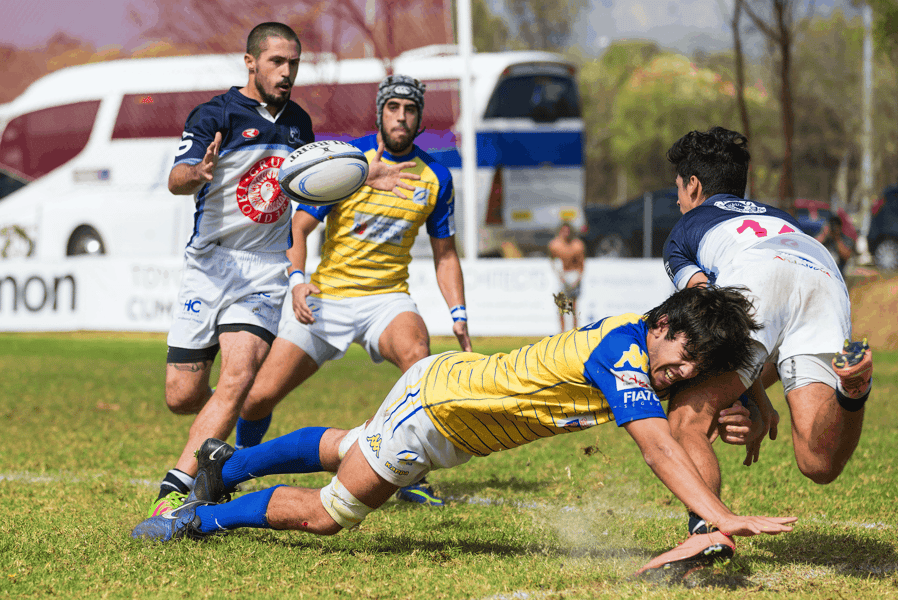

PI, at the best of times, feels like a ‘crunching hit’ waiting to happen and especially at this juncture when firms are being ‘battered’.

Simon Jackson is managing director at SDL Surveying

As someone who coaches a kids’ rugby team, I know a ‘hospital pass’ when I’m given one, and therefore at a recent business update session for our network and third-party partners, when the topic of professional indemnity (PI) insurance was raised and this ‘ball’ was beautifully flighted across to me, I sensed that it would soon be followed by the business equivalent of a crunching hit which some of the game’s biggest tacklers would be proud of.

The point is that PI, at the best of times, feels like a ‘crunching hit’ waiting to happen and especially at this juncture when firms are being ‘battered’ with ever-higher premiums, it seems that all firms who exist in the professional space, have their metaphorical ribs exposed, and will do for some time.

Whatever line of business you’re in, I suspect you have felt no different to us when opening up those renewal PI premium offers and seeing just how much more it’s going to cost you this year, than it did last, or the year before, or the year before that.

Just within the surveying profession, we’re aware that most firms have seen significant increases over the last few years. It is a horrible situation to be in, and I wish I could say that the future looked any better but in all likelihood it will get worse.

The reasoning behind this stems from an industry review, which showed that PI, which covers all professions, is one of the poorest performing insurance lines. This of course is exacerbated by the fact that all professional services are lumped in together, so whether you are a lawyer, accountant, surveyor, conveyancer, adviser, etc, you are ‘covered’ as one mass group and this is done on a global scale.

From our sector’s perspective, the changes in the PI market not only led to significant increases in premiums but also changes to the RICS’ minimum terms, which also made it more expensive.

Unfortunately, I wish there were better answers for firms given this situation, but there’s essentially no way around premium increases simply because the PI market wants to be better remunerated for what it does.

And, that being the case, it obviously makes sense to prepare for that, perhaps putting money away each month to cover the anticipated increases and possibly over-estimating the increase – if that was possible – so that you potentially don’t need all the money you’ve set aside.

However, what we can perhaps also do is to seek to keep those increases to an absolute minimum by getting the best priced-policy available for our needs. My advice in order to do this is to work with a good broker early in the process; this means working with them months before you would normally even consider your PI renewal in order to get ahead of the curve and to be prepared.

I would also suggest you provide far more information than simply filling in the standard proposal form on this, simply because they are not particularly good and don’t portray your firm in the best way possible. Far better, in my opinion, to create your own presentation pack which, can outline the data you’ve collected about where your work is coming from, what type, the work which might come with greater risk, in order that you can then speak to the underwriters directly. After all, you’ll be the best person to present the risk in your business and showcase it in the best light, and to hopefully then get the best deal available.

It sounds like a lot of work but it will undoubtedly be worth doing it this way, rather than getting to the point in the year when the renewal reminder turns up, and you are effectively knocked into next week at what it is going to cost you in order to secure PI cover for the next 12 months. That’s never a nice feeling and at least by planning ahead you can hopefully take away that shock-factor and potentially get yourself the best price possible, albeit one that is highly likely to be far in excess of what firms had to pay just a few short years ago.