Pressure builds as we wait for another Bank of England rate cut

House prices have been rising, hitting an average of nearly £300,000 in August, interest rates were falling, but suddenly the picture is not looking so rosy. Rates are now rising as Lloyds Banking, Barclays, Santander and many others are already increasing mortgage rates, and many are now concerned that the property thaw may well have been a short improvement.

Latest reports could add to the gloom, saying the UK economy may be facing further inflationary pressure soon, and economists at Lloyds Bank are predicting a "sizeable rise" in unemployment next month. This comes as the latest unemployment figures from the Office for National Statistics (ONS) reported a drop in the unemployment rate from 4.1% in July to 4.0% in August, defying expectations of stability. However, Nikesh Sawjani, an economist at Lloyds Bank, warned that these results might not present the full picture. "These results are likely to be treated with caution," he explained, attributing the unexpectedly low unemployment rate to rolling three-month calculations, with June's outlier figure of 3.7% skewing the overall average.

Read more: Which mortgage borrowers are struggling?

Sawjani anticipates that next month’s report, covering the three months to September, will reveal a rise in unemployment as the June data is phased out. Recent labour market surveys, including the KPMG/REC survey, also point toward growing unemployment in the near future – possibly taking some of the wind out of the sails of the improving mortgage market.

According to the Lloyds Bank Business Barometer for September 2024, broader economic confidence is beginning to show signs of strain. Business confidence dipped to 47%, a three-month low, driven by concerns about the economy despite strong trading prospects – and that confidence drop may well be dribbling through to home buyers, hitting the mortgage market. The employment outlook weakened slightly, with fewer businesses planning to increase their workforce, suggesting growing caution among firms.

