Are you ready for another market surge if borrowers pile back in?

Despite a refreshing run of mortgage interest rate cuts, leading to cheaper mortgage repayments, there has been a lot of uncertainty recently over whether rates would continue to drop. Firstly, Catherine Mann spoke about purging these [inflationary] behaviours and keeping rates higher, then Huw Pill, the Bank of England’s chief economist said that we needed a "restrictive monetary policy stance". Then Treasury analysis told us that Rachel Reeves’ spending plans could add an unwanted 2.5% to interest rates – slamming the door shut on any possible property market recovery. But that having been said, another global bank has come out and told us all – don’t panic! Things are going to get better for the mortgage industry – and perhaps faster than we expected.

Read more: November interest rate cut much more certain

Goldman Sachs has released a report that says that with the UK’s current base rate at 5%, it remains "notably restrictive." The bank now suggests that the Bank of England will lower interest rates more than the markets currently expect, citing ongoing progress in reducing inflation and recent signals from policymakers suggesting a softer stance.

The Wall Street bank predicted: "We forecast sequential Bank rate cuts to a terminal rate of 2.75% by November 2025, significantly below current market pricing."

Although market expectations are for the Bank of England to begin easing its stance on interest rates in the coming months, there is still an expectation by other commentators that rates will stabilise at around 3.5% in the long term, a figure notably higher than Goldman Sachs's projections.

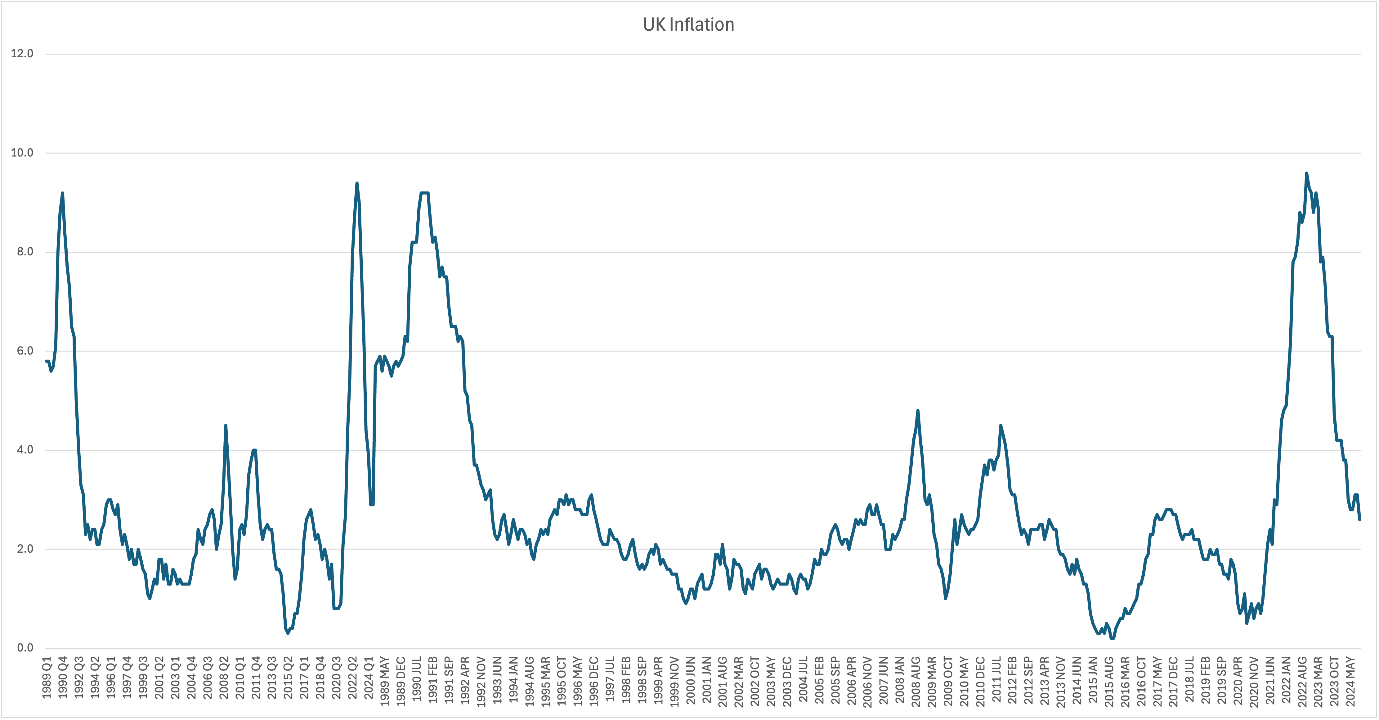

Recent data showed that inflation in the UK dropped faster than the Bank of England anticipated, with the annual rate falling to 1.7% in September, down from 2.2% in August. Meanwhile, services inflation, a key domestic price measure closely monitored by the central bank, declined from 5.6% to 4.9%.

Read more: Rates set to fall to 2.75% says HSBC

Though inflation is expected to rise slightly in the last quarter of this year due to a hike in the energy price cap, traders are still predicting 25 basis point rate cuts in both the Bank of England’s November and December meetings, which would reduce the base rate to 4.5%.

There is a broad range of views on the Bank of England’s Monetary Policy Committee (MPC) regarding the persistence of inflation and the speed at which monetary policy should be eased. Governor Andrew Bailey has hinted that if inflation continues to stabilise, the Bank could move more "aggressively" in reducing rates (despite Huw Pill’s more hawkish stance).

Bailey, along with other members of the MPC, will participate in discussions at the International Monetary Fund's annual meetings in Washington this week, where their comments may offer further insight into the future direction of monetary policy.

Goldman Sachs also pointed out that while slower productivity growth, falling capital goods prices, and an ageing population have all contributed to lower neutral interest rates in the UK, these factors have been countered by a sharp rise in public debt and faster population growth.

The UK’s debt-to-GDP ratio has surged from about 35% in 2007 to nearly 100%, the highest level seen since the 1960s. Over the same period, the contribution of productivity growth to overall GDP has significantly weakened, affecting the economy’s underlying resilience.

Rachel Reeves, the Chancellor, is expected to announce an increase in borrowing in the upcoming budget at the end of October – with reports varying between £40 to even £80 billion. This borrowing will be aimed at funding an increase in public investment, which analysts believe could boost economic growth. Unlike the situation during former Prime Minister Liz Truss's time in office, when borrowing for tax cuts caused turmoil in the bond markets, borrowing for investment is expected to be more well received.

Read more: Sellers reduce house prices ahead of budget - lender

Economists often look to the neutral interest rate when formulating policy, as this rate is thought to neither accelerate inflation nor overly constrain economic activity. However, the difficulty in pinpointing the neutral rate means there’s a risk that central banks may overshoot or undershoot with their interest rate decisions.

Goldman Sachs cautioned: "The uncertainty around these estimates is very large, consistent with the Bank of England's caution in relying too heavily on the neutral rate for practical policymaking."

The Bank of England currently estimates that the neutral rate for the UK sits somewhere between 2% and 2.5%.