Fix as soon as possible say experts, as cheapest rates are withdrawn

Just over a week ago, the frosty property market seemed to be facing a thaw. There was growing momentum in the market, mortgage interest rates were dropping daily - then all of a sudden, they weren’t. Mortgage Introducer was already reporting growing concerns that a potential Labour tax and spend budget was scaring the market (and that Oasis weren’t helping) then The Coventry broke ranks and withdrew an incredibly popular product – quickly followed by Santander and Barclays pulling mortgages from sale.

Read more: Is this the beginning of the end of mortgage rate cuts?

Mortgage Introducer had also already alerted readers to the fact that there may have been some issues with the property data we were seeing, that most reports saw as entirely positive. A close look at Zoopla’s report at the time was concerning – a substantial number of properties currently listed were “chain-free”, with Zoopla estimating that 32% of these may belong to landlords or second homeowners – bailing before a big CGT hit.

The buy-to-let market, already grappling with rising mortgage costs and proposed changes to energy efficiency standards, was facing additional uncertainty with rumours of capital gains tax (CGT) hikes.

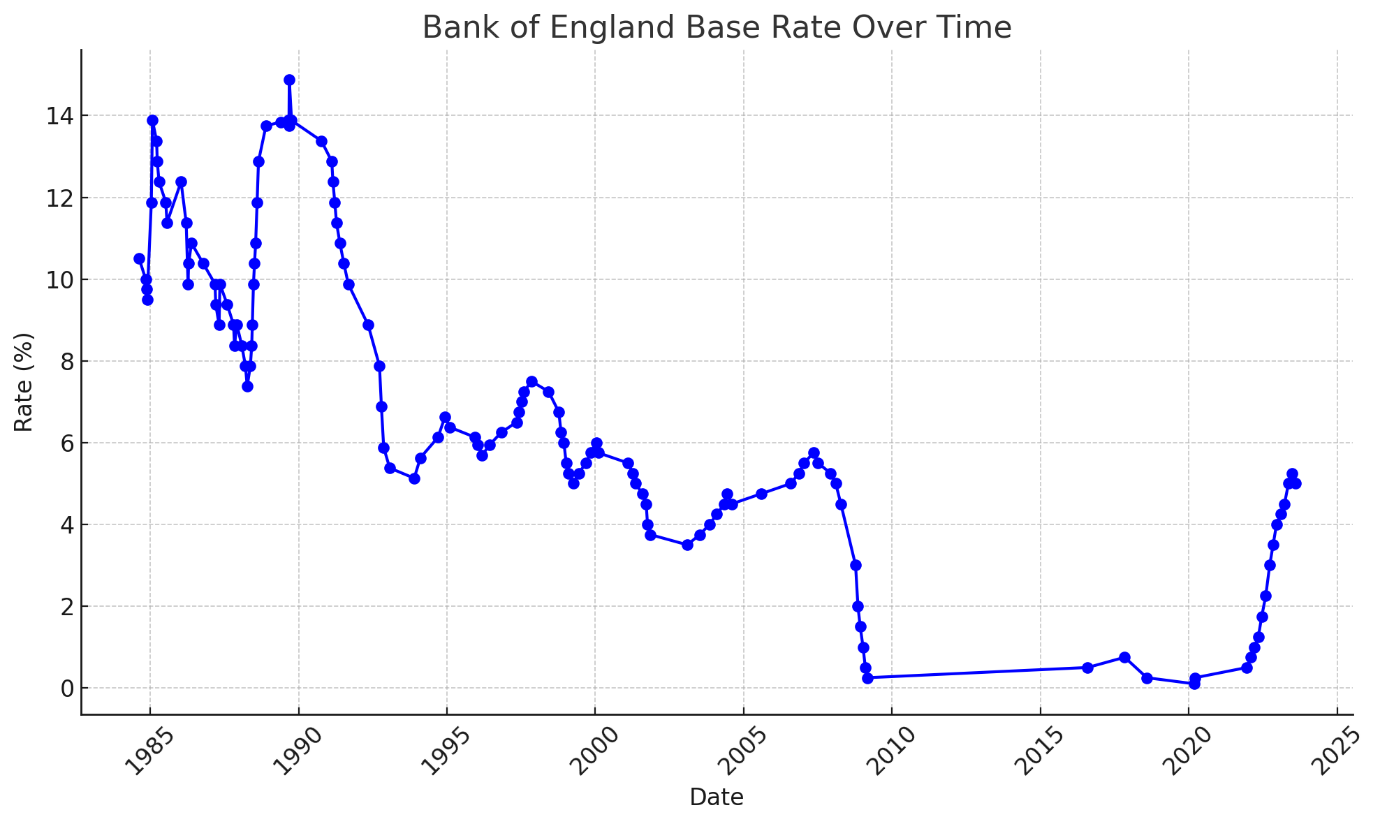

And now other voices are also warning borrowers that the downward plunge of mortgage rates is coming to an end. The chances of seeing borrowing costs for buying a home return to the very low levels experienced in the last decade are “unlikely”, the head of the UK’s largest mortgage lender told the BBC over the weekend. Charlie Nunn, CEO of Lloyds Bank, indicated that while mortgage rates are expected to decrease, they are not likely to fall back to the near-zero levels witnessed during the 2010s.

Read more: Borrowing costs rise as Reeves budget fears spread

In recent years, the rates on new fixed mortgage deals have climbed, primarily due to rising interest rates aimed at controlling inflation, which surged due to the COVID pandemic and the war in Ukraine. Although these rates have recently dipped following an interest rate cut, some brokers have cautioned that this trend might “come to an abrupt halt”.

During an appearance on the BBC’s Sunday with Laura Kuenssberg programme, when asked whether “cheap” mortgage deals might return, Nunn responded: “We do think they [mortgage rates] are going to continue to come down, but getting back to the level we saw in the last decade where interest rates were down at zero, I think, is unlikely.”

Nunn acknowledged that the rise in borrowing costs has been “really challenging” for homeowners. However, he noted that only about 40% of UK homes are financed by mortgages. He also mentioned that the average household income for those with a mortgage is around £75,000, meaning “many of those families have been able to absorb” the higher monthly payments.

Read more: ’Best in market’ Santander mortgage pulled