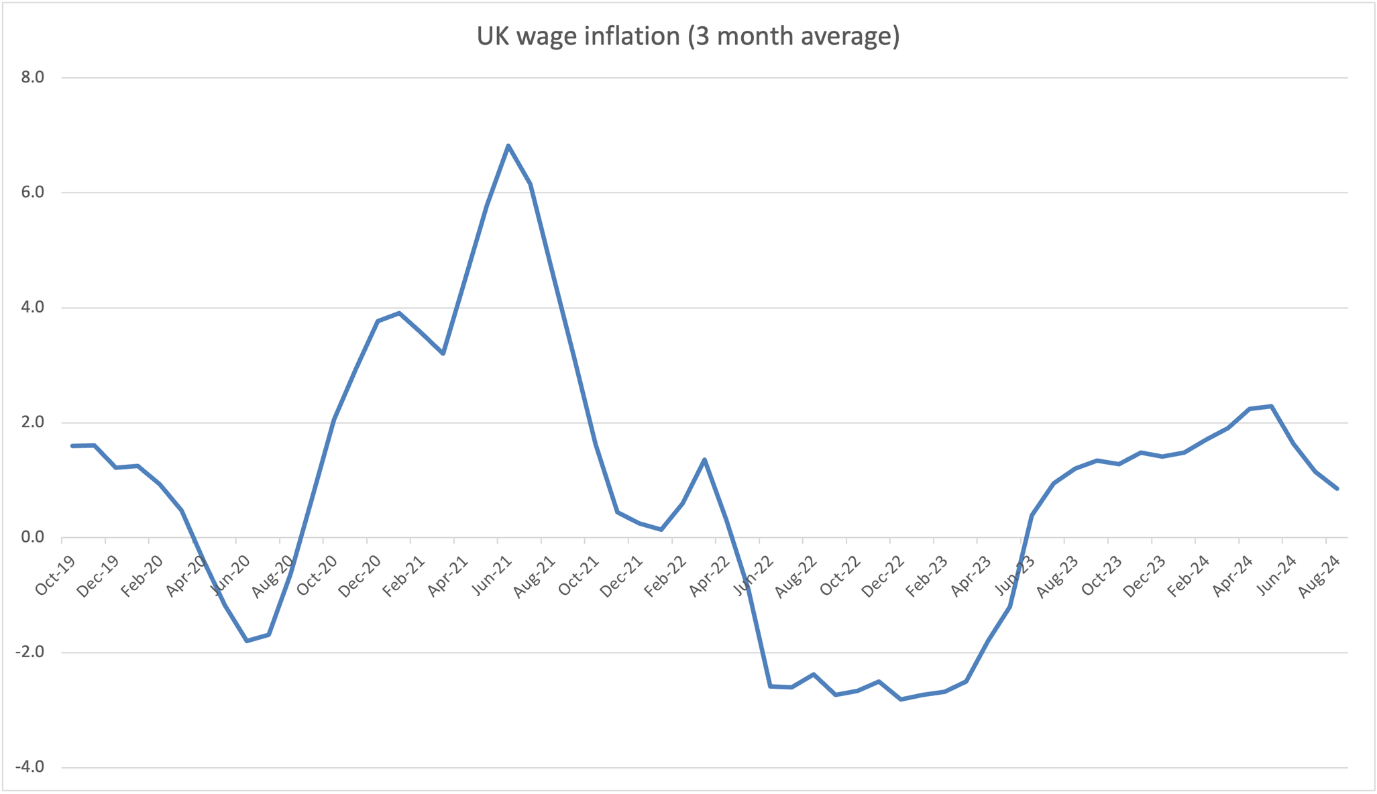

Wages remain a focal point for policymakers as they track inflationary pressures. The latest data shows wage growth, excluding bonuses, rose by 4.9% in the year to June-August 2024, while total pay, including bonuses, increased by 3.8%. While this slowdown is a positive sign for the Bank of England, the pace of wage growth remains above the level required to meet the Bank’s 2% inflation target.

Read more: Cheap mortgages are over – Lloyds Bank

"This is clearly good news for BoE policymakers looking for signs of easing in inflationary pressures. However, the pace of wage growth is still probably too high to be consistent with the BoE's 2.0% inflation target on a sustainable basis," Sawjani added.

Adding to the uncertainty, the Barometer highlights rising price expectations among businesses, with 65% of firms planning to raise prices over the next 12 months—an 11-point increase from the previous month. This trend underscores the persistent inflationary pressure within the economy, driven partly by businesses seeking to maintain profit margins despite weaker economic optimism.

Looking ahead, businesses are preparing for a more challenging economic environment. With a mixed employment outlook, rising inflation expectations, and wage growth yet to align with inflation targets, both firms and households may continue to feel financial strain well into 2025.

Which inflation matters most for mortgage interest rates?

