Number of products available reaches highest level in over 16 years

Mortgage rates on two- and five-year fixed deals rose sharply between April and May, according to the latest Moneyfacts UK Mortgage Trends Treasury Report.

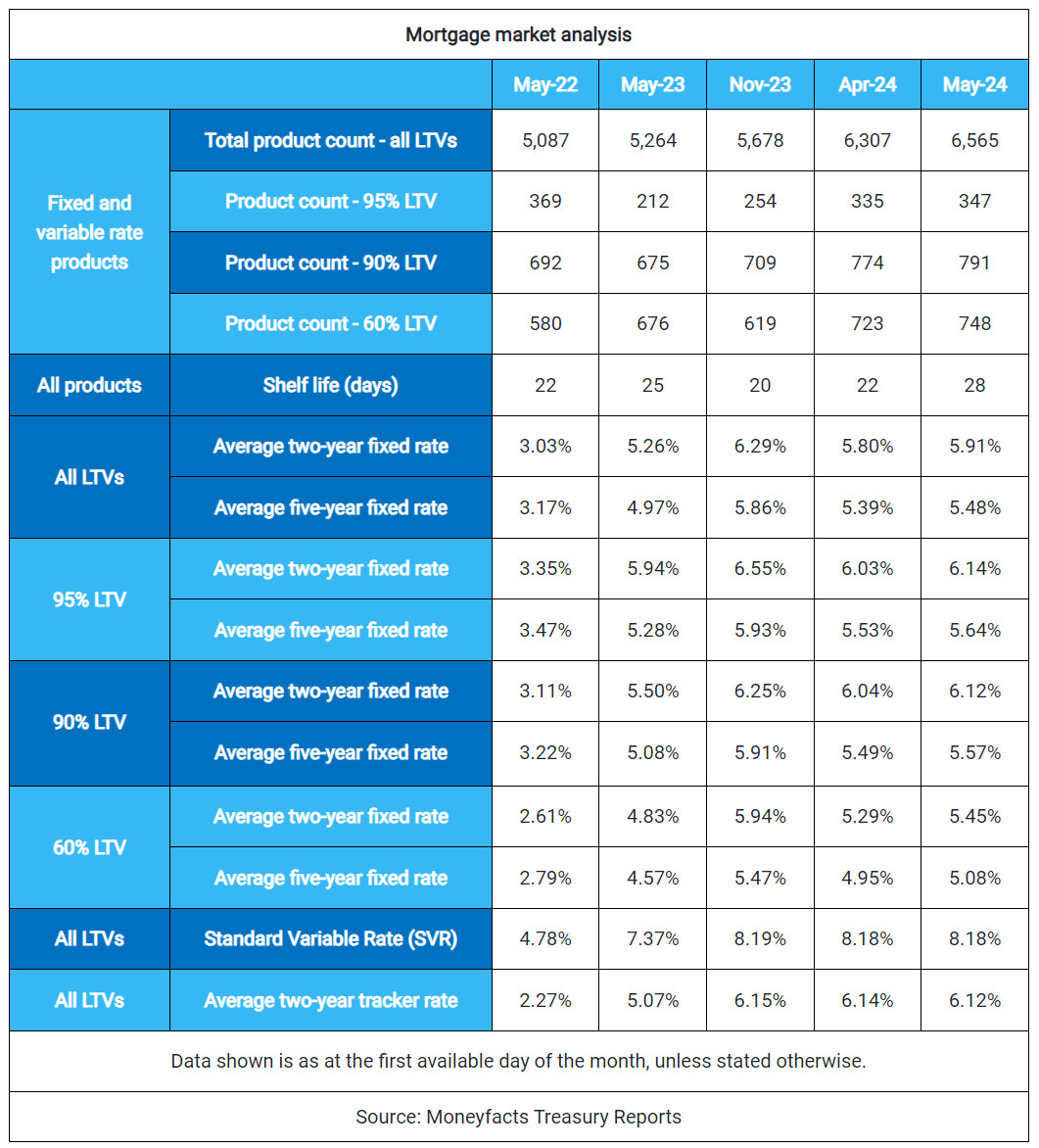

The report showed the average rate for two-year fixed mortgages at 5.91%, while five-year fixed rates stood at 5.48%, marking a 0.43% difference—the largest gap observed in six months.

The data also indicated that the standard variable rate (SVR) remained stable at 8.18%, closely approaching the record high of 8.19% set between November and December 2023. In contrast, the average two-year tracker variable mortgage rate decreased to 6.12%.

The Moneyfacts report also revealed that the number of mortgage products available increased to 6,565, reaching a peak not seen since February 2008. The availability of mortgage deals at the 90% loan-to-value ratio continued to rise for the third consecutive month, also reaching its highest in over 16 years, while the count of deals at 95% loan-to-value also grew for the fifth consecutive month.

Mortgage product shelf-life extended to 28 days, up from 15 days in early March.

Moneyfacts: Residential fixed mortgage rate increases gain pace.

— Moneyfacts Press (@MoneyfactsPress) May 13, 2024

Read more here: https://t.co/H5FQ5sxBip#moneyfacts #mortgages #financenews #moneyfactscompare pic.twitter.com/4SckdANgOX

“Mortgage rate rises have gained pace, with the average two- and five-year fixed rates increasing by 0.11% and 0.09% respectively,” said Rachel Springall (pictured), finance expert at Moneyfacts. “This counters the more subdued rises seen a month prior, so rates are closing in to levels not seen since the start of the year.

“Volatile swap rates spurred lenders to review their fixed mortgage pricing, which has resulted in rises across all loan-to-value tiers on two- and five-year fixed mortgages. Borrowers may be concerned by these movements, but one positive point to take from the latest trends is that mortgage shelf-life has stabilised to 28 days.”

Springall highlighted that the increased product availability, particularly in higher LTVs, offers better options for those with smaller deposits or equity.

“It will still be cheaper for borrowers to grab a fixed mortgage now compared to sitting on a revert rate, based on average rates,” she added. “Some borrowers may even consider a base rate tracker mortgage over the next two years if they are in line with economists’ predictions for the Bank of England to cut base rate this year. Consumers preparing to refinance or ready to buy their first home would be wise to seek advice to navigate the latest deals available.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.