"We're at a crossroads" says new report in support of BTL market

One would have thought that the government would LIKE landlords. With a rental shortage tenants are crying out for more accommodation, but proposals have been coming through thick and fast that seem specifically designed to batter investors. Research by Paragon bank has shown that even by Q2 of 2023, landlords were looking at dumping some or all of their portfolios at double the rate the same quarter the previous year. But in good news for landlords, at least one lender has come out to bat for the buy-to-let crowd (that seems to be getting less crowded by the week).

The country’s third biggest building society lender, Yorkshire Building Society (YBS) has released its latest Home Truths Report which addresses the role of landlords in the UK, and advises the government to look kindly on them. Based on responses from 500 landlords, the report reveals that while inflation and rising interest rates have dominated the financial landscape, many landlords have not aggressively raised rents. Only 43% of surveyed landlords had increased rents in the past 12 months, despite significant financial pressures such as the rise in base interest rates and the UK’s inflation peak of 11.1% in November 2022, following the mini-budget.

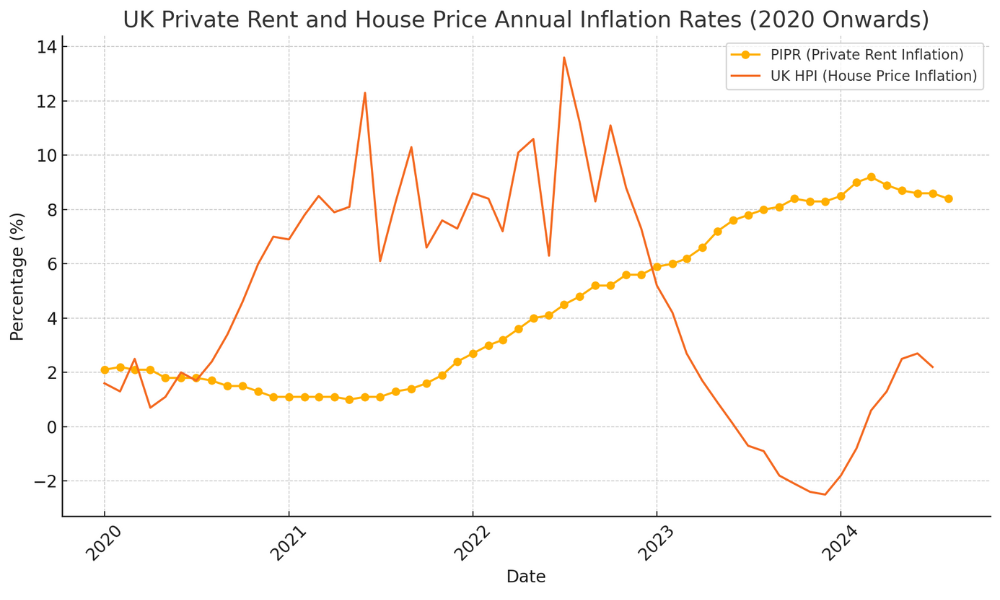

The findings suggest that many landlords are adjusting rent prices in reaction to their own rising costs rather than seeking excess profits. This contrasts with the common perception that landlords are profiting from the housing crisis by continuously increasing rent. Data shows that private rents in the UK increased by 6.2% in 2023, which, although notable, doesn’t match the actual rise in landlord costs, particularly given that consumer price inflation (CPI), which excludes mortgage costs, only reached 4%.

And the new(ish) Labour government’s proposed Renters Rights Bill also looks like it may put the boot in while landlords are down. Former Conservative Party leader Sir Iain Duncan Smith spoke to The Telegraph over the weekend saying: “the Government has to be really careful about what it does here. Making out that anyone who rents out property is a greedy individual and needs to be dealt with is a mistake and a caricature. Landlords will ask themselves ‘what’s the point of letting if I have minimal rights to evict tenants who are being genuinely difficult?’ They will, by all means, leave the market.”

Read more: Is buy-to-let getting too hard?

Landlords’ crucial role in housing supply

In its paper (and advice to the authorities) YBS explains that landlords, often demonized in housing debates, are essential to the UK’s housing supply. However, government policies towards the buy-to-let market have been inconsistent, creating a complex web of regulations. While the intent may have been to address issues like tenant safety and property conditions, the added burdens on landlords have neither significantly improved the housing infrastructure nor delivered notable benefits to tenants.

Read more: Is a tax hike coming for landlords?

Regulatory support and challenges

Despite these pressures, YBS says the majority of landlords support recent regulations aimed at improving safety in rented properties. Reforms like five-yearly electrical tests, smoke alarms on each floor, and yearly gas safety checks have been largely embraced. In fact, 63% of landlords surveyed were in favour of these changes. However, YBS points out that while these policies are necessary, more comprehensive policies are needed to address broader issues.

