But BTL pressures mount, data analysis shows

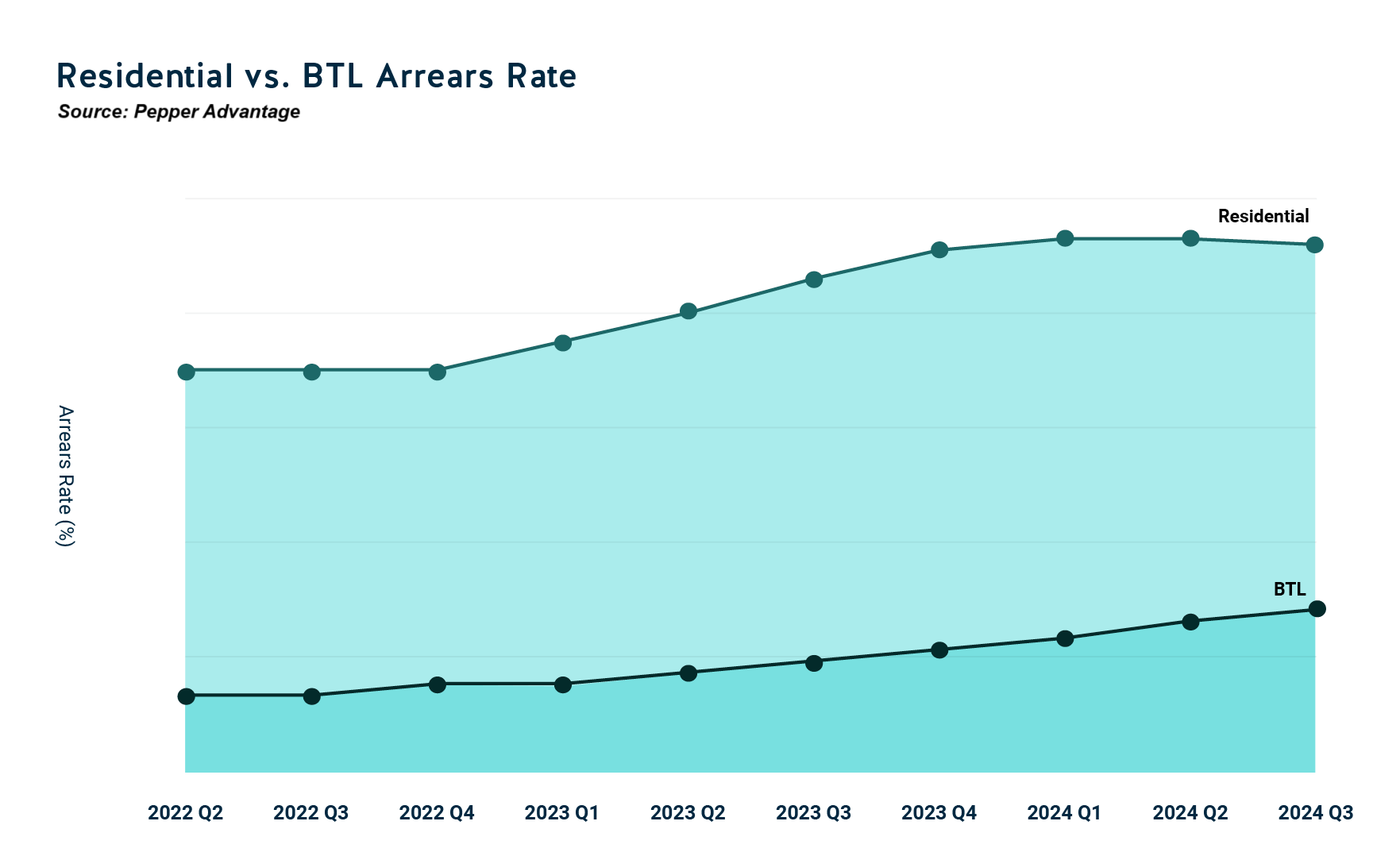

Arrears on UK residential mortgages have continued to improve, even as the buy-to-let market faces mounting challenges, according to global credit intelligence firm Pepper Advantage.

In its analysis of over 100,000 UK residential mortgages for the third quarter of 2024, the company noted a 0.8% decline in arrears for residential mortgages compared to the second quarter. However, BTL arrears rose sharply, increasing by 9.7% quarter-on-quarter.

The overall arrears rate for UK residential mortgages grew by just 0.1% in the third quarter, the smallest increase since the third quarter of 2022. Residential arrears fell by 0.8% in the quarter, continuing an improvement trend from the previous quarter.

At the same time, BTL arrears rate rose for the third consecutive quarter, with a 9.7% increase in the third quarter. The number of new BTL mortgages also dropped by 1.6% compared to the second quarter and 10.6% year-on-year.

According to the latest Pepper Advantage UK Credit Intelligence report, residential mortgage originations fell by 7.6% in the third quarter, following a strong second quarter when originations surged 20.9%. Despite the decline, Pepper Advantage anticipates a strong final quarter of the year as falling interest rates and growing housing market activity boost buyer demand.

Direct debit rejections (DDRs), a key early indicator of financial stress, increased across both residential and BTL segments. DDRs for residential mortgages rose 1.9% in the third quarter, while those for BTL mortgages grew by 2.7%.

Regional data showed varied performance in arrears rates. Greater London saw growth in arrears slow significantly, recording only a 0.4% increase in the third quarter compared to a 6% rise in the second quarter.

The South West recorded a 1.5% decline in arrears, its first since 2022. Other regions, including the North East, North West, Scotland, and Yorkshire and Humberside, also saw declines in arrears. In the West Midlands, arrears growth slowed to just 0.1%.

“Our latest data shows that 2024 has been a year of improvement for the UK mortgage market,” said Aaron Milburn (pictured), UK managing director for Pepper Advantage. “The overall arrears rate for residential mortgages appears to have plateaued, with some regions such as the South West recording a pronounced decline in the rate of arrears. Alongside the encouraging arrears data, the number of new originations remains solid, with falling interest rates starting to have an impact.

“Looking to 2025, the data also shows headwinds clearly remain and the signs of structural challenges in the buy-to-let market are cause for concern with a knock-on effect for renters. Private landlords with BTL mortgages continue to exit the market as they grabble with the entrenched higher rate environment and the potential for additional taxes, increasing supply-side pressures and pushing up rental prices.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.