The Coventry, Santander and Barclays’ mortgage product adjustments may well have been precipitated by just too much sudden business. Although rates were falling, the sudden slowing of competition may have left The Coventry exposed.

“There is also a more subtle dynamic in play that we saw with Coventry Building Society in the last few days – they were the cheapest lender on some products, so were swamped with applications and hence had to pull back,” Richard Campo, head of growth at mortgage and insurance practice Heron Financial, told Mortgage Introducer. “Interestingly, as a building society, they are less susceptible to money market movements, so it was simply the demand for their products which has made them pull back.”

Campo added: “When rates are falling you don’t see this, as the cheapest lender gets undercut before they get overrun with applications. When costs go up, the cheapest lender often has to pull back, mainly to maintain service even before pricing becomes a factor. As the market is much busier than it has been in recent weeks/months it could well be a game of whack-a-mole, trying to pin down the best deal in the coming weeks.”

Campo is one of a growing chorus of experts that thinks we have seen the best that mortgage rates are going to get for the near future at least.

“I think there is a very good argument to make that we’ll see the pricing of fixed rate mortgages increase from here,” he said. “This is, in part, driven by money markets increasing in recent weeks - for example, five-year swaps are up about 2% in the last week and 7% in the last month. So, as lenders complete on previous funds they have brought in and go back to market for more, the costs have simply increased so that usually manifests in higher fixed rate mortgages.”

“I think there is a very good argument to make that we’ll see the pricing of fixed rate mortgages increase from here,” he said. “This is, in part, driven by money markets increasing in recent weeks - for example, five-year swaps are up about 2% in the last week and 7% in the last month. So, as lenders complete on previous funds they have brought in and go back to market for more, the costs have simply increased so that usually manifests in higher fixed rate mortgages.”

Read more: Is Rachel Reeves going to drive up interest rates?

“Swap rates have increased and there is a mixed bag of lender reaction with some of the more exposed specialist lenders increasing,” agreed Michelle Lawson mortgage adviser and director at Lawson Financial. “The same is in the residential space, so there is currently no clear pattern. Rate rises can also be precautionary for service/business levels. There is no clear pattern at the moment.”

The one clear bit of advice appears to be to let clients know that they should look at fixing now if they can. “There is never a situation where I ever advocate anyone to wait,” said Campo. “If rates are falling, great, we can replace the rate/lender as needed. When rates are rising it is a no-brainer. This could be a blip, it could be a trend, but with the looming budget, geopolitical tensions rising, it makes no sense whatsoever to delay applying for a mortgage if you are able to.”