Barclays report also shows an increase of consumer confidence in their household finances

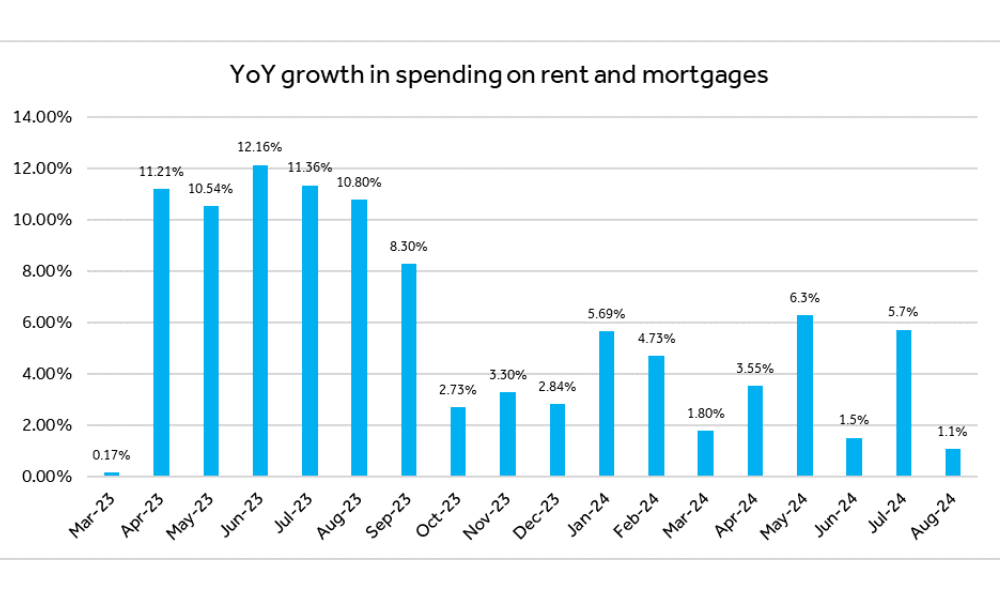

Growth in rent and mortgage spending has slowed to its lowest rate in 17 months at just 1.1%, following the Bank of England’s base rate reduction last month, the latest Barclays Property Insights report has shown.

Consumers are also benefiting from lower utility bills, with warmer weather and Ofgem’s energy price cap contributing to a fourth consecutive month of falling utilities spending, down 11.4% year-on-year.

Consumer confidence in household finances rose to 70% in August, up from 65% in July. Confidence in the housing market also grew, from 25% to 29% over the past four months.

However, with 78% of mortgage holders on fixed rate deals, only a small portion of consumers are seeing immediate benefits from the recent interest rate cut. The percentage of consumers not confident in their ability to afford rent or mortgage payments fell slightly from 16% to 15% month-on-month.

Barclays also noted that rental market competition remained intense. For the fourth consecutive month, 20% of renters reported getting less value for their money due to high demand. Among those aged 18 to 34, the figure rises to 26%. The start of the academic year is adding to the pressure, with 17% of renters stating that an influx of students is driving increased competition for properties.

In response to housing supply challenges, only 14% of 18- to 34-year-old homeowners are considering selling their homes, with many opting for retrofitting instead. About 28% of this age group are making energy efficiency improvements to their homes.

In response to housing supply challenges, only 14% of 18- to 34-year-old homeowners are considering selling their homes, with many opting for retrofitting instead. About 28% of this age group are making energy efficiency improvements to their homes.

Meanwhile, spending at garden centres grew by 8% in August, as improved weather led more people to focus on outdoor spaces. However, home improvement spending dropped by 5.7%, with many younger people indicating plans to begin projects in the autumn ahead of the Christmas season.

“In the year to date, we’ve seen encouraging signs that spending on rent and mortgages is decelerating on the whole, but unsurprisingly, it isn’t a linear descent, and we could see some volatility over the coming months, despite the recent interest rate cut,” said Mark Arnold (pictured left), head of mortgages and savings at Barclays.

“Many people think that interest rates are what really determine the mortgage market – and while that’s true to some extent, for me, the biggest driver is confidence. If you’re going to make the biggest purchase of your life, you need to be confident that the economy is stable, inflation is under control, and you know what you’re going to pay. That stability and confidence will determine how people spend, even for renters.”

Property expert Phil Spencer (pictured right), added: “As we head into the autumn, there are a number of seasonal impacts to the property market which can prove to be a sticking point for consumers trying to move. “Particularly for renters living in university towns, timing is everything as over the coming weeks many students will be entering the market to find accommodation near to their classes.

“Landlords too might want to consider how and when they advertise their properties – though September might bring plenty of candidates, if you are looking for a longer-term tenant, it could be worth waiting for a few weeks until the back-to-school flurry calms down.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.