But affordability continues to limit price growth in some regions

Falling mortgage rates, which are at its lowest level over the past 15 months, are supporting a rebound in UK property sales, the latest Zoopla House Price Index has revealed.

According to Zoopla, sales agreed and buyer demand have risen by more than 25% in the past four weeks compared to the same period last year. This uptick follows a two-year lull as households that had delayed moving decisions re-enter the market.

The number of sales agreed is up by 25%, with regions such as the East Midlands and North-East seeing increases as high as 30%.

The supply of homes for sale is also growing, driven by improved seller confidence and the easing of mortgage rates. This includes both homeowners looking to move and investors responding to recent and potential tax changes.

Around 32% of homes listed on Zoopla are now chain-free, largely due to investors and second homeowners looking to sell amid tax adjustments. The most common chain-free properties are two-bedroom houses, with 41% of such listings currently chain-free. Former rental properties account for 13% of homes on the market.

Several councils in England are expected to double council tax on second homes by 2025, which is leading to increased listings in coastal and rural areas popular with second-home owners. Areas like Truro (47%), Torquay (44%), and Exeter (41%) have seen available supply rise by more than 40%. However, house prices in these areas remain under pressure, with rising supply keeping price growth in check.

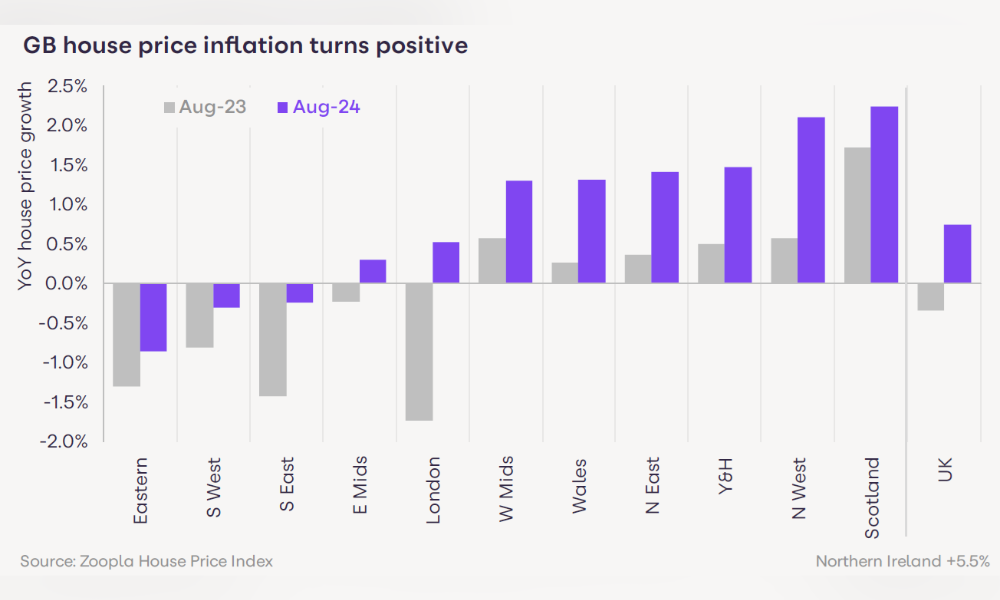

Affordability remains a challenge for house price growth, particularly in southern England. London, however, has seen a recovery, moving from a 1.7% annual price decline a year ago to a modest 0.5% increase today.

While house prices are still lower in the South West, South East, and Eastern England compared to a year ago, other regions, including Northern Ireland, are seeing prices rise. In Northern Ireland, house prices are 5.5% higher after lagging behind the rest of the market in recent years.

The Zoopla report also showed that a greater number of homes on the market is expected to limit price inflation in the coming months. Most new listings are from homeowners looking to sell and buy another property. However, not all homes are fresh to the market—about 20% of listings have been up for sale at some point over the last two years.

Pricing remains critical in attracting buyers, especially for the fifth of homes that have been on the market for more than six months without selling. As a result, around 20% of homes have reduced their asking prices by up to 5%. Over a third of sales (37%) are being agreed at more than 5% below the initial asking price, suggesting buyers remain competitive despite increased market activity.

“Lower mortgage rates are delivering a much needed confidence boost to homeowners, many of whom have sat on the sidelines over the last two years,” said Richard Donnell (pictured), executive director at Zoopla. “Market activity is up across the board and expectations of lower borrowing costs will continue to bring buyers and sellers into the market.

“Speculation over possible tax changes in the Budget and the impact of previous tax changes are continuing to add to the growth in the number of homes for sale. We remain in a buyers’ market and greater choice of homes for sale will keep house price inflation in check into 2025.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.