Two key concerns for landlords are uncertainty around Energy Performance Certificate (EPC) requirements and the scrapping of mortgage interest tax relief. The government had initially proposed that all rental properties achieve an EPC rating of ‘C’ or above by 2025 for new tenancies and by 2028 for all tenancies. However, the deadline was pushed back, causing frustration among landlords who had already invested in energy efficiency upgrades. The lack of clarity surrounding the EPC requirements has led some landlords to exit the market.

Two key concerns for landlords are uncertainty around Energy Performance Certificate (EPC) requirements and the scrapping of mortgage interest tax relief. The government had initially proposed that all rental properties achieve an EPC rating of ‘C’ or above by 2025 for new tenancies and by 2028 for all tenancies. However, the deadline was pushed back, causing frustration among landlords who had already invested in energy efficiency upgrades. The lack of clarity surrounding the EPC requirements has led some landlords to exit the market.

Moreover, the 2020 removal of mortgage interest tax relief has further compounded financial pressures on landlords. This has either led to rent increases or reduced their ability to reinvest in properties, with some landlords questioning the sustainability of their business models in the face of rising costs.

Read more: Ferrets, flat caps and…higher rents?

YBS proposals: A balanced approach for the future

In its report, Yorkshire Building Society proposes that a balanced approach is needed to support both landlords and tenants, ensuring the long-term sustainability of the rental sector and in turn helping maintain the buy-to-let mortgage market. One suggestion is the introduction of a “decent homes charter”, which would reintroduce mortgage interest tax relief for landlords who maintain high property standards, including health and safety measures and energy efficiency improvements. By rewarding responsible landlords, this policy would incentivize improved housing conditions without necessarily driving up rents.

Read more: Is the private rental sector in crisis?

This approach would allow landlords to benefit from tax relief while maintaining property standards, which in turn could alleviate some of the upward pressure on rents. The process would be straightforward, with landlords simply declaring their compliance with set property standards when filing tax returns, leaving the current financial incentives in place for responsible landlords. Additionally, buy-to-let lenders would play a role by ensuring that properties meet these standards as part of their mortgage approval process.

Just who are the UK’s landlords?

The private rental sector in the UK has experienced significant growth and evolution over the past decade. According to the English Private Landlord Survey (EPLS) 2021, commissioned by the Department for Levelling Up, Housing, and Communities, landlords are a diverse group managing a wide range of rental properties across England. The report offers a comprehensive look into who landlords are, their motivations, and the challenges they face, especially in the wake of the COVID-19 pandemic.

The EPLS data shows that most UK landlords are individuals or small-scale property owners rather than large corporate entities. In fact, the majority (94%) of landlords operate as private individuals or groups of individuals, with only 5% running their rental businesses through companies – although many may be considering ‘going corporate’ as it were. Individual landlords often have smaller portfolios: about 43% of them own just one rental property, which accounts for 20% of all tenancies. In contrast, larger landlords who own five or more properties are responsible for nearly half (48%) of all private rentals.

Why do people become landlords?

The motivations behind becoming a landlord are varied. The most common reason cited by respondents was a preference for investing in property rather than other types of investments, such as stocks or bonds, with 42% selecting this as their primary motivation. A significant number (40%) also view their rental properties as part of their retirement plans, intending them as long-term investments to contribute to their pensions.

Interestingly, over a third of landlords (35%) initially purchased their properties as homes for themselves, only later deciding to rent them out. Inheritance and gifts accounted for a much smaller proportion of landlords, with just 7% and 1%, respectively, acquiring their first rental property in this way.

A gender and age profile of landlords

The typical landlord in the UK is older than the average adult population, with the median age of a landlord being 58 years. Over 60% of landlords are aged 55 or older. In terms of gender, men make up a slight majority (55%), and male landlords are more likely to own multiple properties than their female counterparts. However, women are more likely to own a single rental property.

Most use buy-to-let mortgages

When it comes to financial matters, the EPLS found that most landlords (57%) use a buy-to-let mortgage to finance their rental properties, while 38% operate without any borrowing. The median rental income was reported as £17,200 per year, showing a slight increase from previous years.

The report also highlights that landlords are more likely to increase rents for new tenancies rather than renewing existing contracts. For new tenancies, nearly half (45%) of landlords increased rents, while 64% of landlords kept rents stable for renewing tenants.

Landlord concerns and future plans

The report acknowledges that landlords are increasingly concerned about legislative changes, particularly the removal of “no-fault” evictions under Section 21 of the Housing Act. Upcoming changes to energy performance regulations and tax relief are also significant concerns. These factors have led many landlords to reconsider their future in the rental market.

While nearly half of landlords (48%) plan to keep their portfolios unchanged over the next two years, a notable number are considering reducing their holdings. Legislative changes, along with personal financial pressures, are the most frequently cited reasons for selling off properties. On the other hand, some landlords plan to expand, particularly those who view their rental properties as long-term investments.

