"All signs now point to a far stronger year for the UK property market"

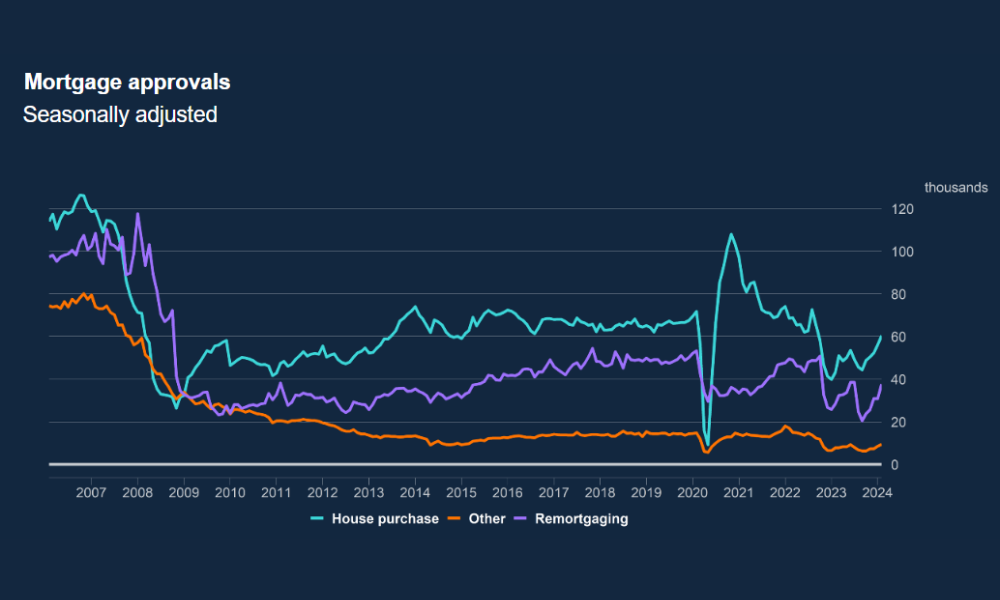

Net approvals for both house purchases and remortgages rose in February, the Bank of England (BoE) has reported.

Net mortgage approvals for house purchases rose to 60,400 in February from 56,100 in January, while net approvals for remortgaging increased to 37,700 from 30,900 during the same period.

There was a 29-basis-point decrease in the ‘effective’ interest rate – the actual interest paid – on newly drawn mortgages, which now sits at 4.9%. The rate on the outstanding stock of mortgages increased by seven basis points, from 3.41% in January to 3.48% in February.

The BoE’s latest Money and Credit report also showed a slightly negative growth rate for net mortgage lending at -0.1%.

Gross lending also increased to £18 billion in February from £17.1 billion in the previous month. Gross repayments decreased, from £18.5 billion to £16.7 billion over the same period.

Meanwhile, individuals borrowed, on net, £1.5 billion of mortgage debt in February, compared to £1.1 billion of net repayments in January.

“Today’s statistics mark the fifth consecutive increase in mortgage approvals,” said Reece Beddall, sales and marketing director at Bluestone Mortgages. “Comparatively, this is a significant improvement to this time last year, where we witnessed five consecutive decreases in mortgage approvals.

“This is a pivotal moment in the market, and we are beginning to see consumer confidence return as lenders look to secure mortgages and achieve their homeownership goals.”

Jason Ferrando, founder and chief executive of easyMoney, said it was only a matter of time before the market started to find its feet and it would appear that the nation’s buyers have now adjusted to the new normal where the higher cost of borrowing is concerned.

“All signs now point to a far stronger year for the UK property market, and while higher mortgage rates remain an obstacle, it’s a matter of when, not if, they start to subside,” he said.

For Tony Hall, head of business development at Saffron for Intermediaries, the Bank of England figures are further confirmation that the housing market has seen a bumper recovery in 2024, after a volatile 2023.

“With inflation slowing to 3.4% in February, we are optimistic that borrowers will be able to benefit from greater certainty and stability in the market this year,” Hall said. “We haven’t quite reached that point yet, however.

“In the last week, we have seen some lenders drop rates, while others have put them up, showing the off-beat rhythm of mortgage pricing at the moment as lenders wait for swap rates to settle. Other lenders are turning to new ways to help release the pent-up demand that has built up through a period of higher rates.”

Stuart Cheetham, chief executive of MPowered Mortgages, added that lenders are now competing hard on the rates they offer, both to new borrowers and to those remortgaging.

“But for rates to come down significantly, we need a clear signal from the Bank of England that it will be ready to relax its tight monetary policy when it next sets the base rate in early May,” Cheetham said.

Any thoughts on the figures revealed in this Bank of England report? Share them with us by leaving a comment in the discussion box at the bottom of the page.