But why is consumer confidence steady?

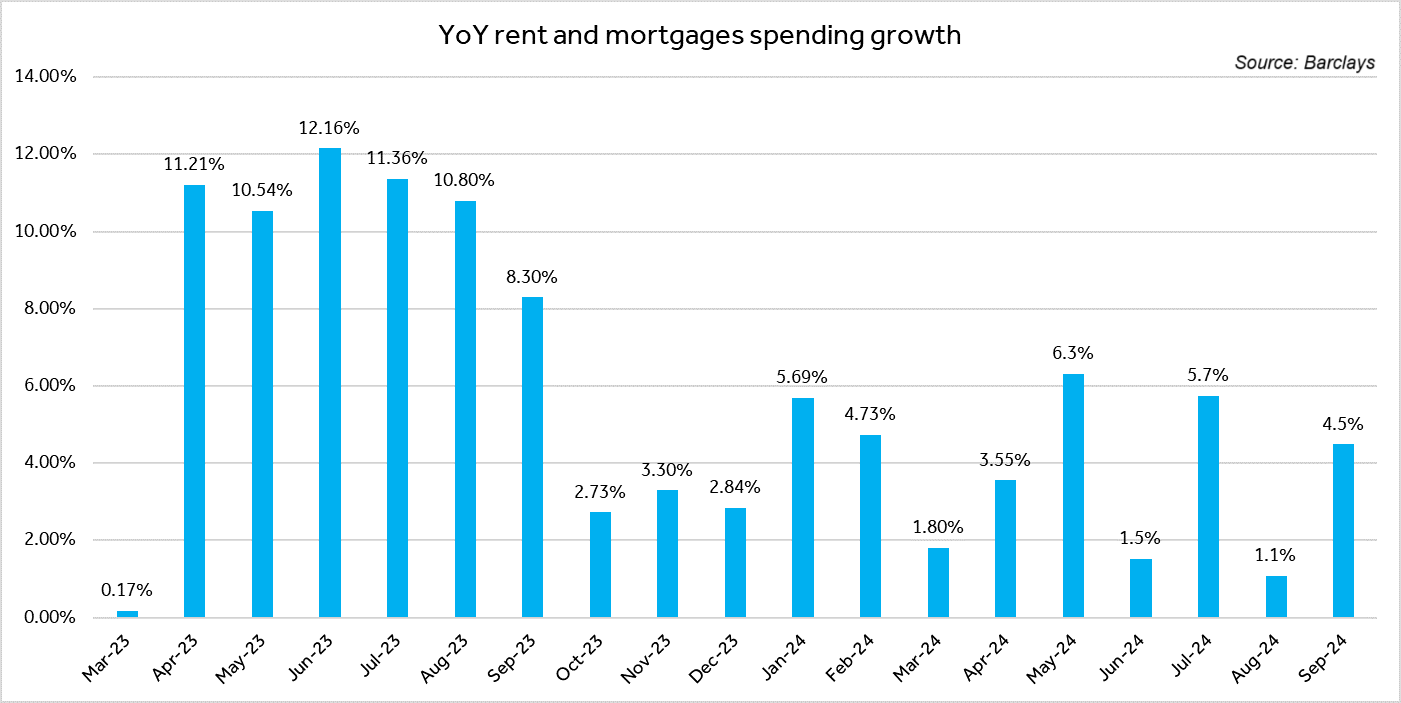

Spending on rent and mortgages rose by 4.5% year-on-year in September, marking an acceleration from August’s slower growth, major lender Barclays reported.

The increase, revealed in the latest Barclays Property Insights data, comes after the Bank of England held its base rate steady during the last Monetary Policy Committee (MPC) meeting.

In contrast, spending on utilities dropped by 12.5%. Barclays, however, said this decline is unlikely to last with winter approaching and Ofgem’s energy price cap increase taking effect on October 1.

Despite fluctuations in housing and energy costs, consumer confidence in household finances remained stable at 70% month-on-month. The proportion of consumers lacking confidence in their ability to meet rent and mortgage payments stayed unchanged at 15%, suggesting that, while interest rates remain on hold, consumers are not anticipating further rate hikes in the near term.

“While consumer costs continue to be impacted by ongoing volatility in the housing market, we are encouraged by the long-term downward trajectory of rent and mortgage spending,” said Mark Arnold (pictured), head of mortgages and savings at Barclays.

“The next MPC decision in November will be closely watched, but it’s important to recognise the broader issues affecting the housing market, including supply and demand pressures. We hope to collaborate with government and industry to address these challenges in the coming months.”

Mortgage and rental payments data, which includes transactions such as direct debits and bank transfers to mortgage lenders and private landlords, covers the period from August 19 to September 22 compared to the same timeframe in 2023. The report also draws on consumer card spending data from Barclays debit cards and Barclaycard credit cards.

The consumer spending research was based on a survey conducted by Opinium Research of 2,000 respondents, representing a cross-section of UK consumers by age, gender, region, and income group.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.