What will happen to home sales, house prices, and mortgage rates this year?

The UK housing market continues to show signs of a rebound in activity, with predictions from property website Zoopla indicating a 10% rise in total home sales from one million last year to 1.1 million in 2024.

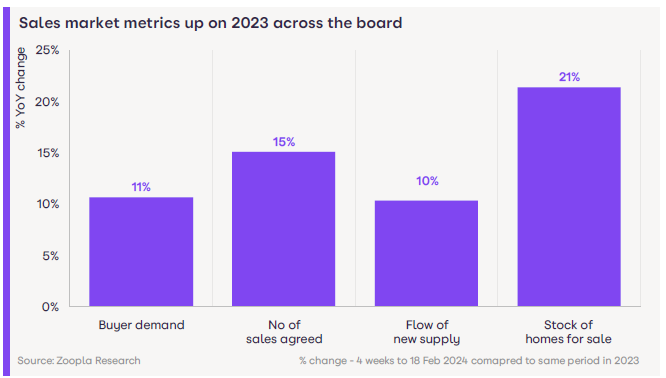

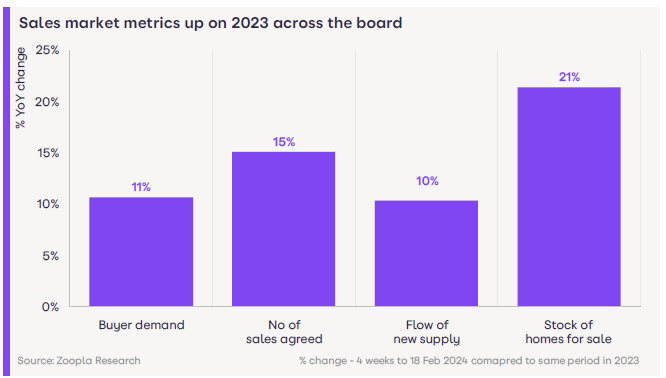

According to the latest Zoopla House Price Index, the supply of homes for sale has increased by 21% compared to last year, alongside an 11% rise in buyer demand and a 15% increase in sales agreed, highlighting a boost in buyer confidence and more realistic pricing by sellers.

The North East and London have led the charge, registering sales increases of 17% and 16% respectively.

Despite a decrease in the pace of house price inflation to -0.5%, the trend of slowing house price declines is consistent across all UK regions. Five regions in England are still experiencing annual price drops of up to -2.1%, whereas the rest, including Wales, Scotland, and Northern Ireland, are seeing positive price growth, with Northern Ireland reporting a 4.3% annual price inflation.

This stabilisation in pricing suggests that significant drops in house prices are not necessary to sustain sales, as evidenced by estate agents now securing an average of six new sales a month, compared to 5.2 in the previous year.

Zoopla noted that the UK is experiencing a “three-speed” housing market, influenced by geographical location. Southern England, excluding London, is facing the largest annual price falls due to rising mortgage rates and decreased buyer power, with average home prices at £344,000, which is 30% above the UK average.

London, while still the most expensive market with an average home price of £534,000, has seen slower price inflation over the past seven years, gradually improving affordability and attracting more buyers. The capital’s housing supply has increased by only 7% compared to 21% for the UK overall, leading to quicker improvements in price inflation rates.

The rest of the UK has witnessed limited annual price falls, with house prices at or below the national average, and a less pronounced impact from higher mortgage rates on purchasing power.

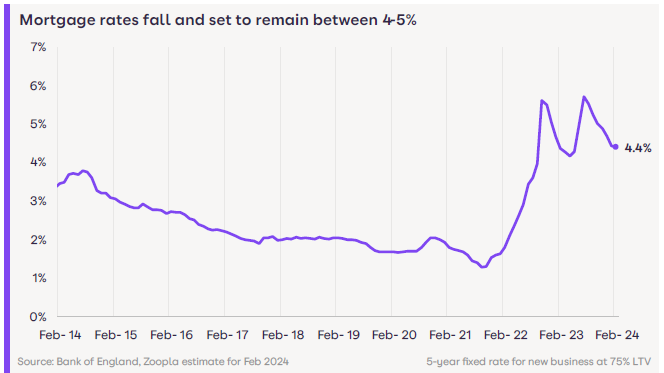

Looking ahead, mortgage rates are expected to stabilise, supporting the upturn in market activity. Rates have returned to levels seen a year ago, but lenders are beginning to withdraw mortgage deals priced below 4% as the cost of financing rises.

Zoopla said buyers should prepare for mortgage rates between 4% to 5% throughout much of 2024, which is anticipated to align with flat to low single-digit price increases.

“The housing market has proved very resilient to higher mortgage rates and cost-of-living pressures,” said Richard Donnell (pictured), executive director at Zoopla. “More sales and more sellers shows growing confidence among households and evidence that 4% to 5% mortgage rates are not a barrier to improving market conditions.

“The momentum in new sales being agreed has been building for the last five months, and the sales market is on track for 1.1 million sales over 2024 supported by new sellers coming to the market. While sales are set to increase, we don’t expect house price growth to accelerate further in 2024.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.