Rebound expected as the year progresses

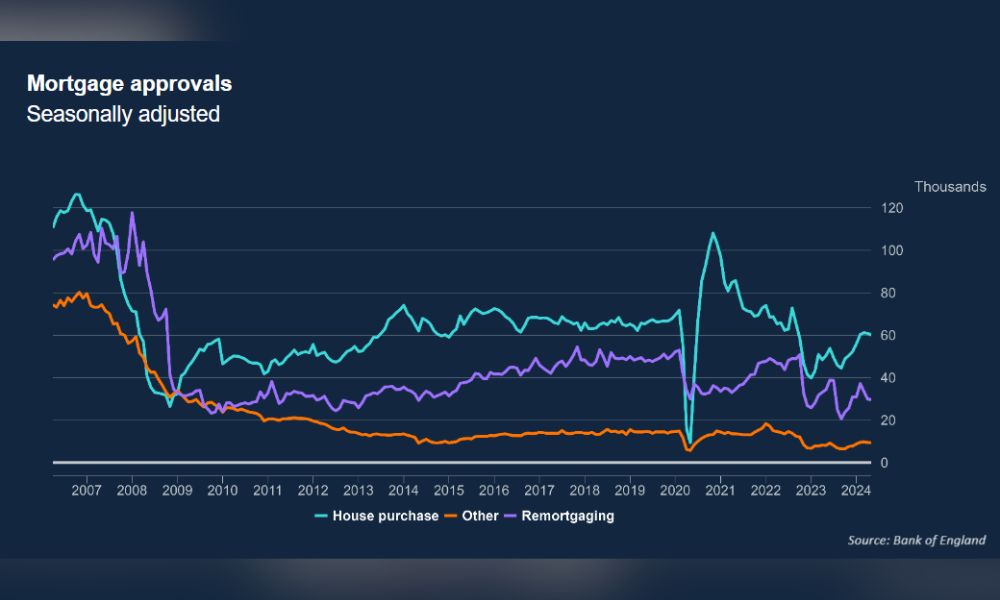

Mortgage approvals for house purchases fell from 60,800 in April to 60,000 in May, latest data from the Bank of England (BoE) has revealed.

Approvals for remortgaging, which only include remortgaging with a different lender, also decreased slightly from 29,900 in April to 29,600 in May.

Net borrowing of mortgage debt by individuals fell from £2.2 billion in April to £1.2 billion in May.

The BoE’s latest Money and Credit report also revealed that the annual growth rate for net mortgage lending increased to 0.3% in May, following a rise to 0.2% in April. This was the first rise in the growth rate since October 2022.

Gross lending climbed for the fourth consecutive month, reaching £22.2 billion in May, up from £21.1 billion in April. Gross repayments also increased by £1.2 billion over the same period, totalling £20.5 billion.

“The latest figures from the Bank of England show a decrease in mortgage lending as the UK continues its bumpy journey back to economic normality,” said Paul Heywood (pictured left), chief data and analytics officer at Equifax UK. “While not yet reflected in today’s data, there are growing signs of economic easing – with inflation finally on target for the first time in almost three years and news of high street lenders cutting mortgage rates.”

“The latest figures from the Bank of England show a decrease in mortgage lending as the UK continues its bumpy journey back to economic normality,” said Paul Heywood (pictured left), chief data and analytics officer at Equifax UK. “While not yet reflected in today’s data, there are growing signs of economic easing – with inflation finally on target for the first time in almost three years and news of high street lenders cutting mortgage rates.”

Jonathan Samuels (pictured centre), chief executive of Octane Capital, noted that while mortgage approval levels have fallen marginally over the last two months, they remain considerably higher than we have seen for quite some time.

“This demonstrates that the sector is continuing to benefit from a far greater degree of stability since the base rate has been held,” Samuels said.

“There is no doubt a ‘wait and see’ element at play here as well, with a segment of buyers putting their plans to purchase on temporary hold ahead of the election. So, while mortgage approval levels have remained consistent of late, we expect to see further growth in these numbers as the year progresses.”

Jeremy Leaf (pictured right), a north London estate agent, said the slight decrease in mortgage approvals was not surprising.

“In our offices, sales agreed numbers are still good as buyers and sellers shrug off concerns about the election, but more importantly perhaps, valuation appraisals and listings are on the up, which has meant prices are softening a little,” he added.

“Approvals are always a very good indicator of demand in the recent past and near-term transactions to come. Certainly, we are seeing no signs of withdrawals or heavy negotiations so expect more of the same or even slightly better as hopefully mortgage rates start to drop over the next quarter.”

Any thoughts on the figures revealed in this Bank of England report? Share them with us by leaving a comment in the discussion box at the bottom of the page.