Moves are creating challenges for brokers

The rapid fire mortgage rate reductions which have greeted the Bank of England’s revised base rate over the past fortnight, have been variously described as mortgage wars or rate wars, and in this feverish pricing battle, lenders are arguably the generals, determining the next move.

The battleground is a mortgage market which has seen lenders, major and minor, slashing rates with astonishing frequency – with several big hitters a day, it seems, announcing further rate cuts, often in response to what their rivals have done only hours before.

All of this makes the working day for brokers ever more complicated, keeping abreast of the changes as they happen. And while some welcome the downward trajectory of rates, others have called for greater stability in a market that has been anything but settled in recent years.

Ben Waugh, managing director of later life lender more2life, acknowledged how competition has ramped up over the past few weeks.

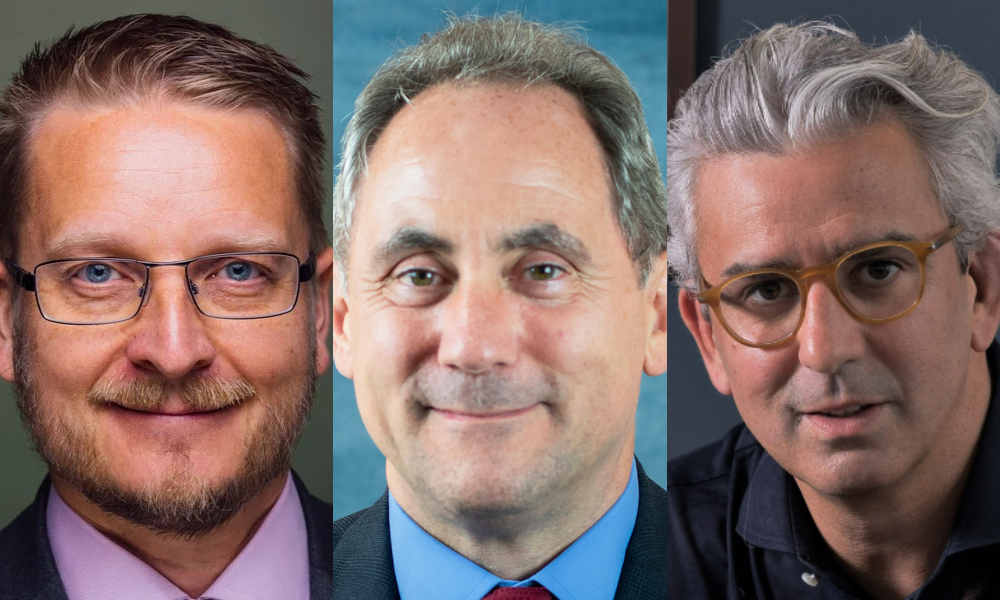

“In a somewhat subdued market, where consumers have been holding out for more suitable rates, lenders are in heated competition for business,” Waugh (pictured left) told Mortgage Introducer, “so the recent wave of rate reductions may mark the return of more preferential products.

“It’s too soon to tell whether the current trend will stick. We have heard rumblings from across the pond. If the Fed announces a cut in its rates, then other central banks may be more inclined to follow suit. In any case, many lenders will have already priced the cut into their fixed-rate products ahead of time, so this won’t result in any immediate downward pressure on mortgage rates more broadly.”

Waugh believes that, from a customer perspective, the current price war may open up a few opportunities to step on to the property ladder.

“The market is steering towards a more manageable economic climate, and the increased availability of competitive products is a positive step in the right direction,” he suggested, “but there are still difficulties that lie ahead for borrowers that aren’t going to disappear overnight. Asking prices are nearing record high levels and the reality is wage growth hasn’t gone nearly far enough to keep up.”

Waugh forecast that the recent trend for rate reductions would likely accelerate market activity in the coming months.

“Advisers will play a crucial role in helping borrowers steer through choppy waters and secure the best deal for a stable financial future,” he noted. “In the case of the later life lending sector, older homeowners should remember that rates are more affected by gilts than the base rate. It’s worth adjusting expectations accordingly. “

What do lenders weigh up in making mortgage rate cuts?

Keith Barber (pictured centre), director of business development, at Family Building Society, meanwhile noted the balancing act required of lenders in the current market.

“Borrowers want to see rates cut as soon as possible,” he observed. “On the other hand, the savers who provide the money we lend out want the higher rates they’ve seen for the last couple of years to continue. As always, we’ll try to balance the interests of both sides, maintaining a competitive position versus other lenders in our areas.”

Family Building Society is very aware that fast changing rates cause a problem for brokers, Barber said - both when rates are rising and when falling, and has responded accordingly.

“Brokers are effectively having to do the same research work over and over for each client, to make sure they achieve good outcomes,” he said. “That’s one of the reasons we moved to paying a full procuration fee for PT (product transfer) business last year.”

The way in which the base rate escalated – 14 increases over an 18 month period – was unsettling, in Barber’s view.

“That was far too often and very disruptive for everyone,” he said. “We think that, on the way down, the reductions should be in large steps. Unfortunately, we can’t predict the timing. We do think base rate at 5% is too high, given the lasting effect of fixed rate mortgages at this level.”

Read more: When will the Bank of England cut the base rate again?

How big a factor is the base rate in pricing mortgages?

For Leon Diamond (pictured right), CEO of LiveMore Capital - the mortgage lender for people aged 50-90+ - the base rate is only part of the story when it comes to determining the cost of loans.

“While the base rate is an important influencer, our pricing is principally dictated by swap rates, which are decreasing due to future expectations and equity market volatility,” he explained.

“Whether other lenders drop their rates or not, it has always been important to us that we pass on any reductions to our customers. We have a responsibility to provide the best value mortgages we possibly can. A lot of people are still coming to terms with the higher costs of living, and I think it will take some time for many households to acclimatise.”

LiveMore appreciates that it can be a challenge for brokers to keep up with rate changes, Diamond said. “We make sure we advise our brokers as soon as we possibly can,” he promised.

Diamond anticipated a possible further interest rate cut before the end of the year, but remarked that inflation was predicted to climb a little imminently, and the Bank of England’s Monetary Policy Report had sounded a cautious note.

“At four versus five committee members voting against a rate cut, it was a very close-run thing this time around,” Diamond reasoned. “I certainly wouldn’t assume a string of cuts any time soon.”

Paul Fryers, managing director at Zephyr Homeloans, said the lender’s latest rate change - a reduction across most of its mortgage products by between five and 10 basis points - took place before the most recent announcement by the Bank of England. It takes a number of factors into consideration when it comes to rate changes.

“Typically though we always try to pass on reduced funding costs to assist brokers and their customers with more options,” Fryers commented. “The market view, available on the Bank of England’s website, is that the cost of funding is going to come down over time. Having said that, there’s no evidence that we’re going to see a return to the very low interest rates that we saw before the pandemic. In the past few days, the financial markets have reacted to news about the US economy, which just serves to show how difficult predicting the future can be.”