Rising cost of mortgages causing concern for borrowers coming off a fixed rate deal

Interest rates for mortgage borrowers have been volatile over the past six months, despite no change to the Bank of England’s base rate, according to analysis from price comparison site Moneyfactscompare.co.uk.

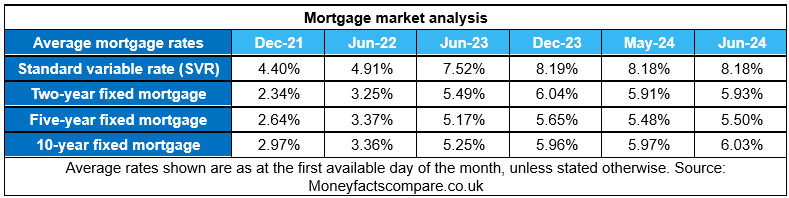

Since December 2023, the average two-year fixed rate has fallen from 6.04% to 5.93%, while the average five-year fixed rate has dropped from 5.65% to 5.50%. However, these average rates have risen from 5.91% and 5.48%, respectively, since last month.

The average rate for a 10-year fixed rate mortgage has increased from 5.96% to 6.03% since December 2023, and from 5.97% since May 2024. The average standard variable rate (SVR) stands at 8.18%, down from 8.19% in December 2023, with no change month-on-month.

“The rising cost of mortgages may cause deep concern for borrowers about to come off a fixed rate deal and needing to refinance,” said Rachel Springall (pictured), finance expert at Moneyfactscompare.co.uk. “Affordability is a pressing point for both homeowners looking to refinance and new buyers, so those struggling to see how they can afford mortgage repayments will no doubt be desperate for interest rates to come down.”

Springall noted that while it may still be more affordable for homeowners to lock into a new fixed rate mortgage than to fall onto a standard variable rate (SVR), which is above 8%, the average SVR has nearly doubled since the Bank of England began increasing the base rate in December 2021.

“A typical mortgage being charged the current average SVR of 8.18% would be paying £287 more per month, compared to a typical two-year fixed rate (5.93%),” she said.

Due to volatile swap rates, lenders have been increasing fixed mortgage rates and withdrawing some deals priced below 5%. As a result, the average two-year fixed rate is nearing its level from six months ago, undoing the positive rate cut momentum seen during the first quarter of 2024.

The average five-year fixed rate has remained above 5% since June 2023, fluctuating around 6% over the past six months.

“At present, it’s cheaper to lock into a five-year fixed mortgage than a two-year deal, based on average rates, which has been the case since October 2022,” Springall pointed out. “First-time buyers who are struggling to get their foot onto the property ladder and don’t have the ‘Bank of Mum and Dad’ to lean on may feel getting a mortgage is too far out of reach right now.

“Regardless, the uncertainty surrounding interest rates should make it vital for borrowers to seek advice from an independent financial adviser to review all the options available to them.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.