Foxtons also report a slight cooling in demand

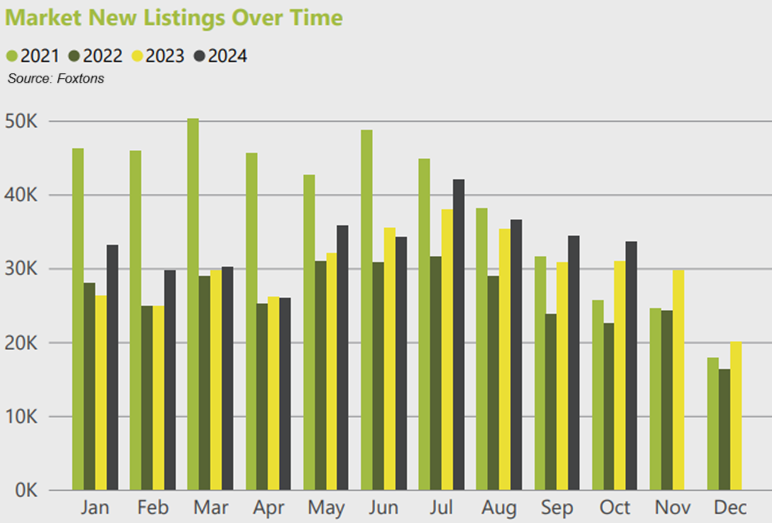

The highest level of new rental stock in London in the past four years was recorded last month, according to new data from Foxtons, revealing an 8% increase in listings compared to a year ago.

Month-on-month, the supply of available properties in October 2024 dipped just 2%, defying the typical seasonal slowdown and underscoring a standout year for new rental listings in the capital.

Applicant demand, however, was slightly lower than the same period last year, down 3% from October 2023. Compared to September 2024, demand dropped by 32%, which aligns with historical seasonal trends. Despite this, Central London has remained a bright spot, seeing a 15% year-to-date increase in demand from 2023, supported by a strong summer period.

The latest Foxtons Lettings Market Report also showed a 12% year-to-date decrease in the number of applicants per new rental listing, which has also fallen 24% between September and October as peak lettings season came to an end. However, Central London bucked the trend, recording an 11% year-on-year increase in applicants per listing.

Applicant budgets continued to hit record levels throughout 2024, with the average weekly budget reaching £558. Although the average rent peaked at £593 per week in September 2024, rents eased by 4% in October. Across all regions of London, rental prices remained largely in line with 2023 levels, suggesting that affordability constraints are beginning to temper further increases.

“Rental listings in London reached their highest October levels since 2019, signalling a notable increase in stock,” said Gareth Atkins (pictured), managing director of lettings at Foxtons. “This is positive news for both renters, who benefit from a greater choice of properties, and landlords, who may find it easier to attract tenants.

“The stock of available rental properties only decreased by 2% from September levels, which is highly unusual for this time of year, defying the typical seasonal slowdown in the rental market. Additionally, the Autumn Budget provided some welcome relief to landlords, with existing rental properties unaffected by changes, as Capital Gains Tax remained unchanged, maintaining stability in the market.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.