How big is rental in the UK?

The Property Rental Income Statistics: 2024 report, released by HM Revenue & Customs (HMRC) a few weeks ago, offers a comprehensive view of the UK’s rental property sector based on data from the government’s Income Tax Self-Assessment (ITSA) returns. This official statistics release covers income and expenses from UK properties for the past five tax years, from the 2018-2019 to the 2022-2023 tax year. It provides valuable insights into rental market trends, including regional distributions of income and expenses, the impact of furnished holiday lettings, and an analysis of landlord income distribution.

Key insights from 2022-2023:

- Number of landlords: In the 2022-2023 tax year, 2.84 million unincorporated landlords declared income from property rentals. Of these, 88.1% claimed allowable expenses, indicating that the vast majority of landlords actively manage and offset their rental income with expenses.

- London dominates rental income: The concentration of rental income in London is a significant trend. Although only 17% of unincorporated landlords are based in London, they accounted for 24% of the total rental income declared by landlords. This highlights London’s dominant position in the rental market and the high rental values typically seen in the capital.

UK property income overview

The report shows that private individuals form the backbone of the rental property market. Of the 2.84 million landlords, a staggering 99% are private individuals who report their rental income through the ITSA system. In the 2022-2023 tax year, individuals declared £44.7 billion in rental income, out of a total of £47.44 billion, further emphasizing the dominance of individual landlords over other entities such as partnerships, which accounted for a smaller share (£2.74 billion).

The past five years have shown steady growth in the rental income sector. Between 2018-2019 and 2022-2023, the total income from rental properties increased by £1.34 billion, representing a 3% rise. This growth was driven by both an increase in the number of landlords and a rise in average property income. However, there was a slight dip in total property income in 2022-2023, where income fell to £47.44 billion from £49.4 billion in 2021-2022, reflecting potential challenges in the market.

Income from furnished holiday lettings

The report also tracks income from UK furnished holiday lettings, a niche but growing segment of the rental market. In 2022-2023, 130,000 landlords declared income from holiday lettings, contributing £2.29 billion to the rental sector. While this group represents a small fraction of the overall landlord population (around 5%), it has seen rapid growth. In the five years between 2018-2019 and 2022-2023, total income from holiday lettings increased by 67%, reflecting a growing demand for short-term rental properties in popular holiday destinations across the UK.

Property expenses

Landlords are entitled to claim various allowable expenses against their property income. In 2022-2023, a total of £22.98 billion was claimed as expenses by unincorporated landlords, with 88.1% of landlords claiming at least one type of expense.

The most common expense categories included:

- Rent, rates, and insurance: Claimed by 66.7% of landlords, amounting to £2.7 billion.

- Repairs and maintenance: Claimed by 66.3% of landlords, totaling £5.6 billion.

- Residential finance costs: This was the largest category by value, with £6.87 billion claimed, representing 30% of all expenses.

The report notes that expenses have followed a steady trend over the past five years, with total property expenses increasing by 3% from 2018-2019 to 2022-2023. Notably, the 2020-2021 period saw a slight decline in expenses due to disruptions during the pandemic, but this recovered in subsequent years.

Regional analysis of property income and expenses

The geographic distribution of property income and expenses reveals stark regional disparities. Based on the landlords’ taxpayer addresses, the majority of rental income and expenses are concentrated in London and the South East. In 2022-2023:

- London: 17% of landlords were based in London, contributing 24% of total rental income. London landlords also accounted for 26% of total expenses declared.

- South East: Combined with London, the South East represented 33% of all landlords and 41% of total rental income. In terms of expenses, London and the South East together accounted for 43% of all allowable expenses.

By contrast, regions such as Wales, Scotland, Northern Ireland, and the North East of England reported significantly lower proportions of income and expenses. For example, the North East accounted for just 2% of total rental income and expenses, reflecting the region’s lower rental property values and the smaller number of landlords operating there.

Read more: Ferrets, flat caps and…higher rents?

Income distribution among landlords

The report provides a breakdown of landlords by income bracket, showing that most landlords earn modest sums from their rental properties. In 2022-2023:

- 52% of landlords (around 1.47 million) earned less than £10,000 in property income annually. Only a small fraction of landlords reported higher incomes, with the majority of property owners relying on rental income as a supplementary source of revenue rather than a primary one.

Trends and future outlook

The overall picture of the UK rental market is one of gradual growth, with both the number of landlords and the total rental income increasing over the past five years. However, the slight decline in income between 2021-2022 and 2022-2023 suggests that market dynamics are shifting, potentially due to rising costs, economic uncertainty, or changes in demand.

Expenses, on the other hand, have remained relatively stable, with residential finance costs continuing to represent the largest portion of landlords’ outgoings. The concentration of both income and expenses in London and the South East suggests that these regions will continue to dominate the rental market for the foreseeable future