

4. Retrofit Boost mortgage

If your clients plan on buying homes that are energy efficient, Virgin Money’s Retrofit Boost mortgage can help them save a lot. It offers up to £15,000 cashback on energy efficient home improvements right after the mortgage period ends. Plus, unlike taking out more loans, the mortgage balance will not go up. In turn, you can reassure your clients that their total mortgage cost will remain throughout the life of the home loan.

5. Own New Rate Reducer mortgage

Mortgage brokers with clients who want to purchase a new build property via a participating builder can apply for this mortgage. The scheme is open to both first time property buyers and current homeowners. Watch this introduction to Own New Rate Reducer mortgage:

If you cannot find the mortgage solutions for your clients from the choices above, there are other property loan options offered by Virgin for intermediaries. Some of them are:

- Product Transfer

- Help to Buy mortgage

- Greener residential mortgage

- Freedom to Fix residential mortgage

- ERC Free residential mortgage (mortgage option without Early Repayment Charge)

With these competitive mortgage products, it’s no surprise that most of the top mortgage intermediaries in the UK work with Virgin Money.

Requirements for Virgin Money mortgage applicants

Only four applicants in a mortgage application with Virgin for intermediaries will be accepted. As for residency, applicants must be residents in the UK and have a 3-year consecutive UK address history. They also must be 18 years old at the time of application and 75 at the end of their mortgage term.

UK residency is determined by the UK’s Statutory Residence Test (SRT). This does not always require a minimum number of days for an individual to be physically present in the UK. However, it can confirm the residency period needed as proof to be eligible for Virgin Money’s mortgage loan options.

Remortgaging with Virgin for intermediaries

Do you have clients who want to remortgage their properties? Virgin for intermediaries has remortgaging options with varying interest rates. They can also provide free basic valuation and standard legal work for remortgage applicants.

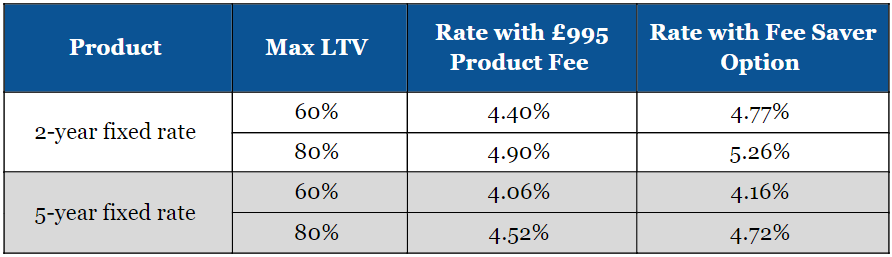

Check out this comparative table for interest rates and LTV ratios for Virgin for intermediaries’ Everyday Fixed Rate Remortgage:

For houses that are valued at £1 million or more, Virgin for intermediaries offers their residential remortgage exclusives. This product has a maximum LTV ratio of 75% for both 2-year and 5-year fixed rate loan options. Its maximum loan size is £2 million; plus, it also comes with free basic valuation and standard legal work.

Benefits of partnering with Virgin for intermediaries

Partnering with Virgin for intermediaries has many upsides. Not only will you be presented with competitive mortgage options, but you will also have access to their broker tools and exclusive content. You can also enjoy access to these benefits as a Virgin Money intermediary:

- downloadable files

- incentives

- BDM Finder

- mortgage calculators

- additional support

Let us take a closer look at each benefit below:

1. Downloadable files

Use the handy documents within the Virgin for intermediaries platform for free. They provide downloadable guides, forms, and product information sheets.

Here are examples of these downloadable documents:

- applications forms and mortgage rates guide

- business plan and cashflow form

- intermediation agreement

- gifted deposit template

- direct debit mandate

- porting waiver letter

- sales aids

Mortgage brokers have access to these useful downloads even without registering with Virgin for intermediaries. You would only need to go to the website and look for the file that you need. However, these files are only useful when you apply as an intermediary partner.

2. Incentives

Another advantage of being a Virgin Money intermediary is the availability of cashbacks and incentives. Free valuations are also provided in certain mortgage options.

Virgin for intermediaries offers 3% and 5% incentives for most of their fixed rate mortgages. Cashbacks start from £250 and can be as high as £1,000 for a 10-year fixed rate residential home loan.

3. BDM Finder

Virgin Money also provides a page where their intermediary partners can find their business development teams. The BDM Finder can connect you with a Business Development Manager who can assist you with concerns, primarily:

- questions or clarifications about their mortgage product line

- advice on making a home loan application for your clients

- updates on Virgin for intermediaries’ lending policy

4. Mortgage calculators

For aspiring mortgage brokers, you can use online mortgage calculators to quickly identify the amount of money that your clients can borrow. It will help you comb through the different mortgage products to find the most suitable choice. Mortgage rates and other figures are also viewed with ease through these calculators.

Virgin Money has three helpful mortgage calculators for their intermediary partners:

- Residential affordability calculator

- Buy-to-let affordability calculator

- Overpayment calculator

.@VirginMoneyInt has announced a series of rate reductions across its fixed rate mortgage products, effective from today, with a couple of five-year fixes now available at sub-4% rates. https://t.co/AW8Wf1suL8

— Mortgage Introducer (@MortgageChat) August 13, 2024

Read and bookmark our guide on Virgin mortgage rates. We update our guide weekly to make sure you’re on top of important mortgage rates information to share with your clients.

5. Additional support

As an additional support for mortgage brokers, Virgin Money provides technical help for their registered intermediary partners. They also publish the latest changes to their mortgage product line so that interested brokers will always be updated.

You can get additional support for your clients by submitting a customer vulnerability form. Virgin for intermediaries will call your clients directly if the following conditions are met:

- you have made a request on behalf of your client

- you have your client's consent to do so

- your client's mortgage term has ended

- you know when your client is available to accept a call from Virgin Money

Virgin for intermediaries acknowledges that there are vulnerable clients. These property owners might be dealing with financial troubles and other concerns. In turn, Virgin Money can work with you to address these issues.

Why work with Virgin for intermediaries?

Virgin for intermediaries is already an established lending company. That alone is a huge plus for mortgage brokers who want to work with them. Building a lasting relationship with credible institutions can take you further in your career. You will get to enjoy topnotch services along with award-winning mortgage solutions for your clients.

If you choose to work with Virgin Money, you will also benefit from their intermediary-centric support hub. Another perk is that this lender is bent on helping mortgage brokers propel themselves onto the career ladder. They do this through their incentives, downloadable guides, and other tools.

These, among other benefits, are the reasons why they might be the right lending company for you and your clients. But if you think that Virgin for intermediaries is not the best fit, we have listed other guides to mortgage lenders with intermediary-only platforms:

- Your guide to Accord for intermediaries

- Your guide to Aldermore for intermediaries

- Your guide to Barclays for intermediaries

- Your guide to Coventry for intermediaries

- Your guide to HSBC for intermediaries

- Your guide to Leeds for intermediaries

- Your guide to Nationwide for intermediaries

- Your guide to NatWest for intermediaries

Do you find this guide to Virgin for intermediaries helpful? Why or why not? Feel free to share your thoughts in the comments section below.