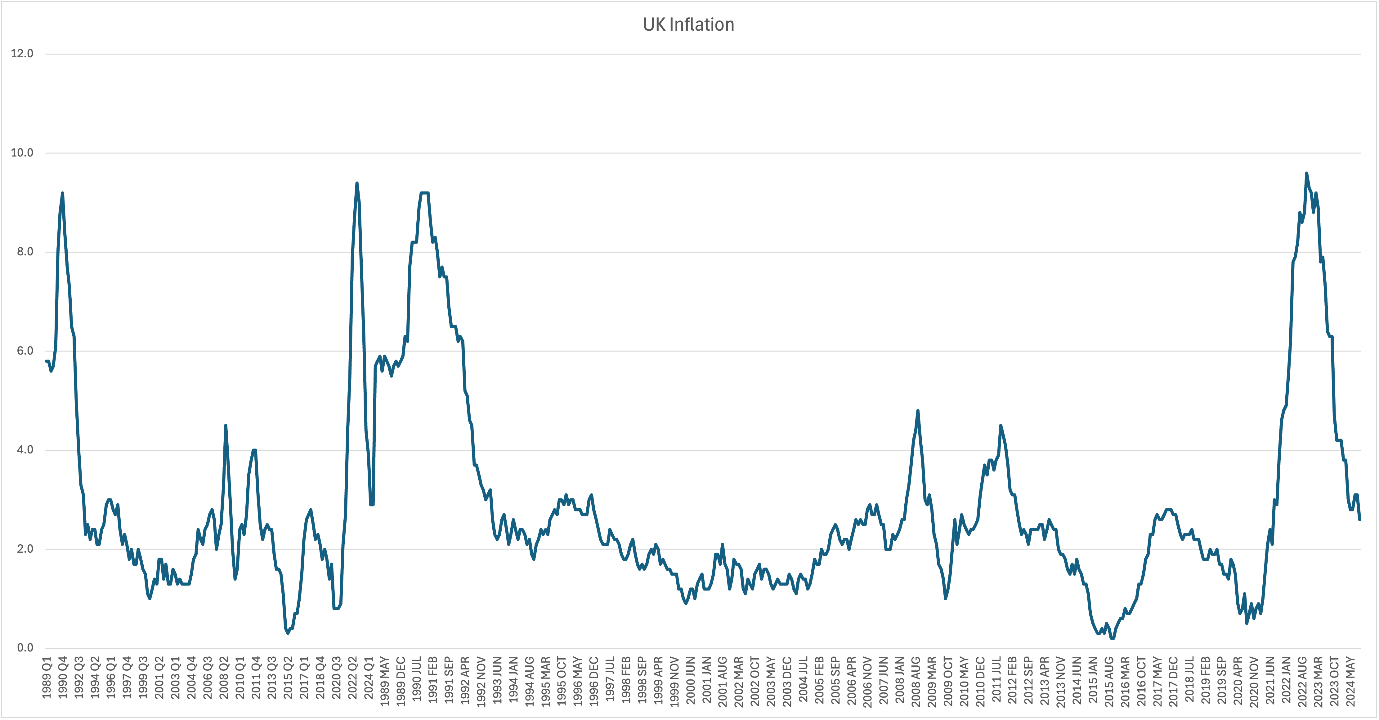

The Bank of England (BoE) focuses on several inflation measures when making interest rate decisions, with the primary focus on Consumer Price Index (CPI) inflation. However, other related measures also play important roles in shaping monetary policy. Here’s a breakdown of the key inflation metrics that influence the BoE:

Read more: Don't cut rates too fast says Bank of England's top economist

- Consumer Price Index (CPI)

- Why it matters: CPI is the official measure of inflation targeted by the BoE. The Bank aims to keep annual CPI inflation at 2% over the medium term.

- Impact: If CPI inflation rises above the 2% target, the BoE may raise interest rates to curb inflation by slowing demand. Conversely, if inflation is below target, the Bank may cut rates to stimulate spending.

2. Core CPI (CPI Excluding Energy, Food, Alcohol, and Tobacco)

- Why it matters: Core CPI strips out volatile components like food and energy prices, giving a clearer picture of underlying inflation trends.

- Impact: Core inflation is crucial because it reflects persistent price pressures. The BoE closely monitors it to assess whether inflation is being driven by temporary factors or sustained demand.

3. CPIH (CPI Including Housing Costs)

- Why it matters: CPIH expands on CPI by including owner-occupiers' housing costs, giving a broader picture of consumer price changes.

- Impact: Although CPIH is informative, the BoE primarily targets CPI. However, housing-related inflation can influence expectations about future price stability.

4. Producer Price Index (PPI)

- Why it matters: PPI measures price changes at the factory gate, which often precede consumer price changes. It provides early signals of inflationary pressure in the production process.

- Impact: Rising PPI can indicate future CPI inflation, prompting the BoE to take preemptive action by adjusting interest rates.

5. Wage Growth and Labour Costs

- Why it matters: Strong wage growth can fuel demand-driven inflation, particularly in the services sector, which is sensitive to labour costs.

- Impact: Persistent wage inflation can push the BoE to raise interest rates, even if CPI is not yet significantly above target, to prevent inflationary spirals.

6. Inflation Expectations

- Why it matters: If businesses and consumers expect high inflation in the future, it can become self-fulfilling as wages and prices rise preemptively.

- Impact: The BoE monitors surveys and market-based indicators of inflation expectations to gauge future risks and adjust policy accordingly.

7. Import Prices and Exchange Rates

- Why it matters: A weak exchange rate can drive up import prices, contributing to inflation.

- Impact: The BoE considers exchange rate movements, especially if they impact CPI, although its primary focus remains domestic price pressures.

In summary, CPI inflation remains the BoE’s primary target, but core inflation, wage growth, and inflation expectations are essential for understanding persistent trends and shaping policy responses. Temporary changes in energy or food prices (reflected in headline CPI) are monitored but often do not directly dictate interest rate changes unless they drive inflation expectations higher.