Zoopla reveals new figures on sales, house prices, and regional trends

The UK housing market is experiencing a surge in activity, Zoopla’s latest House Price Index has revealed, with the second half of the year expected to see more market activity, though house prices are anticipated to rise only slowly.

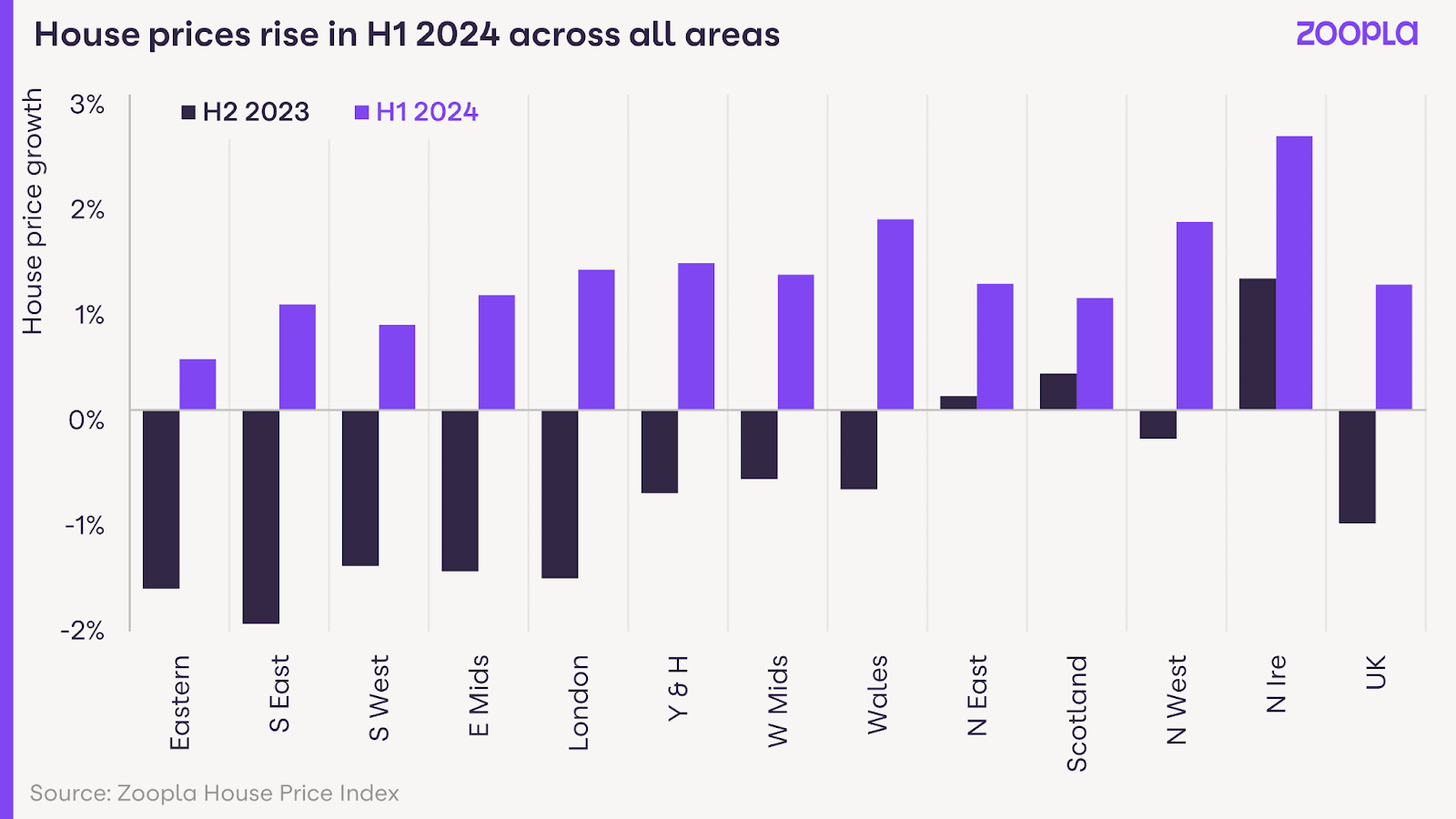

According to Zoopla, the housing market is adjusting to mortgage rates above 4%, with positive signs of increased activity. Over the past 12 months, house prices have risen by just 0.1%, reaching an average of £265,600. However, prices have increased across all UK regions in the first half of 2024.

House prices are expected to rise by about 2% by the end of the year. The improved market outlook is supported by a higher number of homes for sale, more than at any point in the past six years, providing buyers with more choices and supporting sales.

Zoopla has reported that many would-be movers are upsizing, looking for larger homes to accommodate growing families. In addition, buyers are often seeking homes further afield to balance affordability and value.

The increased supply has led to a 16% rise in the number of sales agreed compared to last year, with sales up across all UK regions. Sales are now 22% above pre-pandemic levels.

Buyers are paying 96.8% of the asking price on average, the highest in 18 months, suggesting continued house price growth. In June 2024, homes sold for an average of £16,600 below the asking price.

There has been no material impact from the King’s Speech or new government plans on the market outlook for the next 12 to 18 months. Long-term benefits for homebuyers and renters are expected from economic growth, rising household incomes, and increased home building.

While overall growth in the past year has been modest, regional variations show a north-south divide, with Belfast seeing a 4.3% increase in house prices, Northern Ireland 3.9%, and Scotland 1.4%. In contrast, prices in South East England fell by 1%, South West England by 0.7%, and the East of England by 1.2%.

“The housing market is starting to heat up after a stone cold 2023,” said Richard Donnell (pictured), executive director at Zoopla, commenting on the latest Zoopla House Price Index. “There are clear signs of growing confidence among buyers and sellers, with many more homes for sale and buyers paying an increased proportion of the asking price.

“We expect to see more sales, but house price inflation will be kept in check by more supply and affordability pressures keeping a lid on buying power, especially across southern England. While we don’t expect to see any impact from the new government, or the King’s Speech specifically, in the next 12 to 18 months, it is possible we will in the longer term.

“The housing market is essentially an extension of the UK economy. Government policies focused on economic growth that feeds into income growth will help support both home buyers and renters. The Bank of England will have more impact on the market in the short term and much depends on the timing of the first base rate cut.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.